RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI 2015-2026

Understanding the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change

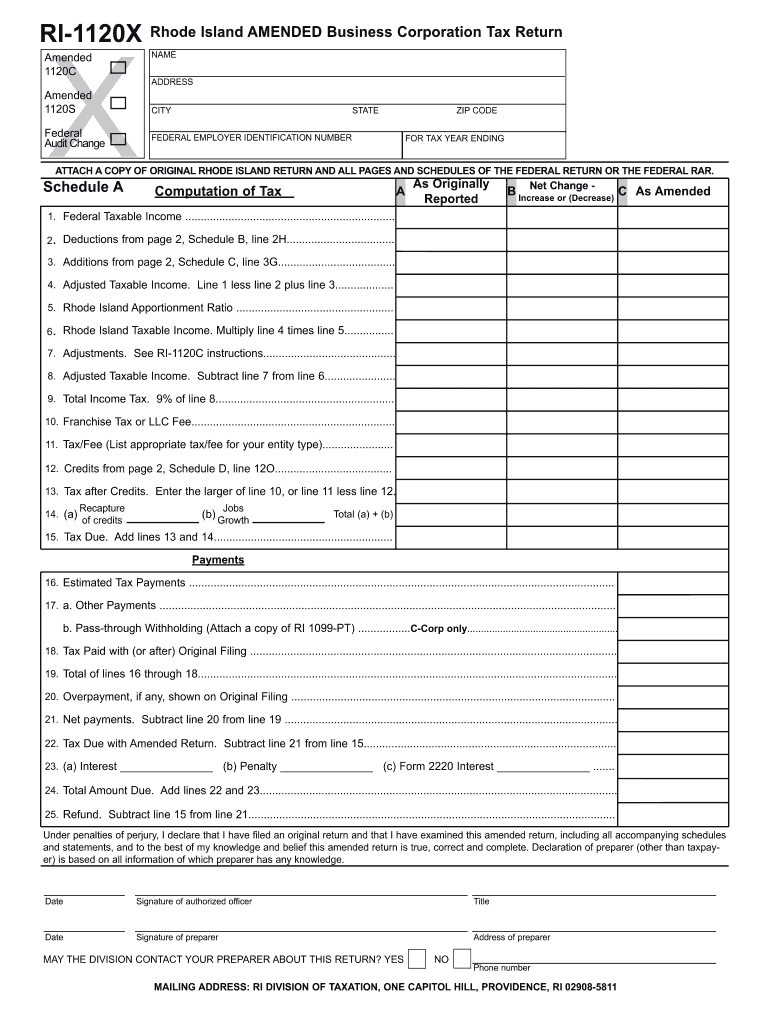

The RI 1120X Amended 1120C X Amended 1120S is a specific form used by businesses in Rhode Island to amend previously filed business corporation tax returns. This form is essential for correcting errors or making changes to the information reported in the original returns. It is particularly relevant for businesses undergoing a federal audit change, ensuring that any adjustments made at the federal level are accurately reflected in state tax filings. The form requires detailed information about the business, including the name, address, city, state, ZIP code, and federal employer identification number.

Steps to Complete the RI 1120X Amended 1120C X Amended 1120S

Completing the RI 1120X involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the original return and any federal audit changes. Next, fill out the form with updated information, ensuring that all sections are completed, including the name, address, and federal employer identification number. It is important to clearly indicate the changes being made and provide any required explanations. Once completed, review the form for accuracy before submitting it to the Rhode Island Division of Taxation.

Legal Use of the RI 1120X Amended 1120C X Amended 1120S

The RI 1120X serves a legal purpose in the context of business taxation in Rhode Island. It allows businesses to correct previously filed returns, which is crucial for maintaining compliance with state tax laws. Failing to amend a return when necessary can lead to penalties or interest charges. Therefore, understanding the legal implications of using this form is important for business owners, as it helps ensure that they remain in good standing with the state tax authority.

Key Elements of the RI 1120X Amended 1120C X Amended 1120S

Several key elements must be included when filing the RI 1120X. These include the business's legal name, the address where the business is located, the city and state, the ZIP code, and the federal employer identification number. Additionally, the form requires a clear description of the changes being made, along with any supporting documentation that may be necessary to substantiate the amendments. Ensuring that all required information is accurately provided is essential for the successful processing of the amended return.

Filing Deadlines for the RI 1120X Amended 1120C X Amended 1120S

Filing deadlines for the RI 1120X are crucial for businesses to adhere to in order to avoid penalties. Generally, the amended return should be filed within a specific timeframe following the original return's due date. Businesses should check the Rhode Island Division of Taxation's guidelines for the exact deadlines applicable to their situation, especially if the amendments are related to federal audit changes. Staying informed about these deadlines helps ensure compliance and avoids unnecessary complications.

Form Submission Methods for the RI 1120X Amended 1120C X Amended 1120S

The RI 1120X can be submitted through various methods, including online filing, mailing, or in-person submission at designated tax offices. Each method has its own advantages, such as the speed of online filing or the personal touch of in-person submissions. Businesses should choose the method that best suits their needs while ensuring that they follow all required procedures for submission to the Rhode Island tax authority.

Quick guide on how to complete ri 1120x amended 1120c x amended 1120s federal audit change rhode island amended business corporation tax return name address

Effortlessly Prepare RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary format and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and eSign RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI

- Find RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just a few seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your revisions.

- Choose how you wish to submit your form—by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Edit and eSign RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI, ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri 1120x amended 1120c x amended 1120s federal audit change rhode island amended business corporation tax return name address

Create this form in 5 minutes!

How to create an eSignature for the ri 1120x amended 1120c x amended 1120s federal audit change rhode island amended business corporation tax return name address

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change?

The RI 1120X Amended 1120C X Amended 1120S Federal Audit Change is a form used by businesses in Rhode Island to amend their business corporation tax returns. This form allows businesses to correct errors or make changes to previously filed returns, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the RI 1120X Amended 1120C X Amended 1120S process?

airSlate SignNow simplifies the process of preparing and submitting the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change. Our platform allows users to easily eSign and send documents, making it a cost-effective solution for managing business tax returns.

-

What features does airSlate SignNow offer for handling amended tax returns?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage. These tools streamline the process of completing the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change, ensuring that all necessary information, including NAME, ADDRESS, CITY, STATE, ZIP CODE, and FEDERAL EMPLOYER, is accurately captured.

-

Is there a cost associated with using airSlate SignNow for tax return amendments?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to essential features for managing the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration enhances your ability to manage the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change efficiently, allowing for a smoother workflow.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. By utilizing our platform for the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change, businesses can save time and ensure compliance with Rhode Island tax regulations.

-

How secure is my information when using airSlate SignNow?

airSlate SignNow prioritizes the security of your information with advanced encryption and secure data storage. When handling sensitive documents like the RI 1120X Amended 1120C X Amended 1120S Federal Audit Change, you can trust that your NAME, ADDRESS, CITY, STATE, ZIP CODE, and FEDERAL EMPLOYER details are protected.

Get more for RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI

- 2019 form 990 t exempt organization business income tax return and proxy tax under section 6033e

- 2019 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

- 2019 publication 972 internal revenue service form

- Form ss 4 rev december 2019 internal revenue service

- Instructions for form ss 4 rev december 2019 instructions for form ss 4 application for employer identification number ein

- Register rules avoidthescamnet form

- Ct agreement 2016 2019 form

- Jd fm 240 connecticut judicial branch ctgov jud ct form

Find out other RI 1120X Amended 1120C X Amended 1120S Federal Audit Change Rhode Island AMENDED Business Corporation Tax Return NAME ADDRESS CI

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast