RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri 2011

Understanding the RI 1120X Rhode Island AMENDED Business Corporation Tax

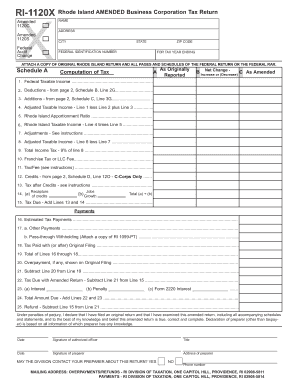

The RI 1120X is a specific form used for amending the Business Corporation Tax in Rhode Island. This form is essential for corporations that need to correct previously filed tax returns. It allows businesses to report changes in income, deductions, or credits that may affect their tax liability. By filing the RI 1120X, corporations can ensure compliance with state tax laws and rectify any discrepancies in their financial reporting.

Steps to Complete the RI 1120X Rhode Island AMENDED Business Corporation Tax

Completing the RI 1120X involves several key steps. First, gather all relevant financial documents and previous tax returns to ensure accurate reporting. Next, clearly indicate the changes being made on the form, providing detailed explanations for each adjustment. It is crucial to fill out all required sections accurately, including the corporation's name, address, and tax identification number. After completing the form, review it for any errors before submission.

Filing Deadlines for the RI 1120X

Corporations must adhere to specific filing deadlines when submitting the RI 1120X. Generally, the amended return should be filed within three years from the original due date of the tax return being amended. It is important to check for any updates or changes to these deadlines, as they can vary based on the tax year and specific circumstances of the corporation.

Required Documents for the RI 1120X

When filing the RI 1120X, certain documents are necessary to support the amendments being made. This includes a copy of the original tax return, any supporting schedules or documentation that justify the changes, and any correspondence with the Rhode Island Division of Taxation regarding the amendments. Having these documents ready will facilitate a smoother filing process.

Legal Use of the RI 1120X

The RI 1120X is legally recognized as the official form for amending Business Corporation Tax returns in Rhode Island. It serves as a formal request to the state tax authority to revise previously submitted information. Proper use of this form is essential for maintaining compliance with state tax regulations and avoiding potential penalties associated with inaccurate filings.

Who Issues the RI 1120X

The RI 1120X is issued by the Rhode Island Division of Taxation. This governmental body is responsible for overseeing tax compliance and administration within the state. The Division provides guidance on the completion and submission of the form, ensuring that corporations understand their obligations under Rhode Island tax law.

Quick guide on how to complete ri 1120x rhode island amended business corporation tax tax ri

Complete RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri effortlessly on any device

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri effortlessly

- Find RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri and click on Get Form to start.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text (SMS), or an invitation link, or download it to your computer.

Never worry about lost or misplaced documents, monotonous form navigation, or mistakes that require new document prints. airSlate SignNow meets your document management needs in a few clicks from your chosen device. Edit and eSign RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri 1120x rhode island amended business corporation tax tax ri

Create this form in 5 minutes!

How to create an eSignature for the ri 1120x rhode island amended business corporation tax tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1120X Rhode Island AMENDED Business Corporation Tax?

The RI 1120X Rhode Island AMENDED Business Corporation Tax is a tax form that allows businesses to amend their previously filed Rhode Island corporate tax returns. This form is essential for correcting errors or making changes to the original submission, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the RI 1120X Rhode Island AMENDED Business Corporation Tax?

airSlate SignNow provides a streamlined platform for businesses to prepare, sign, and submit the RI 1120X Rhode Island AMENDED Business Corporation Tax forms electronically. This simplifies the process, reduces paperwork, and ensures that your amendments are filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and larger organizations. Each plan provides access to features that facilitate the completion and signing of documents like the RI 1120X Rhode Island AMENDED Business Corporation Tax.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the RI 1120X Rhode Island AMENDED Business Corporation Tax, secure e-signatures, and document tracking. These features help ensure that your tax documents are handled efficiently and securely.

-

What benefits does airSlate SignNow offer for businesses filing the RI 1120X?

Using airSlate SignNow for filing the RI 1120X Rhode Island AMENDED Business Corporation Tax offers numerous benefits, including time savings, reduced errors, and enhanced compliance. The platform's user-friendly interface makes it easy to navigate the complexities of tax amendments.

-

Can airSlate SignNow integrate with other accounting software for tax filing?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, allowing for seamless data transfer when preparing the RI 1120X Rhode Island AMENDED Business Corporation Tax. This integration helps streamline your workflow and ensures that all financial information is accurate.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, employing advanced encryption and security protocols to protect sensitive tax documents like the RI 1120X Rhode Island AMENDED Business Corporation Tax. You can trust that your information is safe while using our platform.

Get more for RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri

Find out other RI 1120X Rhode Island AMENDED Business Corporation Tax Tax Ri

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF