New York State E File Signature Authorization for Tax YearFor Forms it 201, it 201 X, it 203, it 203 X, it 214, AndNew York Stat 2022-2026

Understanding the New York State E File Signature Authorization

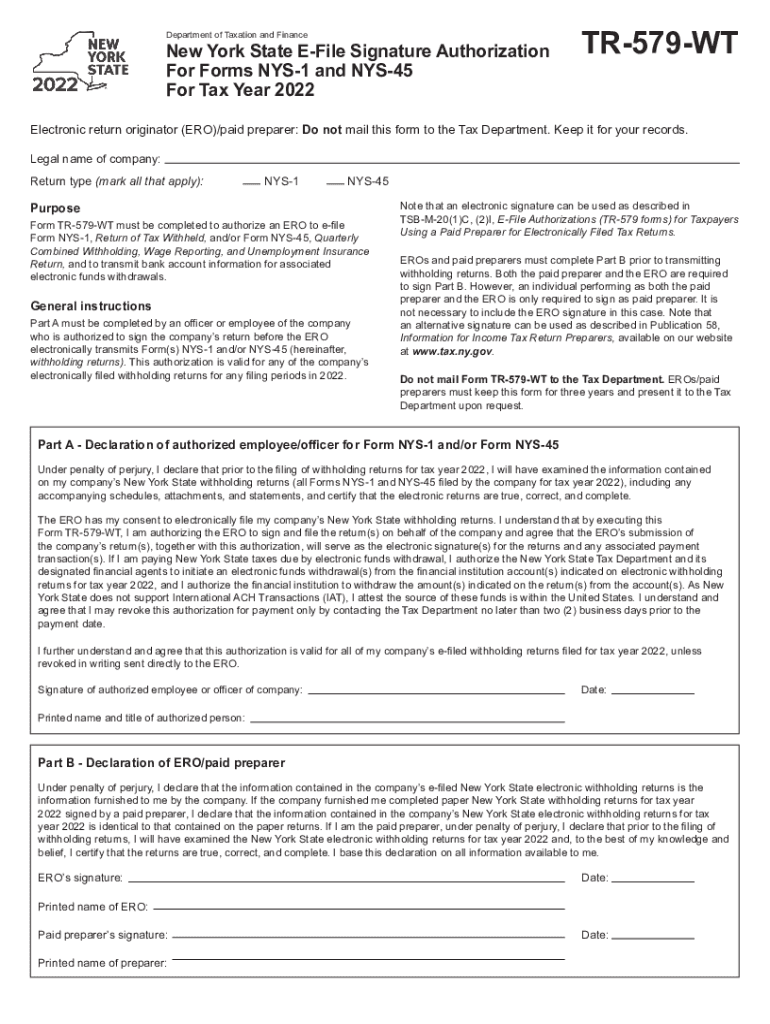

The New York State E File Signature Authorization is a crucial document for taxpayers submitting their tax returns electronically. This form allows taxpayers to authorize their tax preparers to e-file their returns on their behalf. It is applicable for various forms, including IT-201, IT-201 X, IT-203, IT-203 X, and IT-214. By completing this authorization, taxpayers ensure that their returns are filed accurately and efficiently, streamlining the overall tax filing process.

How to Use the New York State E File Signature Authorization

Using the New York State E File Signature Authorization involves a few straightforward steps. Taxpayers must first obtain the form, which can typically be accessed online or through their tax preparer. Once the form is filled out, it must be signed by the taxpayer to validate the authorization. After signing, the completed form should be submitted alongside the electronic tax return to ensure that the tax preparer has the necessary permissions to file on the taxpayer's behalf.

Steps to Complete the New York State E File Signature Authorization

Completing the New York State E File Signature Authorization involves several key steps:

- Obtain the form from a reliable source, such as the New York State Department of Taxation and Finance website.

- Fill in the required information, including the taxpayer's name, Social Security number, and the tax preparer's details.

- Review the information for accuracy to avoid any potential issues during filing.

- Sign and date the form to confirm the authorization.

- Submit the signed form along with the electronic tax return.

Key Elements of the New York State E File Signature Authorization

Several key elements are essential for the New York State E File Signature Authorization to be valid:

- The taxpayer's full name and Social Security number must be clearly stated.

- The tax preparer's information, including their name and identification number, is required.

- Both the taxpayer's signature and the date of signing are necessary for validation.

- The form must be submitted with the corresponding tax return to be effective.

State-Specific Rules for the New York State E File Signature Authorization

New York State has specific rules governing the use of the E File Signature Authorization. Taxpayers must ensure that they comply with these regulations to avoid penalties or delays in processing their returns. It is important to note that the authorization is only valid for the tax year specified on the form. Additionally, taxpayers should keep a copy of the signed authorization for their records, as it may be needed for future reference or in case of audits.

Examples of Using the New York State E File Signature Authorization

There are various scenarios in which the New York State E File Signature Authorization is utilized:

- A self-employed individual authorizing their tax preparer to file their business and personal tax returns electronically.

- A retired taxpayer allowing their accountant to handle their tax filings for the year.

- A student who may not have the time or expertise to file their taxes, granting permission to a family member or tax professional.

Quick guide on how to complete new york state e file signature authorization for tax yearfor forms it 201 it 201 x it 203 it 203 x it 214 andnew york state e

Prepare New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as a superb eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents quickly without delays. Handle New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to modify and eSign New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat effortlessly

- Find New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details carefully and then click the Done button to save your changes.

- Choose how you wish to submit your form, whether via email, SMS, or invitation link, or download it to your computer.

Disregard the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax yearfor forms it 201 it 201 x it 203 it 203 x it 214 andnew york state e

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax yearfor forms it 201 it 201 x it 203 it 203 x it 214 andnew york state e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214?

The New York State E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214 is a document that allows taxpayers to electronically sign their tax returns. This authorization simplifies the e-filing process and ensures that your tax submissions are valid and secure.

-

How does airSlate SignNow facilitate the New York State E File Signature Authorization process?

airSlate SignNow streamlines the New York State E File Signature Authorization process by providing an intuitive platform for e-signing documents. Users can easily upload their tax forms, add signatures, and submit them electronically, making the entire process efficient and hassle-free.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms offers numerous benefits, including time savings, enhanced security, and reduced paper usage. The platform ensures compliance with New York State regulations for the E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, allowing users to file confidently.

-

Is there a cost associated with using airSlate SignNow for New York State E File Signature Authorization?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses and individuals. Pricing plans vary based on features and usage, ensuring that users can find a solution that fits their budget while efficiently managing the New York State E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, enhancing your workflow. This allows you to seamlessly manage the New York State E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214 alongside your existing tools.

-

What types of documents can I e-sign using airSlate SignNow?

With airSlate SignNow, you can e-sign a wide range of documents, including tax forms, contracts, and agreements. Specifically, it supports the New York State E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, ensuring you can manage all your essential paperwork efficiently.

-

How secure is the e-signing process with airSlate SignNow?

The e-signing process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that your New York State E File Signature Authorization for Tax Year for Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214 is protected against unauthorized access and tampering.

Get more for New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat

- Is air with smog homogeneous or heterogeneous form

- How to close kiwibank account online form

- Protected person status document form

- Ending punctuation marks etap form

- Safe reference form dhr state md

- Home office letter template form

- Request for approval of state aidfed funds for schools form

- Cheerlead contract template form

Find out other New York State E File Signature Authorization For Tax YearFor Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, AndNew York Stat

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free