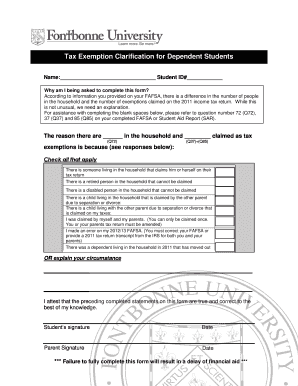

Tax Exemption Clarification for Dependent Fontbonne University Form

Understanding the Tax Exemption Clarification for Dependents at Fontbonne University

The Tax Exemption Clarification for Dependents at Fontbonne University is a crucial document that helps students and their families understand the eligibility for tax exemptions related to educational expenses. This form is particularly important for parents or guardians claiming a dependent student on their tax returns. It outlines the necessary criteria and provides guidance on how to navigate the tax implications of supporting a student at Fontbonne University.

Steps to Complete the Tax Exemption Clarification for Dependents

Completing the Tax Exemption Clarification for Dependents involves several key steps:

- Gather necessary documentation, including the student's enrollment status and financial information.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified guidelines, either online or via mail.

Eligibility Criteria for the Tax Exemption Clarification

To qualify for the Tax Exemption Clarification for Dependents, certain eligibility criteria must be met. Generally, the student must be enrolled at Fontbonne University and considered a dependent under IRS guidelines. This typically includes:

- The student must be under the age of twenty-four and enrolled at least half-time.

- The parent or guardian must provide more than half of the student's financial support.

- The student must not file a joint tax return with a spouse.

Required Documents for Submission

When submitting the Tax Exemption Clarification for Dependents, it is essential to include specific documents to support your claim. Required documents may include:

- Proof of the student's enrollment status at Fontbonne University.

- Financial documentation showing the support provided by the parent or guardian.

- Any previous tax returns that may be relevant to the claim.

IRS Guidelines for Tax Exemption Clarification

Understanding IRS guidelines is vital for effectively using the Tax Exemption Clarification for Dependents. The IRS provides specific rules regarding who can claim a dependent and what qualifies as support. It is important to familiarize yourself with:

- The definition of a dependent as per IRS regulations.

- Income thresholds that determine eligibility for tax exemptions.

- Documentation requirements for claiming a dependent on tax returns.

Form Submission Methods

The Tax Exemption Clarification for Dependents can be submitted through various methods, depending on the preferences and resources available. Common submission methods include:

- Online submission through the Fontbonne University portal.

- Mailing the completed form to the appropriate department at the university.

- In-person submission at the university's administrative office.

Quick guide on how to complete tax exemption clarification for dependent fontbonne university

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for those tasks.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and hit the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or mistakes that necessitate creating new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exemption clarification for dependent fontbonne university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Exemption Clarification For Dependent Fontbonne University?

The Tax Exemption Clarification For Dependent Fontbonne University refers to the guidelines and documentation required for students claiming tax exemptions for their dependents. Understanding these clarifications can help families maximize their tax benefits while ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with the Tax Exemption Clarification For Dependent Fontbonne University?

airSlate SignNow provides a streamlined platform for sending and eSigning necessary documents related to the Tax Exemption Clarification For Dependent Fontbonne University. This ensures that all required forms are completed accurately and submitted on time, reducing the stress of tax season.

-

What features does airSlate SignNow offer for managing tax exemption documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax exemption documents. These features simplify the process of obtaining the Tax Exemption Clarification For Dependent Fontbonne University, making it more efficient for users.

-

Is there a cost associated with using airSlate SignNow for tax exemption documents?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is competitive and provides a cost-effective solution for managing the Tax Exemption Clarification For Dependent Fontbonne University and other important documents.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your workflow. This integration is particularly beneficial for those handling the Tax Exemption Clarification For Dependent Fontbonne University, as it allows for easy document sharing and collaboration.

-

What are the benefits of using airSlate SignNow for tax exemption processes?

Using airSlate SignNow for tax exemption processes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages are crucial when dealing with the Tax Exemption Clarification For Dependent Fontbonne University, ensuring that all documents are handled professionally.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents. This level of security is essential when managing the Tax Exemption Clarification For Dependent Fontbonne University, ensuring that your information remains confidential and secure.

Get more for Tax Exemption Clarification For Dependent Fontbonne University

- Check request form requester fills in date of request pe

- Career planning policy form

- Instructions for completing csi forms cgs medicare

- Positive drug test results what you need to know foley form

- City state zip rural roundup form

- Change in family coverageoffice of human resources form

- Charitable contribution payroll deduction form

- How to prepare for a performance appraisala supervisors

Find out other Tax Exemption Clarification For Dependent Fontbonne University

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online