Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return 2023

What is the Form ND 1 Individual Income Tax Return

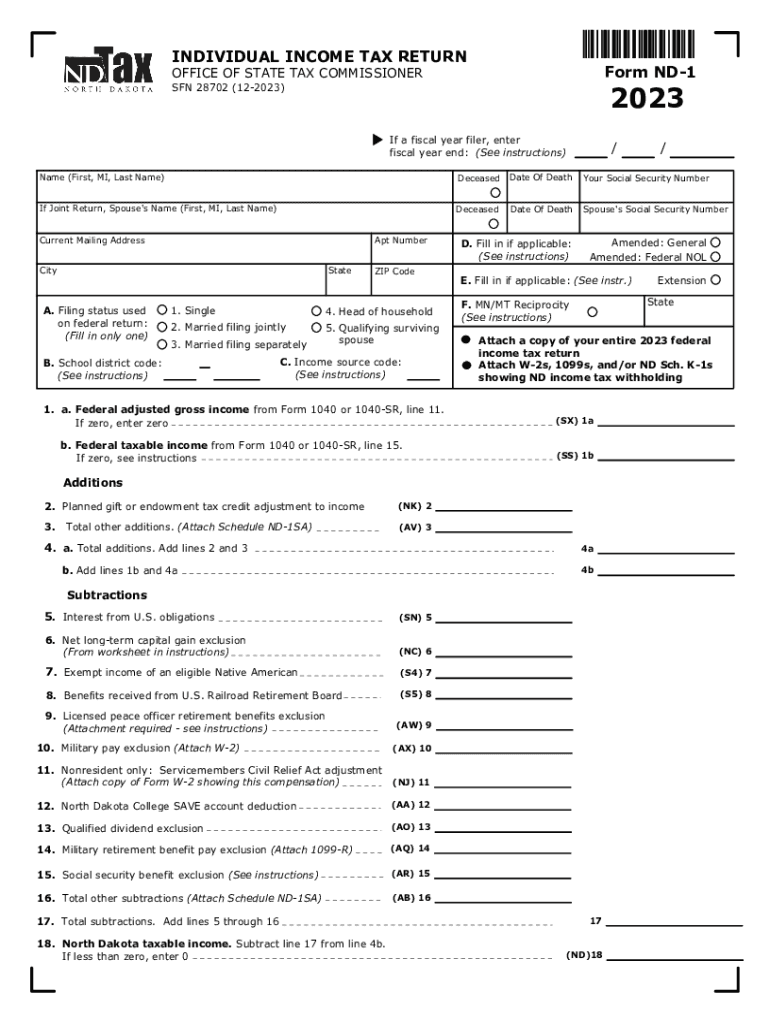

The Form ND 1 Individual Income Tax Return is a state-specific tax form used by residents of North Dakota to report their annual income and calculate their state tax obligations. This form is essential for individuals who earn income within the state, as it helps determine the amount of tax owed or any potential refund. The ND 1 form collects various financial information, including wages, interest, dividends, and other sources of income, as well as deductions and credits that may apply to the taxpayer.

How to obtain the Form ND 1 Individual Income Tax Return

To obtain the Form ND 1 Individual Income Tax Return, individuals can visit the North Dakota Office of State Tax Commissioner’s website, where the form is available for download. Additionally, taxpayers may request a physical copy by contacting their local tax office or the state tax commissioner directly. It is important to ensure that the correct version of the form is used for the relevant tax year, as forms may be updated annually.

Steps to complete the Form ND 1 Individual Income Tax Return

Completing the Form ND 1 involves several key steps:

- Gather all necessary financial documents, including W-2 forms, 1099s, and records of any other income.

- Fill out personal information, including name, address, and Social Security number at the top of the form.

- Report all sources of income in the designated sections, ensuring accuracy to avoid discrepancies.

- Claim any applicable deductions and credits, which can reduce the overall tax liability.

- Calculate the total tax owed or refund due by following the instructions provided on the form.

- Sign and date the form before submitting it to the appropriate tax authority.

Legal use of the Form ND 1 Individual Income Tax Return

The Form ND 1 is legally required for all residents of North Dakota who meet the income threshold set by the state. Failing to file this form can result in penalties, interest on unpaid taxes, and potential legal action by the state tax authorities. It is crucial for taxpayers to file their returns accurately and on time to comply with state tax laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form ND 1. Typically, the deadline for submitting the form is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific state announcements regarding extensions or changes to deadlines.

Form Submission Methods

The Form ND 1 can be submitted through various methods:

- Online: Taxpayers can file electronically using approved tax software that supports North Dakota tax forms.

- By Mail: Completed forms can be printed and mailed to the North Dakota Office of State Tax Commissioner.

- In-Person: Taxpayers may also choose to deliver their completed forms directly to their local tax office.

Quick guide on how to complete form nd 1 individual income tax return form nd 1 individual income tax return 707336538

Effortlessly prepare Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Handle Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return with ease

- Locate Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form nd 1 individual income tax return form nd 1 individual income tax return 707336538

Create this form in 5 minutes!

How to create an eSignature for the form nd 1 individual income tax return form nd 1 individual income tax return 707336538

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ND 1 Individual Income Tax Return?

The Form ND 1 Individual Income Tax Return is a tax form used by residents of North Dakota to report their individual income to the state. This form is essential for calculating state tax liabilities and ensuring compliance with state tax laws. By using airSlate SignNow, you can easily eSign and submit your Form ND 1 Individual Income Tax Return online.

-

How can airSlate SignNow help with the Form ND 1 Individual Income Tax Return?

airSlate SignNow provides a user-friendly platform that allows you to fill out, eSign, and send your Form ND 1 Individual Income Tax Return efficiently. Our solution streamlines the process, making it easier to manage your tax documents without the hassle of printing and mailing. With airSlate SignNow, you can focus on your finances while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow for the Form ND 1 Individual Income Tax Return?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including individual users and businesses. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Our cost-effective solution makes it easy to manage your Form ND 1 Individual Income Tax Return without breaking the bank.

-

Are there any features specifically designed for the Form ND 1 Individual Income Tax Return?

Yes, airSlate SignNow includes features tailored for the Form ND 1 Individual Income Tax Return, such as customizable templates, secure eSigning, and document tracking. These features enhance your experience by ensuring that your tax documents are completed accurately and submitted on time. With airSlate SignNow, you can confidently manage your tax obligations.

-

Can I integrate airSlate SignNow with other software for my Form ND 1 Individual Income Tax Return?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to streamline your workflow. By integrating with your preferred tools, you can easily import data and manage your Form ND 1 Individual Income Tax Return alongside other financial documents. This integration saves time and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for my Form ND 1 Individual Income Tax Return?

Using airSlate SignNow for your Form ND 1 Individual Income Tax Return provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. Our platform allows you to complete and eSign your tax return from anywhere, ensuring you meet deadlines without stress. Additionally, our secure system protects your sensitive information throughout the process.

-

Is airSlate SignNow suitable for businesses filing the Form ND 1 Individual Income Tax Return?

Yes, airSlate SignNow is an excellent choice for businesses filing the Form ND 1 Individual Income Tax Return. Our platform can handle multiple users and large volumes of documents, making it ideal for organizations of all sizes. With features designed for collaboration and efficiency, airSlate SignNow simplifies the tax filing process for businesses.

Get more for Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return

Find out other Form ND 1 Individual Income Tax Return Form ND 1 Individual Income Tax Return

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later