Business Tax Account City of Oakland 2023-2026

What is the Business Tax Account City Of Oakland

The Business Tax Account in the City of Oakland is a vital component for businesses operating within the city limits. This account serves as a record for all business tax obligations, ensuring compliance with local regulations. It is essential for businesses to register for a Business Tax Account to manage their tax responsibilities effectively and to avoid penalties for non-compliance.

How to obtain the Business Tax Account City Of Oakland

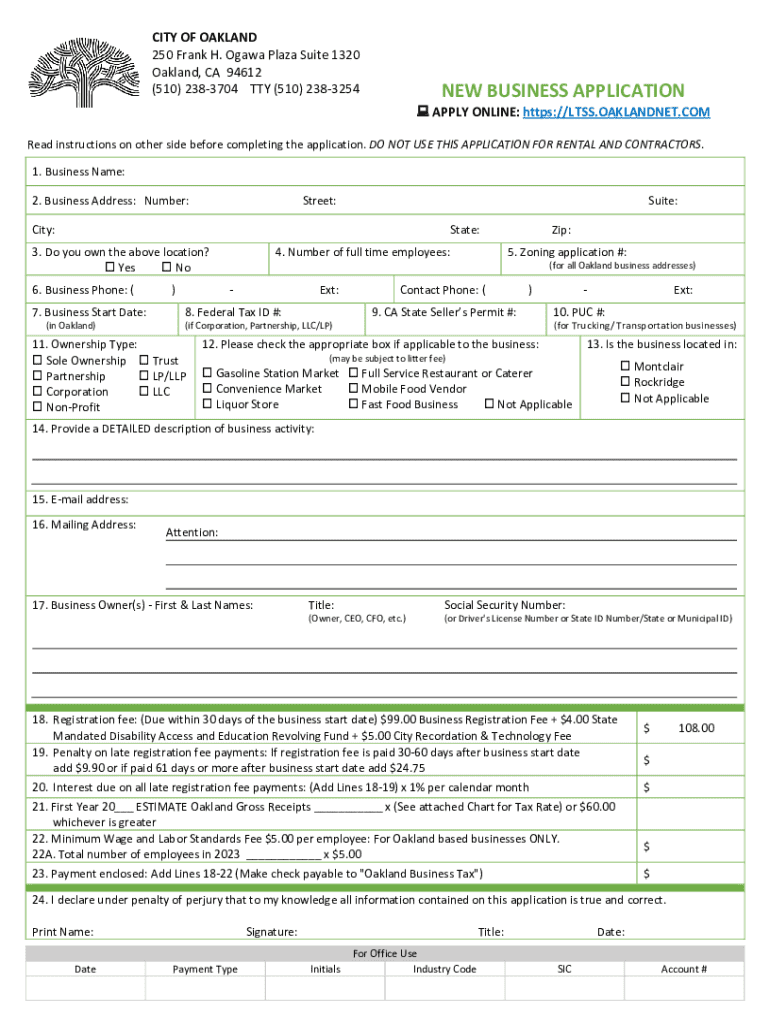

To obtain a Business Tax Account in Oakland, businesses must complete a registration process. This typically involves submitting a new business application form, which can be accessed through the city’s official website. Applicants will need to provide details such as the business name, address, ownership structure, and type of business activities. Once submitted, the city will review the application and issue a Business Tax Account number upon approval.

Steps to complete the Business Tax Account City Of Oakland

Completing the Business Tax Account registration involves several key steps:

- Gather necessary information about your business, including its legal structure and ownership details.

- Access the new business application form from the City of Oakland’s website.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application either online or via mail, as specified by the city guidelines.

- Await confirmation from the city regarding the approval of your Business Tax Account.

Required Documents

When applying for a Business Tax Account in Oakland, certain documents are typically required. These may include:

- A completed new business application form.

- Proof of business registration with the state of California.

- Identification documents for the business owner(s).

- Any additional permits or licenses specific to your business type.

Eligibility Criteria

Eligibility for a Business Tax Account in Oakland generally includes having a physical business presence within the city. This applies to various business types, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Additionally, businesses must comply with all local zoning laws and regulations to qualify for a Business Tax Account.

Penalties for Non-Compliance

Failure to obtain a Business Tax Account or to comply with tax obligations in Oakland can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is crucial for business owners to stay informed about their tax responsibilities to avoid these consequences.

Quick guide on how to complete business tax account city of oakland

Effortlessly Prepare Business Tax Account City Of Oakland on Any Device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Handle Business Tax Account City Of Oakland across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Business Tax Account City Of Oakland

- Locate Business Tax Account City Of Oakland and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click Done to save your changes.

- Select your preferred method of sending your form, whether via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Business Tax Account City Of Oakland to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax account city of oakland

Create this form in 5 minutes!

How to create an eSignature for the business tax account city of oakland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit CA businesses in Oakland City?

airSlate SignNow is a powerful eSignature solution that allows CA businesses in Oakland City to send and sign documents quickly and securely. By streamlining the signing process, businesses can save time and reduce paperwork, ultimately enhancing productivity and efficiency.

-

How much does airSlate SignNow cost for businesses in Oakland City, CA?

airSlate SignNow offers flexible pricing plans tailored for CA businesses in Oakland City. With options ranging from basic to advanced features, businesses can choose a plan that fits their budget and needs, ensuring they get the best value for their investment.

-

What features does airSlate SignNow offer for CA businesses in Oakland City?

airSlate SignNow provides a variety of features designed for CA businesses in Oakland City, including customizable templates, real-time tracking, and secure cloud storage. These features help businesses manage their documents efficiently and ensure compliance with legal standards.

-

Can airSlate SignNow integrate with other tools used by CA businesses in Oakland City?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used by CA businesses in Oakland City, such as Google Drive, Salesforce, and Microsoft Office. This integration allows for a smoother workflow and enhances overall productivity.

-

Is airSlate SignNow secure for CA businesses in Oakland City?

Absolutely! airSlate SignNow prioritizes security for CA businesses in Oakland City by employing advanced encryption and compliance with industry standards. This ensures that all documents and signatures are protected, giving businesses peace of mind.

-

How can CA businesses in Oakland City get started with airSlate SignNow?

Getting started with airSlate SignNow is easy for CA businesses in Oakland City. Simply sign up for a free trial on our website, explore the features, and start sending documents for eSignature within minutes. Our user-friendly interface makes the onboarding process seamless.

-

What are the benefits of using airSlate SignNow for CA businesses in Oakland City?

Using airSlate SignNow provides numerous benefits for CA businesses in Oakland City, including faster turnaround times for document signing, reduced operational costs, and improved customer satisfaction. These advantages help businesses stay competitive in today's fast-paced market.

Get more for Business Tax Account City Of Oakland

- Horse bill of sale california form

- Enter the complete name of the limited liability company llc exactly as it appears in the records of the form

- Standard quotation and specification form virginia

- Withholding tax forms wv state tax department

- Wv form cd 1np 2014

- Cd 1np form

- Dmc 1618 pps application new york state department of agriculture ny form

- Ny sun incentive program addendum to agreement form

Find out other Business Tax Account City Of Oakland

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement