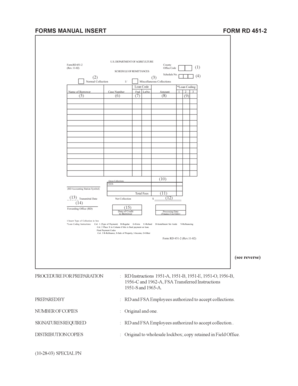

Form 451 2

What is the Form RD 451 2

The Form RD 451 2 is a specific document used in various administrative processes, often related to regulatory compliance within certain industries. It serves to collect essential information required by state or federal agencies, ensuring that businesses and individuals adhere to necessary legal standards. Understanding the purpose and context of this form is crucial for accurate completion and submission.

How to Use the Form RD 451 2

Using the Form RD 451 2 involves several steps to ensure that all required information is accurately provided. First, identify the specific purpose of the form in your situation, whether for compliance, reporting, or application. Next, gather all necessary documentation and information that will be needed to complete the form. Carefully fill out each section, ensuring clarity and accuracy, as errors can lead to delays or rejections.

Steps to Complete the Form RD 451 2

Completing the Form RD 451 2 requires a systematic approach to ensure all information is accurately captured. Begin by reviewing the form's instructions, which outline the required fields and any additional documentation needed. Fill in your personal or business information as requested, ensuring that all entries are clear and legible. After completing the form, double-check all entries for accuracy before submitting it to the appropriate agency.

Legal Use of the Form RD 451 2

The legal use of the Form RD 451 2 is governed by specific regulations that dictate how the form should be completed and submitted. It is essential to comply with these regulations to ensure that the form is considered valid and enforceable. This includes understanding the legal implications of the information provided and ensuring that all signatures are obtained where necessary, as this can affect the form's legitimacy.

Form Submission Methods

The Form RD 451 2 can typically be submitted through various methods, including online, by mail, or in person. Each submission method may have its own requirements and processing times. Online submissions often provide quicker processing and confirmation, while mailed forms may require additional time for delivery and handling. In-person submissions can offer immediate confirmation but may necessitate scheduling an appointment with the relevant agency.

Key Elements of the Form RD 451 2

Understanding the key elements of the Form RD 451 2 is vital for accurate completion. These elements include personal identification information, specific details related to the purpose of the form, and any required signatures or certifications. Each section must be filled out completely to avoid delays in processing. Familiarizing yourself with these components can enhance your confidence in completing the form correctly.

Quick guide on how to complete form 451 2

Complete Form 451 2 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Form 451 2 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Form 451 2 effortlessly

- Locate Form 451 2 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data using tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Form 451 2 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 451 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form rd 451 2 and its purpose?

The form rd 451 2 is a document used for specific business transactions and agreements. It serves to formalize the understanding between parties and ensure compliance with regulations. By utilizing the form rd 451 2, businesses can streamline their document processing and enhance their operational efficiency.

-

How does airSlate SignNow support the completion of form rd 451 2?

airSlate SignNow simplifies the process of completing the form rd 451 2 by providing easy editing and signing capabilities. Users can fill out the form electronically, making it accessible from any device. This feature helps businesses reduce paperwork and save valuable time.

-

What pricing plans are available for using airSlate SignNow for form rd 451 2?

airSlate SignNow offers various pricing plans tailored to accommodate different business needs while processing documents like form rd 451 2. Plans are flexible and include options for individual users and teams. You can choose a plan that fits your budget and ensures seamless eSignature functionalities.

-

What features does airSlate SignNow provide for managing form rd 451 2?

Key features of airSlate SignNow for managing form rd 451 2 include advanced security protocols, real-time tracking, and cloud storage. These features ensure that your form rd 451 2 is not only safe but also easily accessible whenever needed. Additionally, collaborative editing allows multiple users to work on the document simultaneously.

-

How can businesses benefit from using airSlate SignNow for form rd 451 2?

Using airSlate SignNow for form rd 451 2 offers businesses increased efficiency, reduced turnaround time, and enhanced accuracy in document handling. The platform allows for seamless communication and reduces the errors common in manual paperwork. Overall, it helps improve the workflow and productivity of organizations.

-

Does airSlate SignNow integrate with other software to streamline form rd 451 2 processing?

Yes, airSlate SignNow integrates with various business applications such as CRM systems, project management tools, and file storage services. This integration facilitates a smoother workflow, allowing users to manage form rd 451 2 alongside other business-critical documents. It minimizes the need for duplicate data entry and enhances overall efficiency.

-

Is airSlate SignNow compliant with legal standards for form rd 451 2?

Absolutely, airSlate SignNow complies with legal standards necessary for the execution of form rd 451 2 and all electronic signatures. The platform adheres to electronic signature laws like the ESIGN Act and UETA, assuring users of the legal validity of signed documents. This compliance helps in maintaining trust and reliability in your business transactions.

Get more for Form 451 2

- Connecticut source income of a nonresident nexus ctgov form

- E filing of individual income tax returns with homestead form

- Form 1042 annual withholding tax return for us source

- State of nj department of the treasury ptebait faq form

- 2023 instructions for form 1099 b instructions for form 1099 b proceeds from broker and barter exchange transactions

- Schedule nj coj credit for income or wage taxes paid to form

- State income tax return extension information oltcom

- New jersey where to file addresses for taxpayers and tax form

Find out other Form 451 2

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors