Nc E 589ci Form 2018-2026

What is the Nc E 589ci Form

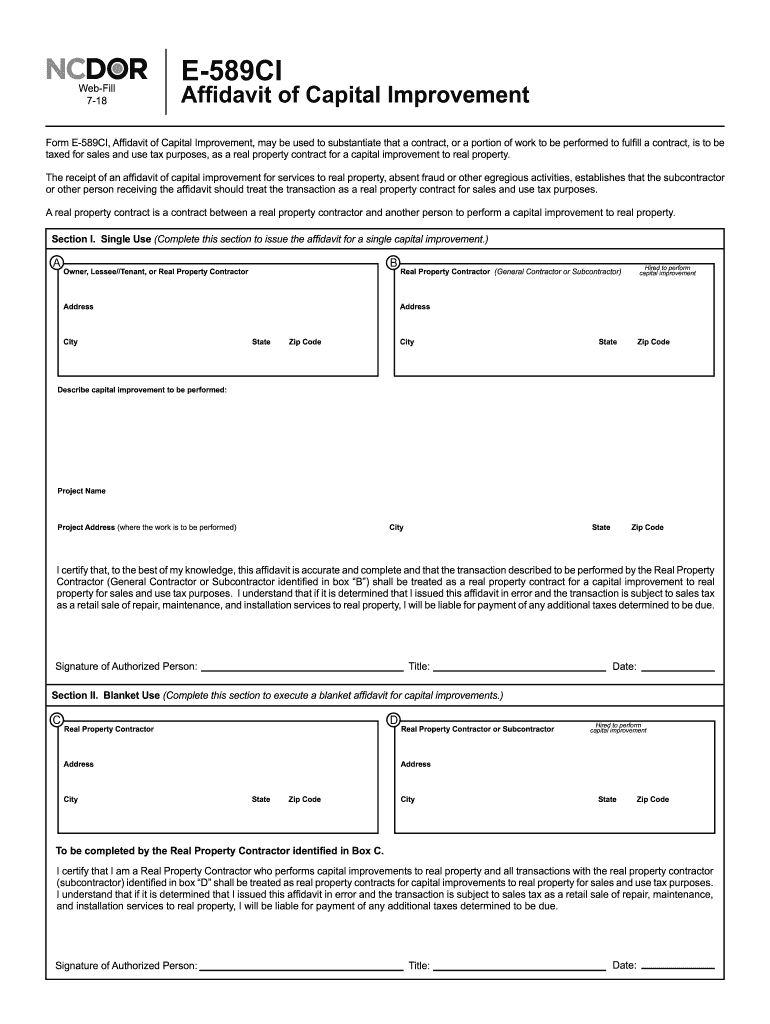

The Nc E 589ci form, also known as the North Carolina capital improvement form, is a document utilized for claiming tax exemptions on certain capital improvements made to real property in North Carolina. This form is essential for property owners who wish to report improvements that enhance the value of their property while potentially reducing their tax liabilities. The form is designed to ensure compliance with state tax regulations and to facilitate the accurate reporting of capital improvements.

How to use the Nc E 589ci Form

Using the Nc E 589ci form involves several key steps to ensure accurate completion and submission. First, gather all necessary information regarding the capital improvements made, including dates, costs, and descriptions. Next, fill out the form by providing detailed information in the designated fields. It is important to review the completed form for accuracy before submission. Once finalized, the form can be submitted to the appropriate state tax authority, either online or by mail, depending on the specific requirements.

Steps to complete the Nc E 589ci Form

Completing the Nc E 589ci form requires careful attention to detail. Follow these steps:

- Collect documentation related to the capital improvements, such as receipts and invoices.

- Access the Nc E 589ci form through the official state tax website or other authorized sources.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide detailed descriptions of the capital improvements, including their costs and the dates they were completed.

- Review the form for any errors or omissions.

- Submit the form according to the specified guidelines, ensuring you keep a copy for your records.

