Montana Form Clt 4s Instructions 2019

Understanding the Montana Form CIT 2018

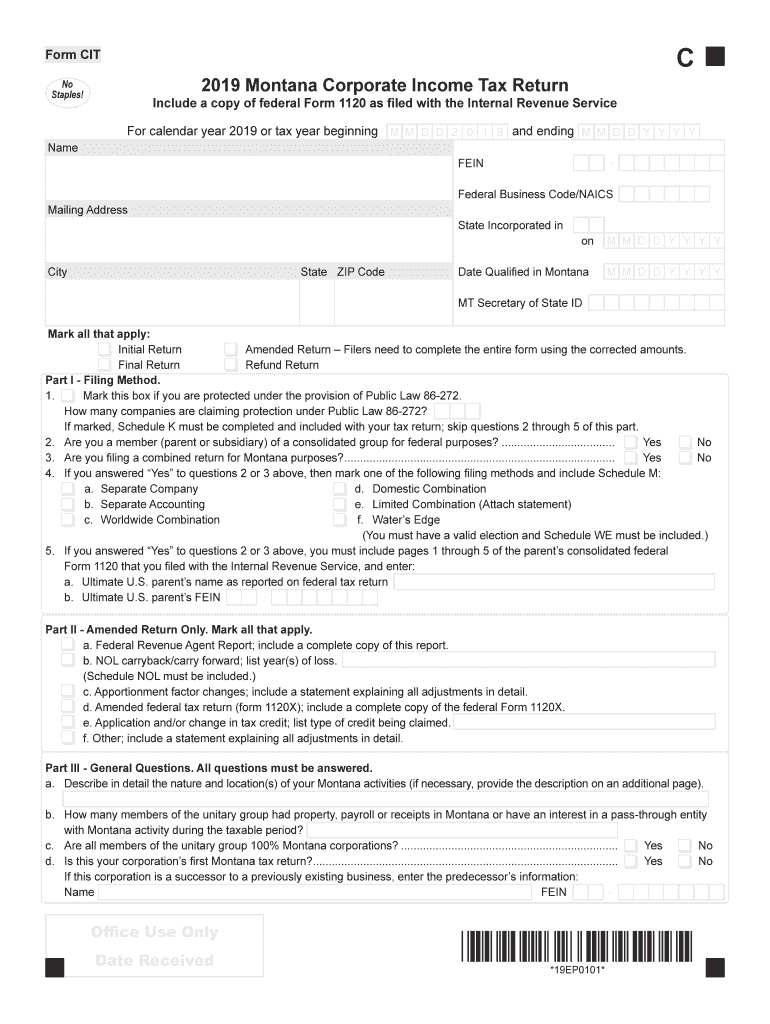

The Montana Form CIT 2018, also known as the Montana Corporate Income Tax Form, is essential for corporations operating within the state. This form is used to report corporate income and calculate the amount of tax owed to the state of Montana. It is crucial for corporations to accurately complete this form to comply with state tax regulations. The form requires detailed financial information, including revenue, expenses, and deductions, to determine the taxable income of the corporation.

Steps to Complete the Montana Form CIT 2018

Completing the Montana Form CIT 2018 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate total revenue and allowable deductions to determine taxable income.

- Fill out the form accurately, ensuring all sections are completed, including the corporation's name, address, and federal employer identification number (EIN).

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or via mail to the appropriate tax authority.

Legal Use of the Montana Form CIT 2018

The Montana Form CIT 2018 is legally binding when filled out correctly and submitted on time. Compliance with state tax laws is essential to avoid penalties and interest on unpaid taxes. Corporations must ensure that all information provided on the form is truthful and accurate, as any discrepancies can lead to audits or legal issues. Utilizing a reliable eSignature solution can enhance the legal validity of the submitted form.

Filing Deadlines for the Montana Form CIT 2018

Corporations must adhere to specific filing deadlines for the Montana Form CIT 2018 to avoid late fees. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by April 15. It is advisable for corporations to mark these dates on their calendars to ensure timely submission.

Required Documents for the Montana Form CIT 2018

To complete the Montana Form CIT 2018, corporations need to gather several documents:

- Federal tax return (Form 1120 or 1120-S)

- Income statements and balance sheets

- Records of all income and deductions

- Any relevant state-specific tax documents

Having these documents ready will streamline the process of filling out the form and ensure accuracy.

Form Submission Methods for the Montana Form CIT 2018

Corporations can submit the Montana Form CIT 2018 through various methods:

- Electronically via the Montana Department of Revenue's online portal.

- By mail, sending the completed form to the designated tax office.

- In-person at local tax offices, if preferred.

Each submission method has its own advantages, and corporations should choose the one that best fits their needs.

Quick guide on how to complete dept comm no3bs hawaii state legislature hawaiigov

Complete Montana Form Clt 4s Instructions seamlessly on any device

Online document management has gained immense popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Montana Form Clt 4s Instructions on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Montana Form Clt 4s Instructions effortlessly

- Find Montana Form Clt 4s Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Montana Form Clt 4s Instructions to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dept comm no3bs hawaii state legislature hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the dept comm no3bs hawaii state legislature hawaiigov

How to generate an electronic signature for your Dept Comm No3bs Hawaii State Legislature Hawaiigov online

How to create an electronic signature for the Dept Comm No3bs Hawaii State Legislature Hawaiigov in Google Chrome

How to create an electronic signature for signing the Dept Comm No3bs Hawaii State Legislature Hawaiigov in Gmail

How to create an electronic signature for the Dept Comm No3bs Hawaii State Legislature Hawaiigov right from your smartphone

How to make an eSignature for the Dept Comm No3bs Hawaii State Legislature Hawaiigov on iOS

How to create an electronic signature for the Dept Comm No3bs Hawaii State Legislature Hawaiigov on Android devices

People also ask

-

What is the Montana form CIT 2018?

The Montana form CIT 2018 is a crucial document used for corporate income tax purposes in Montana. It provides the state with important financial information about corporations operating within its jurisdiction, ensuring compliance with state tax laws.

-

How can airSlate SignNow assist with the Montana form CIT 2018?

airSlate SignNow offers businesses a streamlined way to send, sign, and store the Montana form CIT 2018 securely. By utilizing our eSignature solution, you can physically sign your documents online, reducing turnaround time and improving efficiency.

-

Is there a cost associated with using airSlate SignNow for the Montana form CIT 2018?

airSlate SignNow provides a variety of pricing plans tailored to meet the needs of businesses of all sizes. The cost-effectiveness of our solutions means you can manage the Montana form CIT 2018 without signNowly impacting your budget.

-

What features does airSlate SignNow provide for handling documents like the Montana form CIT 2018?

Our platform includes features like customizable templates, secure cloud storage, and real-time tracking, all geared towards making the handling of documents like the Montana form CIT 2018 as efficient as possible. Users can also automate workflows to save time and minimize errors.

-

Can I integrate airSlate SignNow with other applications when managing the Montana form CIT 2018?

Yes, airSlate SignNow seamlessly integrates with a wide range of applications, helping you manage your documents like the Montana form CIT 2018 alongside other business tools. This enables a smoother workflow and better data management.

-

What are the benefits of using airSlate SignNow for the Montana form CIT 2018?

Utilizing airSlate SignNow for the Montana form CIT 2018 offers signNow benefits, including improved efficiency and reduced paperwork. Our electronic signature solution also enhances document security and ensures compliance with legal standards.

-

How easy is it to get started with airSlate SignNow for my Montana form CIT 2018 needs?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account, upload your Montana form CIT 2018, and begin managing your documents with our user-friendly interface.

Get more for Montana Form Clt 4s Instructions

- Petcare form

- 2014 oh form

- Arnold mandell lease agreement form

- Subcontractor approval form 2004 city of cincinnati cincinnati oh

- Application for vbml fee waiver city of cincinnati cincinnati oh form

- Sample i 765 form for 17 month opt extension university of iowa international uiowa

- Retired idaho state police officers isp idaho form

- Rv rental agreement pdf jaxevents com form

Find out other Montana Form Clt 4s Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors