Direct Debt Request 2019

What is the Direct Debt Request

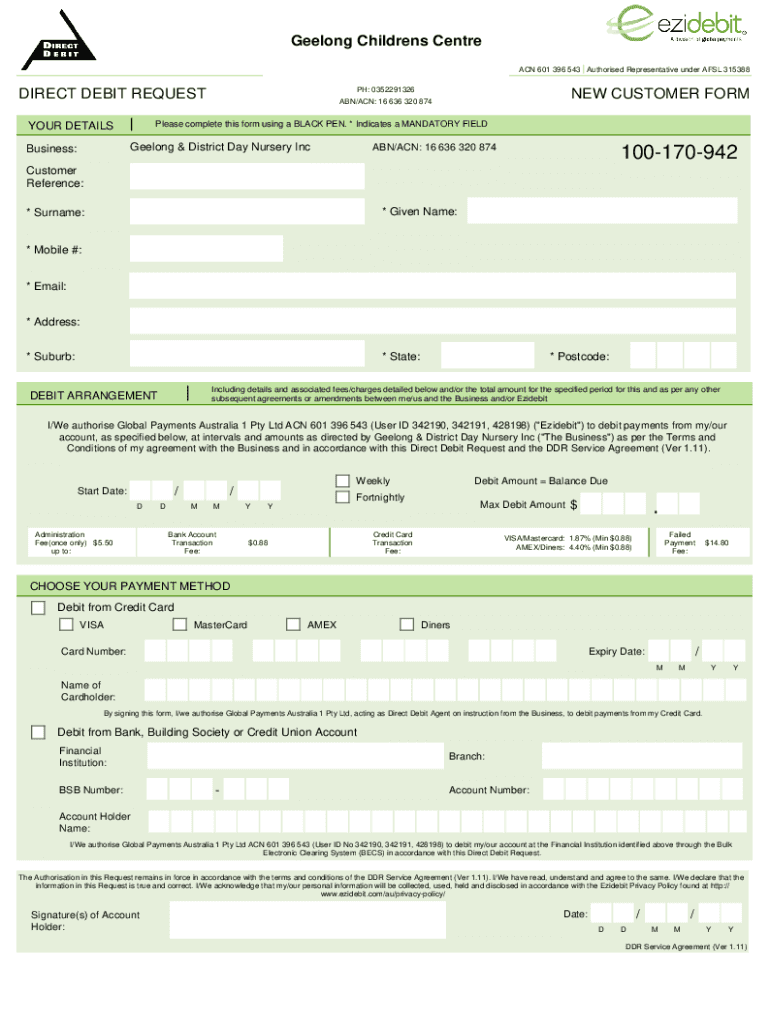

The Direct Debt Request is a financial document that allows individuals or businesses to authorize automatic withdrawals from their bank accounts for recurring payments. This form is commonly used for payments such as utility bills, loan repayments, or subscription services. By completing this request, the payer grants permission to the payee to withdraw funds directly, ensuring timely payments without the need for manual intervention.

How to use the Direct Debt Request

To use the Direct Debt Request, individuals must first obtain the form from the service provider or financial institution. Once acquired, fill in the required fields, which typically include personal information, bank account details, and the payment amount. After completing the form, review it for accuracy and submit it to the designated entity. The payee will process the request, and once approved, automatic withdrawals will commence according to the agreed schedule.

Steps to complete the Direct Debt Request

Completing the Direct Debt Request involves several key steps:

- Obtain the Direct Debt Request form from the service provider.

- Fill in your personal information, including your name, address, and contact details.

- Provide your bank account information, including the account number and routing number.

- Specify the amount to be withdrawn and the frequency of the payments.

- Review the form for accuracy and sign it to authorize the request.

- Submit the completed form to the payee, either online or by mail.

Key elements of the Direct Debt Request

Several key elements are essential when filling out the Direct Debt Request:

- Personal Information: Full name, address, and contact details of the payer.

- Bank Account Details: Accurate bank account number and routing number to facilitate withdrawals.

- Payment Amount: Clearly state the amount to be withdrawn periodically.

- Withdrawal Frequency: Indicate how often the payments will occur, such as weekly, monthly, or quarterly.

- Authorization Signature: A signature is required to validate the request and grant permission for withdrawals.

Legal use of the Direct Debt Request

The Direct Debt Request is legally binding once signed by the payer. It is important to ensure that all information provided is accurate to avoid potential disputes. The request must comply with federal and state regulations governing electronic payments and consumer protection laws. Additionally, payees are required to notify payers of any changes to the withdrawal schedule or amount, ensuring transparency and compliance with legal standards.

Form Submission Methods

Submitting the Direct Debt Request can be done through various methods, depending on the payee's policies:

- Online Submission: Many service providers offer online platforms where the form can be filled out and submitted electronically.

- Mail: The completed form can be printed and mailed to the designated address of the payee.

- In-Person: Some institutions may allow individuals to submit the form in person at their local branch or office.

Quick guide on how to complete direct debt request

Effortlessly prepare Direct Debt Request on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly, without complications. Manage Direct Debt Request on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to edit and electronically sign Direct Debt Request with ease

- Locate Direct Debt Request and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Direct Debt Request while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct direct debt request

Create this form in 5 minutes!

How to create an eSignature for the direct debt request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Direct Debt Request in airSlate SignNow?

A Direct Debt Request in airSlate SignNow allows businesses to automate the process of collecting payments directly from customers' bank accounts. This feature simplifies payment collection and enhances cash flow management, making it easier for businesses to manage recurring payments.

-

How does airSlate SignNow handle Direct Debt Requests?

airSlate SignNow streamlines Direct Debt Requests by providing a user-friendly interface for creating and sending payment requests. Users can easily customize their requests, ensuring that all necessary information is included, which helps in reducing errors and improving customer satisfaction.

-

What are the benefits of using Direct Debt Requests?

Using Direct Debt Requests through airSlate SignNow offers several benefits, including increased efficiency in payment collection, reduced administrative workload, and improved cash flow. Additionally, it enhances customer experience by providing a seamless payment process.

-

Is there a cost associated with Direct Debt Requests?

Yes, there is a cost associated with using Direct Debt Requests in airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing varies based on the features and volume of transactions, ensuring that you only pay for what you need.

-

Can I integrate Direct Debt Requests with other software?

Absolutely! airSlate SignNow offers integrations with various accounting and CRM software, allowing you to seamlessly manage your Direct Debt Requests alongside your other business processes. This integration helps in maintaining accurate records and enhances overall operational efficiency.

-

How secure are Direct Debt Requests in airSlate SignNow?

Security is a top priority for airSlate SignNow. Direct Debt Requests are protected with advanced encryption and compliance with industry standards, ensuring that your financial data and customer information remain safe and secure throughout the transaction process.

-

Can I customize my Direct Debt Request templates?

Yes, airSlate SignNow allows you to customize your Direct Debt Request templates to fit your branding and specific needs. This flexibility ensures that your requests are professional and aligned with your business identity, enhancing customer trust.

Get more for Direct Debt Request

Find out other Direct Debt Request

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form