Legal use of the Nc E 589ci Form

The legal use of the Nc E 589ci form is governed by North Carolina tax laws. This form must be completed accurately to qualify for any tax exemptions related to capital improvements. Misrepresentation or errors in the form can lead to penalties or denial of the claimed exemptions. Therefore, it is crucial to ensure that all information provided is truthful and supported by appropriate documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Nc E 589ci form are critical to ensure compliance with state tax regulations. Typically, the form must be submitted by a specific date following the completion of the capital improvements. It is advisable to check the North Carolina Department of Revenue's official calendar for the most current deadlines. Late submissions may result in the loss of eligibility for tax exemptions.

Form Submission Methods (Online / Mail / In-Person)

The Nc E 589ci form can be submitted through various methods to accommodate different preferences. Options include:

- Online: Submit the form electronically via the North Carolina Department of Revenue's website.

- Mail: Print the completed form and send it to the designated address provided by the state tax authority.

- In-Person: Deliver the form directly to a local tax office if preferred.

Quick guide on how to complete nc e 589ci form 2018 2019

Your assistance manual on how to prepare your Nc E 589ci Form

If you’re curious about how to finalize and submit your Nc E 589ci Form, here are some brief instructions on how to make tax submission simpler.

To start, you only need to set up your airSlate SignNow account to change how you handle paperwork online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, create, and complete your tax paperwork effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend answers where necessary. Streamline your tax oversight with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the steps below to finalize your Nc E 589ci Form within minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Nc E 589ci Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase return errors and delay refunds. Moreover, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nc e 589ci form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the nc e 589ci form 2018 2019

How to generate an electronic signature for your Nc E 589ci Form 2018 2019 in the online mode

How to create an electronic signature for your Nc E 589ci Form 2018 2019 in Google Chrome

How to create an electronic signature for signing the Nc E 589ci Form 2018 2019 in Gmail

How to make an eSignature for the Nc E 589ci Form 2018 2019 from your mobile device

How to generate an electronic signature for the Nc E 589ci Form 2018 2019 on iOS

How to create an electronic signature for the Nc E 589ci Form 2018 2019 on Android

People also ask

-

What is e 589ci and how does it work with airSlate SignNow?

The e 589ci is a versatile document management feature that seamlessly integrates with airSlate SignNow. It allows users to create, send, and eSign documents efficiently, ensuring that important paperwork is completed quickly and securely.

-

How much does it cost to use the e 589ci feature in airSlate SignNow?

Pricing for the e 589ci feature within airSlate SignNow varies based on your subscription plan. Typically, plans are designed to be cost-effective, providing access to essential features at competitive rates, making it an excellent choice for businesses of all sizes.

-

What are the key benefits of using e 589ci with airSlate SignNow?

Using the e 589ci feature provides several benefits, including faster document turnaround and enhanced security for your signatures and data. This functionality simplifies the eSigning process, allowing teams to focus on more critical tasks instead of cumbersome paperwork.

-

Can I customize documents using e 589ci in airSlate SignNow?

Yes, the e 589ci feature allows you to customize documents to suit your specific needs. You can personalize templates, add fields, and incorporate branding elements to create professional, tailored documents for any occasion.

-

Does e 589ci support integrations with other software?

Absolutely! The e 589ci feature in airSlate SignNow is designed to integrate with various third-party applications, enhancing your workflow. This capability allows you to connect your existing tools and keep your processes streamlined and efficient.

-

Is e 589ci compliant with legal standards for eSignatures?

Yes, the e 589ci feature in airSlate SignNow complies with international and national standards, ensuring that all eSignatures are legally binding. This compliance provides peace of mind for businesses relying on secure digital transactions.

-

What types of documents can I send using e 589ci?

With the e 589ci feature, you can send a wide range of documents, including contracts, agreements, and any paperwork that requires a signature. This versatility makes it ideal for various industries, from real estate to finance.

Get more for Nc E 589ci Form

Find out other Nc E 589ci Form

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online