C Form CIT Montana Corporate Income Tax Retur 2023

What is the C Form CIT Montana Corporate Income Tax Return

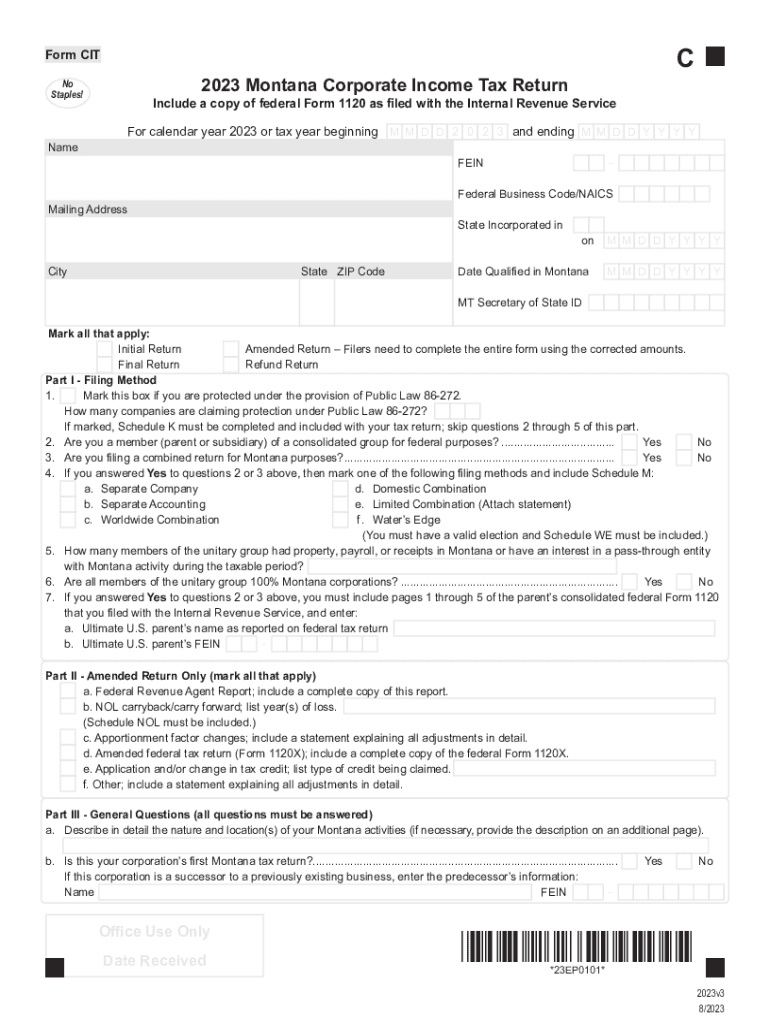

The C Form CIT Montana Corporate Income Tax Return is a tax document that corporations operating in Montana must file annually. This form is used to report the corporation's income, deductions, and tax liability to the state. It is essential for ensuring compliance with Montana tax laws and for calculating the appropriate amount of corporate income tax owed. The form captures various financial details, including gross receipts, allowable deductions, and credits that may apply to the corporation's tax situation.

Steps to Complete the C Form CIT Montana Corporate Income Tax Return

Completing the C Form CIT involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements and balance sheets. Next, fill out the form by entering the corporation's gross income and applicable deductions. Be sure to include any credits that may reduce the tax liability. After completing the form, review all entries for accuracy and ensure that all required signatures are included. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the C Form CIT to avoid penalties. Generally, the return is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the return is typically due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations should also be mindful of any extensions that may be available if additional time is needed to complete the form.

Required Documents

To complete the C Form CIT Montana Corporate Income Tax Return, corporations need to gather several key documents. These include financial statements, such as profit and loss statements and balance sheets, which provide a comprehensive view of the corporation's financial health. Additionally, any documentation related to deductions and credits should be collected, including receipts and invoices. Accurate record-keeping is crucial to ensure that all information reported on the form is correct and substantiated.

Form Submission Methods (Online / Mail / In-Person)

Corporations have multiple options for submitting the C Form CIT Montana Corporate Income Tax Return. The form can be filed online through the Montana Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, corporations may choose to mail a paper copy of the completed form to the appropriate tax office. In-person submissions are also accepted at designated tax offices, providing flexibility for those who prefer direct interaction. Each method has its own guidelines and requirements, so it's essential to follow the instructions carefully.

Penalties for Non-Compliance

Failure to file the C Form CIT Montana Corporate Income Tax Return on time can result in significant penalties. Late filing penalties may accrue based on the amount of tax owed and the duration of the delay. Additionally, interest may be charged on any unpaid tax amounts. Corporations that do not comply with filing requirements may also face audits or further scrutiny from tax authorities. It is important for corporations to understand these potential consequences and to ensure timely and accurate filing to avoid unnecessary penalties.

Quick guide on how to complete c form cit montana corporate income tax retur

Complete C Form CIT Montana Corporate Income Tax Retur effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage C Form CIT Montana Corporate Income Tax Retur on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign C Form CIT Montana Corporate Income Tax Retur without hassle

- Obtain C Form CIT Montana Corporate Income Tax Retur and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers especially for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your choice. Modify and eSign C Form CIT Montana Corporate Income Tax Retur and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct c form cit montana corporate income tax retur

Create this form in 5 minutes!

How to create an eSignature for the c form cit montana corporate income tax retur

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is montana cit tax?

Montana CIT tax refers to the Corporate Income Tax imposed on businesses operating in Montana. It's essential for companies to understand their obligations regarding montana cit tax to ensure compliance and optimize their financial strategies.

-

How does airSlate SignNow help with montana cit tax documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to montana cit tax. By using our platform, businesses can efficiently manage their tax documents, ensuring accuracy and timely submissions.

-

Are there any specific features for montana cit tax management in airSlate SignNow?

While airSlate SignNow is not specifically designed for montana cit tax, its document management features allow users to create, edit, and manage tax-related documents easily. This functionality supports better organization and accessibility of important tax forms.

-

What are the pricing plans for using airSlate SignNow for montana cit tax documents?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes, making it cost-effective for managing montana cit tax documents. You can choose a plan that best fits your needs, ensuring efficient document handling without exceeding your budget.

-

Can I integrate airSlate SignNow with other financial software for montana cit tax purposes?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software, aiding in montana cit tax management. This integration allows for synchronized data flow and enhances your overall tax preparation process.

-

How does airSlate SignNow ensure the security of montana cit tax documents?

Security is a top priority for airSlate SignNow, particularly for sensitive documents like those related to montana cit tax. Our platform employs advanced encryption and security protocols to protect your data from unauthorized access.

-

What benefits does airSlate SignNow offer for montana cit tax compliance?

Using airSlate SignNow for montana cit tax compliance can signNowly streamline your documentation process, reduce errors, and enhance overall efficiency. The eSigning feature ensures that you and all stakeholders can sign documents quickly, promoting timely submissions.

Get more for C Form CIT Montana Corporate Income Tax Retur

Find out other C Form CIT Montana Corporate Income Tax Retur

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free