Attachment D Monthly Hotel Room Tax Rpt City of OKC 2016-2026

Understanding the Oklahoma Monthly Room Tax Report

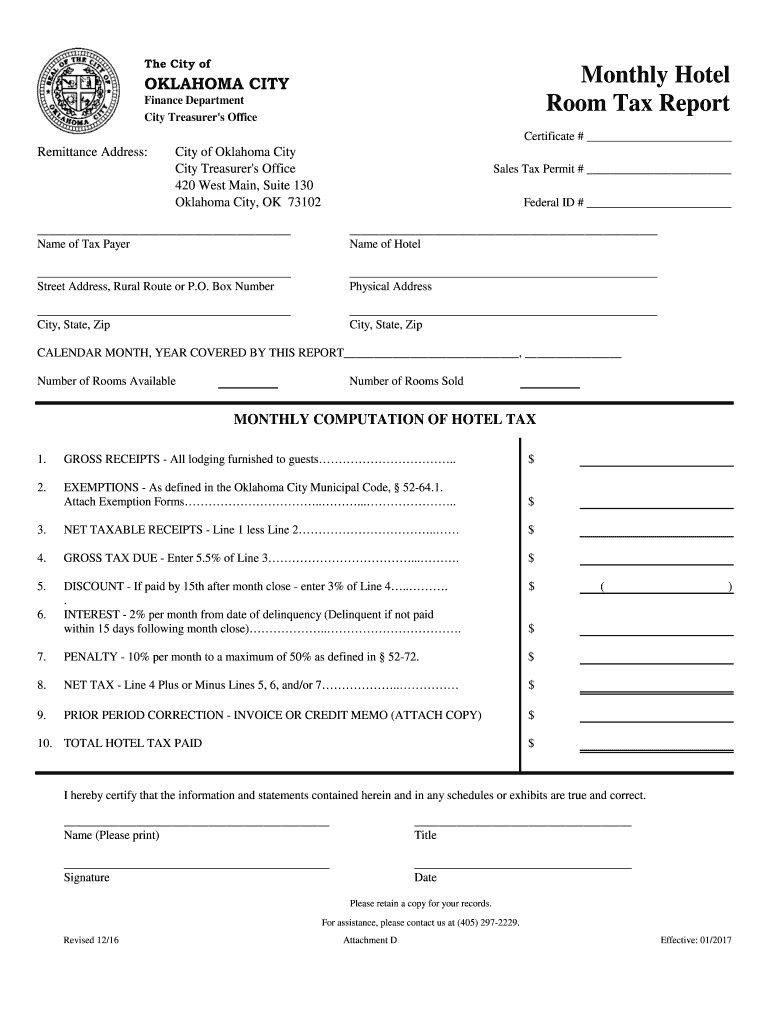

The Oklahoma Monthly Room Tax Report, often referred to as the Attachment D Monthly Hotel Room Tax Report, is a crucial document for hotel operators in Oklahoma City. This report is used to detail the monthly room tax collected from guests, ensuring compliance with local tax regulations. It is essential for maintaining transparency and accountability in hotel operations. The report serves as a record of the taxable revenue generated and the taxes owed to the city, which helps fund various public services and infrastructure projects.

Steps to Complete the Oklahoma Monthly Room Tax Report

Completing the Oklahoma Monthly Room Tax Report involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including daily sales reports and receipts. Then, calculate the total room revenue for the month, ensuring to include all taxable transactions. Next, apply the appropriate tax rate to determine the total tax owed. After calculating the amounts, fill out the report accurately, ensuring all fields are completed. Finally, review the report for any errors before submission to avoid penalties.

Filing Deadlines for the Oklahoma Monthly Room Tax Report

Timely submission of the Oklahoma Monthly Room Tax Report is critical to avoid penalties. The report is typically due on the 15th of each month, covering the previous month's activity. For example, the report for January must be submitted by February 15. It is advisable to keep track of these deadlines and set reminders to ensure compliance. Late submissions may incur fines or interest on the unpaid tax amount, which can add up quickly.

Legal Use of the Oklahoma Monthly Room Tax Report

The Oklahoma Monthly Room Tax Report is a legally mandated document that must be filed by all hotel operators in Oklahoma City. Failure to submit this report can result in legal repercussions, including fines and potential audits. The information reported is used by the city to ensure that hotels are collecting and remitting the correct amount of tax. It is important to understand the legal implications of this report and to maintain accurate records to support the information provided.

Form Submission Methods for the Oklahoma Monthly Room Tax Report

Hotel operators have several options for submitting the Oklahoma Monthly Room Tax Report. The report can be filed online through the city’s tax portal, which offers a streamlined process for submission. Alternatively, operators may choose to submit the report by mail or in person at the designated city office. Each method has its own benefits, with online submission generally being the fastest and most efficient option.

