Tr 579 Wt 2015

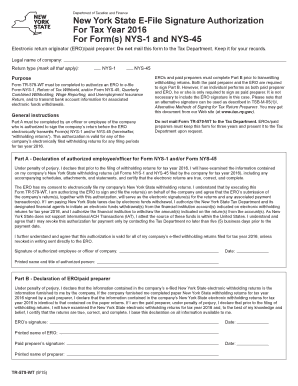

What is the TR 579 WT?

The TR 579 WT is a specific form used for tax purposes in the United States. It serves as a document for reporting certain financial transactions and ensuring compliance with federal tax regulations. This form is particularly relevant for businesses and individuals who need to disclose specific income or expenses to the Internal Revenue Service (IRS). Understanding the purpose and function of the TR 579 WT is essential for accurate tax reporting and avoiding potential penalties.

How to Use the TR 579 WT

Using the TR 579 WT involves several key steps. First, gather all necessary financial documents related to the transactions you need to report. This may include receipts, invoices, and bank statements. Next, fill out the form accurately, ensuring that all required fields are completed. It is crucial to double-check your entries for accuracy, as errors can lead to complications with the IRS. Once the form is completed, it can be submitted either electronically or via mail, depending on your preference and the specific requirements for your situation.

Steps to Complete the TR 579 WT

Completing the TR 579 WT requires careful attention to detail. Here are the steps to follow:

- Review the form to understand the required information.

- Collect all necessary documentation, including any relevant financial records.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided, either online or by mail.

Legal Use of the TR 579 WT

The TR 579 WT must be used in compliance with IRS regulations. Failure to use the form correctly can result in legal repercussions, including fines or audits. It is important to understand the legal implications of the information reported on this form and to ensure that all disclosures are truthful and accurate. Consulting with a tax professional can provide additional guidance on the legal use of the TR 579 WT.

Required Documents

To complete the TR 579 WT, several documents may be required. These typically include:

- Receipts for any expenses being reported.

- Invoices related to income earned.

- Bank statements showing relevant transactions.

- Previous tax returns, if applicable, for reference.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in your reporting.

Filing Deadlines / Important Dates

Filing deadlines for the TR 579 WT are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, businesses may have different deadlines depending on their fiscal year. It is advisable to check the IRS website or consult with a tax advisor for the most current deadlines and any extensions that may apply.

Quick guide on how to complete tr 579 wt 101100778

Manage Tr 579 Wt effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your documents swiftly without any delays. Manage Tr 579 Wt on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Tr 579 Wt with ease

- Find Tr 579 Wt and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tr 579 Wt and ensure excellent communication during every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tr 579 wt 101100778

Create this form in 5 minutes!

How to create an eSignature for the tr 579 wt 101100778

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tr 579 wt and how does it work?

The tr 579 wt is a powerful tool within airSlate SignNow that allows users to efficiently manage document signing and eSigning processes. It streamlines workflows by enabling users to send, sign, and store documents securely. With its user-friendly interface, businesses can easily navigate through the features to enhance their document management.

-

How much does the tr 579 wt cost?

Pricing for the tr 579 wt varies based on the subscription plan you choose. airSlate SignNow offers flexible pricing options to accommodate different business needs, ensuring that you get the best value for your investment. You can visit our pricing page for detailed information on the available plans.

-

What features are included with the tr 579 wt?

The tr 579 wt includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates seamlessly with other applications to enhance productivity. These features make it an ideal solution for businesses looking to optimize their document workflows.

-

What are the benefits of using the tr 579 wt for my business?

Using the tr 579 wt can signNowly improve your business's efficiency by reducing the time spent on document management. It allows for faster turnaround times on contracts and agreements, which can lead to increased revenue. Moreover, the secure eSigning process ensures compliance and enhances the overall customer experience.

-

Can the tr 579 wt integrate with other software?

Yes, the tr 579 wt is designed to integrate seamlessly with various software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to streamline their workflows and enhance collaboration across teams. Check our integrations page for a full list of compatible applications.

-

Is the tr 579 wt suitable for small businesses?

Absolutely! The tr 579 wt is tailored to meet the needs of businesses of all sizes, including small businesses. Its cost-effective pricing and easy-to-use features make it an ideal choice for small teams looking to improve their document signing processes without breaking the bank.

-

How secure is the tr 579 wt for document signing?

The tr 579 wt prioritizes security by employing advanced encryption protocols to protect your documents during transmission and storage. Additionally, it complies with industry standards and regulations to ensure that your data remains safe and confidential. You can trust airSlate SignNow to provide a secure eSigning experience.

Get more for Tr 579 Wt

- Colorado certified vin inspection coloradogov colorado form

- La dept of revenue form r 3400 1998

- Form 14568 d appendix c part ii schedule 4 simple iras internal irs

- Special license application package lcc 3510 state of michigan michigan form

- Annual immunization report on children enrolled in child care centers cdph 8018 cdph ca form

- Plate surrender application 1 2 dmv ny form

- Nys workers compemsafion form rb 89

- How do i download dealers and lessors supplemental report form

Find out other Tr 579 Wt

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation