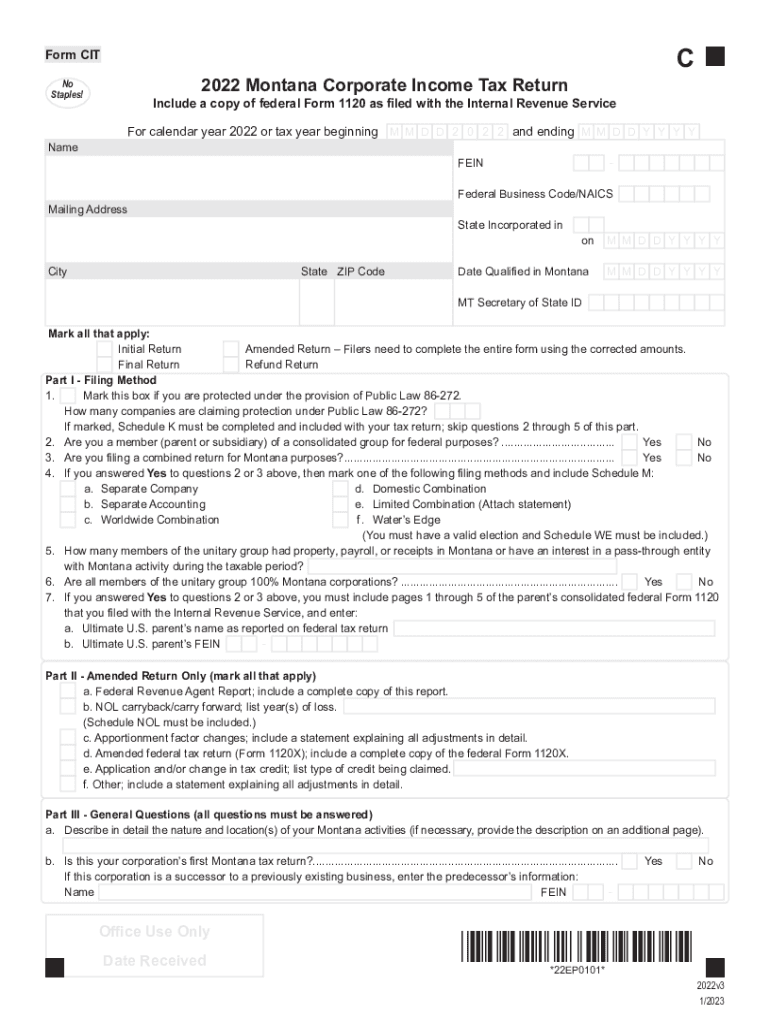

MT CIT CLT 4 Form 2022

What is the Montana Form PTE?

The Montana Form PTE, or Pass-Through Entity tax form, is designed for partnerships, S corporations, and limited liability companies (LLCs) that elect to be taxed as pass-through entities. This form allows these entities to report income, deductions, and credits to the state of Montana. The income is then passed through to the individual owners, who report it on their personal tax returns. Understanding the purpose of this form is crucial for compliance with Montana tax laws.

Steps to Complete the Montana Form PTE

Completing the Montana Form PTE involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the identification section with the entity's name, address, and tax identification number.

- Report the total income and deductions on the form, ensuring accuracy to avoid penalties.

- Calculate the tax owed based on the applicable Montana tax rates for pass-through entities.

- Review the completed form for any errors and ensure all required signatures are present.

Legal Use of the Montana Form PTE

The Montana Form PTE is legally binding once completed and submitted to the Montana Department of Revenue. It must be filed by the designated due date to avoid penalties. The form complies with Montana tax regulations, ensuring that pass-through entities meet their tax obligations. It is important for entities to understand that failure to file correctly can lead to legal repercussions, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the Montana Form PTE is essential for compliance. The form is typically due on the 15th day of the fourth month following the end of the tax year. For most entities operating on a calendar year, this means the deadline is April 15. It is advisable to keep track of any changes to filing deadlines announced by the Montana Department of Revenue, especially for extensions or specific circumstances that may affect filing dates.

Required Documents for the Montana Form PTE

To successfully complete the Montana Form PTE, certain documents are necessary:

- Financial statements, including balance sheets and income statements.

- Records of all income and deductions related to the business.

- Tax identification numbers for all partners or shareholders.

- Any previous year tax returns that may provide context for current filings.

Form Submission Methods

The Montana Form PTE can be submitted through various methods to accommodate different preferences:

- Online: Many entities opt to file electronically through the Montana Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person: Entities may also choose to submit the form in person at their local Department of Revenue office.

Penalties for Non-Compliance

Failure to file the Montana Form PTE on time or inaccuracies in the form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is crucial for pass-through entities to ensure compliance with all filing requirements to avoid these consequences. Understanding the penalties associated with non-compliance can help motivate timely and accurate submissions.

Quick guide on how to complete mt cit clt 4 form

Complete MT CIT CLT 4 Form effortlessly on any device

Managing documents online has become popular among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage MT CIT CLT 4 Form on any device using airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to alter and electronically sign MT CIT CLT 4 Form without any hassle

- Obtain MT CIT CLT 4 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Edit and eSign MT CIT CLT 4 Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mt cit clt 4 form

Create this form in 5 minutes!

How to create an eSignature for the mt cit clt 4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Montana form PTE instructions in the context of airSlate SignNow?

Montana form PTE instructions refer to the guidelines for completing and electronically signing pass-through entity tax forms in Montana. With airSlate SignNow, you can quickly and securely fill out these forms, ensuring compliance with state regulations while simplifying your document management.

-

How can airSlate SignNow help me complete Montana form PTE instructions?

AirSlate SignNow streamlines the process of following Montana form PTE instructions by providing user-friendly tools for eSigning and document sharing. Our platform allows you to easily edit, fill out, and send the necessary forms, reducing the time spent on paperwork.

-

What features of airSlate SignNow are beneficial for Montana form PTE instructions?

Key features of airSlate SignNow that support Montana form PTE instructions include customizable templates, real-time collaboration, and secure cloud storage. These features enhance efficiency, making it easier to complete and manage your tax documentation without any hassles.

-

Is airSlate SignNow compliant with Montana tax regulations for PTE forms?

Yes, airSlate SignNow is designed to comply with Montana tax regulations, ensuring that your Montana form PTE instructions are met accurately. Our service adheres to legal standards, providing you peace of mind that your eSigned documents are valid and recognized by state authorities.

-

What is the pricing structure for using airSlate SignNow for Montana form PTE instructions?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, allowing you to access essential features for managing Montana form PTE instructions. You can opt for monthly or annual subscriptions, depending on your usage frequency, which gives you flexibility and control over your expenses.

-

Can I integrate airSlate SignNow with other applications for Montana form PTE instructions?

Absolutely! AirSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and CRMs, enriching your experience while handling Montana form PTE instructions. This integration capability allows for efficient document management and enhanced workflow.

-

What benefits can I expect when using airSlate SignNow for Montana form PTE instructions?

Using airSlate SignNow for Montana form PTE instructions offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security. The ease of eSigning speeds up the process, enabling you to focus on other important tasks while ensuring that your documents are safely handled.

Get more for MT CIT CLT 4 Form

Find out other MT CIT CLT 4 Form

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online