Online 1120x Rhode Island Form 2012

What is the Online 1120x Rhode Island Form

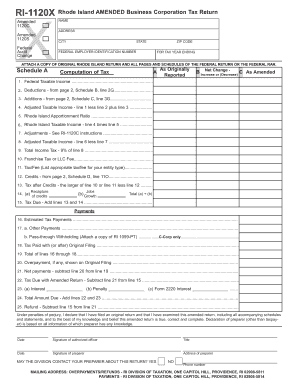

The Online 1120x Rhode Island Form is a tax amendment form specifically designed for corporations operating in Rhode Island. This form allows businesses to correct errors or make changes to their previously filed Rhode Island corporate tax returns. By using this form, corporations can ensure that their tax filings accurately reflect their financial situation, which is essential for compliance with state tax regulations.

Steps to complete the Online 1120x Rhode Island Form

Completing the Online 1120x Rhode Island Form involves several key steps:

- Gather necessary financial documents, including previous tax returns and supporting documentation for any changes.

- Access the Online 1120x Rhode Island Form through the designated platform.

- Fill in the required fields, ensuring that all information is accurate and matches your financial records.

- Provide explanations for the amendments made, detailing the reasons for each change.

- Review the completed form for accuracy before submission.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Online 1120x Rhode Island Form

The Online 1120x Rhode Island Form is legally recognized by the Rhode Island Division of Taxation. It is crucial for corporations to use this form when they need to amend their tax returns to avoid potential penalties. Proper use of this form ensures compliance with state tax laws and helps maintain accurate corporate tax records.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Online 1120x Rhode Island Form. Generally, the form should be filed within three years from the original filing date of the tax return being amended. It is essential to check for any updates or changes in deadlines that may occur annually, as these can impact your filing requirements.

Required Documents

To complete the Online 1120x Rhode Island Form, corporations will need to gather several documents, including:

- Previous tax returns that are being amended.

- Supporting documentation for any changes made, such as financial statements or receipts.

- Any correspondence with the Rhode Island Division of Taxation regarding the original filing.

Who Issues the Form

The Online 1120x Rhode Island Form is issued by the Rhode Island Division of Taxation. This state agency is responsible for overseeing tax compliance and ensuring that corporations adhere to state tax laws. Corporations can rely on the Division of Taxation for guidance on completing and submitting the form correctly.

Quick guide on how to complete online 1120x rhode island form

Conveniently Prepare Online 1120x Rhode Island Form on Any Device

Online document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Online 1120x Rhode Island Form on any device with airSlate SignNow's Android or iOS applications, and simplify any document-related processes today.

The Easiest Way to Alter and eSign Online 1120x Rhode Island Form Effortlessly

- Obtain Online 1120x Rhode Island Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Online 1120x Rhode Island Form while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct online 1120x rhode island form

Create this form in 5 minutes!

How to create an eSignature for the online 1120x rhode island form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Online 1120x Rhode Island Form?

The Online 1120x Rhode Island Form is a digital version of the amended corporate tax return for businesses in Rhode Island. This form allows companies to correct errors on previously filed tax returns efficiently. Using airSlate SignNow, you can complete and eSign this form quickly, ensuring compliance with state regulations.

-

How can I access the Online 1120x Rhode Island Form?

You can access the Online 1120x Rhode Island Form directly through the airSlate SignNow platform. Simply create an account, navigate to the forms section, and select the 1120x Rhode Island Form to begin. Our user-friendly interface makes it easy to fill out and submit your form online.

-

What are the benefits of using airSlate SignNow for the Online 1120x Rhode Island Form?

Using airSlate SignNow for the Online 1120x Rhode Island Form offers several benefits, including time savings and enhanced accuracy. Our platform allows for easy collaboration and secure eSigning, which streamlines the filing process. Additionally, you can track the status of your form in real-time.

-

Is there a cost associated with filing the Online 1120x Rhode Island Form?

Yes, there is a nominal fee associated with using airSlate SignNow to file the Online 1120x Rhode Island Form. However, this cost is often outweighed by the convenience and efficiency of our platform. We offer various pricing plans to suit different business needs, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other software for the Online 1120x Rhode Island Form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your documents and forms. You can connect with accounting software, CRM systems, and more to streamline your workflow when filing the Online 1120x Rhode Island Form.

-

How secure is the Online 1120x Rhode Island Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform to complete the Online 1120x Rhode Island Form, your data is protected with advanced encryption and secure storage. We comply with industry standards to ensure that your sensitive information remains confidential.

-

What features does airSlate SignNow offer for the Online 1120x Rhode Island Form?

airSlate SignNow provides a range of features for the Online 1120x Rhode Island Form, including customizable templates, eSignature capabilities, and document tracking. These features enhance the filing experience, making it easier to manage your forms and ensure timely submissions. Our platform is designed to simplify the entire process.

Get more for Online 1120x Rhode Island Form

- Bourland printing customer service resources ampamp support form

- 108 14 assessment item bank fulton county schools form

- 2014 gatp student packet fcps form

- Loras college request transcript form

- School zone variance letter 2003 form

- Smyrna school district new technology initiative new hardware new software wiringnetwork webinternet database move equipment 1 form

- Baruch overnight guest form

- D3 self release form 2010

Find out other Online 1120x Rhode Island Form

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template