Key Elements of the Oklahoma Monthly Room Tax Report

The Oklahoma Monthly Room Tax Report includes several key elements that must be accurately reported. These elements typically include the hotel’s name, address, and tax identification number, as well as the total room revenue and the total tax collected. Additional sections may require details on exemptions or adjustments. Ensuring that all required information is included is vital for a complete and compliant submission.

Quick guide on how to complete attachment d monthly hotel room tax rpt city of okc

Your instruction manual on how to prepare your Attachment D Monthly Hotel Room Tax Rpt City Of OKC

If you’re curious about how to create and submit your Attachment D Monthly Hotel Room Tax Rpt City Of OKC, here are a few straightforward tips to simplify the tax submission process.

To start, you simply need to register your airSlate SignNow account to transform your document management online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to edit, generate, and finalize your tax forms with ease. With its editor, you can switch between text, checkboxes, and electronic signatures and go back to modify responses when necessary. Streamline your tax handling with advanced PDF editing, eSigning, and convenient sharing options.

Follow these steps to finalize your Attachment D Monthly Hotel Room Tax Rpt City Of OKC in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to locate any IRS tax document; explore various versions and schedules.

- Click Get form to access your Attachment D Monthly Hotel Room Tax Rpt City Of OKC in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if required).

- Review your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that paper submissions can lead to return errors and delays in refunds. As a reminder, prior to e-filing your taxes, please check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct attachment d monthly hotel room tax rpt city of okc

Create this form in 5 minutes!

How to create an eSignature for the attachment d monthly hotel room tax rpt city of okc

How to generate an electronic signature for your Attachment D Monthly Hotel Room Tax Rpt City Of Okc online

How to create an eSignature for the Attachment D Monthly Hotel Room Tax Rpt City Of Okc in Chrome

How to generate an eSignature for putting it on the Attachment D Monthly Hotel Room Tax Rpt City Of Okc in Gmail

How to make an eSignature for the Attachment D Monthly Hotel Room Tax Rpt City Of Okc straight from your smart phone

How to make an eSignature for the Attachment D Monthly Hotel Room Tax Rpt City Of Okc on iOS

How to generate an electronic signature for the Attachment D Monthly Hotel Room Tax Rpt City Of Okc on Android devices

People also ask

-

What is an OK monthly hotel report, and why is it important?

An OK monthly hotel report is a comprehensive document that provides insights into a hotel's performance metrics. It is crucial for tracking revenue, occupancy rates, and guest satisfaction levels, helping hotel managers make informed decisions. By utilizing tools like airSlate SignNow, you can streamline the creation and distribution of these reports effortlessly.

-

How can airSlate SignNow help in creating an OK monthly hotel report?

airSlate SignNow simplifies the process by allowing users to create, edit, and eSign documents online. This means you can quickly compile your OK monthly hotel report with real-time data and ensure it is signed off by relevant stakeholders. The user-friendly interface makes it easy for anyone to generate these reports without extensive training.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs, from individual users to larger teams. Pricing is very competitive, making it a cost-effective solution for managing your OK monthly hotel report alongside other documentation needs. For detailed information on our pricing tiers, you can visit our website or contact our sales team.

-

Does airSlate SignNow integrate with other hotel management systems?

Yes, airSlate SignNow provides seamless integration with various hotel management and accounting software. This means you can easily pull data from your existing systems, ensuring that your OK monthly hotel report is accurate and reflects the latest information. Integrating these platforms streamlines workflows and enhances productivity.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access, sign, and share your OK monthly hotel report from any device. Whether on a smartphone or tablet, you can manage your documents on-the-go, making it easier to meet deadlines and respond promptly to stakeholders.

-

Is my data secure when using airSlate SignNow?

Security is a top priority for airSlate SignNow. All data is encrypted and stored in secure servers, ensuring that your OK monthly hotel report and other sensitive documents are protected from unauthorized access. We comply with industry standards for data protection, giving you peace of mind.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow boasts a variety of features, including customizable templates, automated workflows, and real-time tracking of document status. These tools empower you to efficiently manage your OK monthly hotel report process, ensuring that all necessary steps are completed promptly and correctly. Enhanced collaboration features also allow for easy input from multiple team members.

Get more for Attachment D Monthly Hotel Room Tax Rpt City Of OKC

- Form 451 2

- Form m

- Charles county md special exception form

- Dhs 4691 eng pca time and activity documentation this form should be submitted to document pca time and activity

- Njhfma form

- Oppenheimer fillable application form

- Emery county building department form

- Town of leeds 218 north main street po box 460879 form

Find out other Attachment D Monthly Hotel Room Tax Rpt City Of OKC

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed