Additional Income Form Independent University of

What is the Additional Income Form Independent University Of

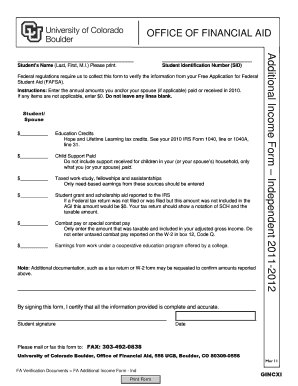

The Additional Income Form Independent University Of is a document used by students or individuals associated with the university to report additional sources of income. This form is particularly relevant for those who may have income from freelance work, part-time jobs, or other non-traditional employment while enrolled in their academic programs. It helps the university assess the financial situation of students, which can influence financial aid eligibility and other support services.

How to use the Additional Income Form Independent University Of

Using the Additional Income Form Independent University Of involves several straightforward steps. First, gather all necessary financial documentation that reflects your additional income sources. Next, accurately fill out the form, providing detailed information about each income source, including amounts and frequency of payment. Once completed, submit the form to the designated office within the university, ensuring you keep a copy for your records. This process helps maintain transparency regarding your financial situation.

Steps to complete the Additional Income Form Independent University Of

Completing the Additional Income Form Independent University Of requires careful attention to detail. Follow these steps:

- Obtain the form from the university's website or financial aid office.

- Fill in your personal information, including your student ID and contact details.

- List all additional income sources, specifying the type of income and the amount earned.

- Provide any necessary supporting documents, such as pay stubs or contracts.

- Review the form for accuracy before submission.

- Submit the form by the specified deadline to the appropriate university department.

Key elements of the Additional Income Form Independent University Of

The Additional Income Form Independent University Of includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Personal Information: This section requires your name, student ID, and contact information.

- Income Sources: A detailed list of all additional income, including employer names and income amounts.

- Supporting Documentation: Instructions for attaching relevant documents that validate the reported income.

- Signature: Your signature certifies that the information provided is accurate and complete.

Required Documents

To successfully complete the Additional Income Form Independent University Of, you may need to provide various supporting documents. These can include:

- Pay stubs from employers.

- Freelance contracts or invoices.

- Tax documents, such as 1099 forms, if applicable.

- Bank statements showing direct deposits related to additional income.

Form Submission Methods

The Additional Income Form Independent University Of can typically be submitted through several methods, depending on the university's policies. Common submission methods include:

- Online Submission: Many universities offer an online portal for submitting forms digitally.

- Mail: You can send the completed form and any supporting documents to the financial aid office via postal mail.

- In-Person Submission: Some students may prefer to deliver the form directly to the university office.

Quick guide on how to complete additional income form independent university of

Accomplish [SKS] easily on any device

Web-based document administration has gained traction among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the proper form and securely save it online. airSlate SignNow provides you with all the resources you need to create, revise, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to alter and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document duplicates. airSlate SignNow meets all your needs in document management with just a few clicks from your chosen device. Modify and eSign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Additional Income Form Independent University Of

Create this form in 5 minutes!

How to create an eSignature for the additional income form independent university of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Additional Income Form Independent University Of?

The Additional Income Form Independent University Of is a specialized document designed to help independent universities streamline their income reporting processes. This form allows institutions to efficiently collect and manage additional income data, ensuring compliance and accuracy in financial reporting.

-

How can airSlate SignNow help with the Additional Income Form Independent University Of?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning the Additional Income Form Independent University Of. With its intuitive interface, you can easily customize the form to meet your specific needs and ensure a smooth workflow for your institution.

-

What are the pricing options for using airSlate SignNow with the Additional Income Form Independent University Of?

airSlate SignNow offers flexible pricing plans that cater to various institutional needs. By choosing the right plan, you can access features that enhance the management of the Additional Income Form Independent University Of, ensuring cost-effectiveness and value for your university.

-

What features does airSlate SignNow offer for the Additional Income Form Independent University Of?

Key features of airSlate SignNow for the Additional Income Form Independent University Of include customizable templates, secure eSigning, and real-time tracking of document status. These features help streamline the process, making it easier for universities to manage additional income documentation efficiently.

-

What are the benefits of using airSlate SignNow for the Additional Income Form Independent University Of?

Using airSlate SignNow for the Additional Income Form Independent University Of offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the process, universities can save time and resources while ensuring that all documents are securely stored and easily accessible.

-

Can airSlate SignNow integrate with other systems for the Additional Income Form Independent University Of?

Yes, airSlate SignNow can seamlessly integrate with various systems and applications, enhancing the management of the Additional Income Form Independent University Of. This integration allows for better data flow and collaboration across different departments within the university.

-

Is airSlate SignNow user-friendly for managing the Additional Income Form Independent University Of?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for staff and administrators to manage the Additional Income Form Independent University Of. The platform's intuitive interface ensures that users can navigate and utilize its features without extensive training.

Get more for Additional Income Form Independent University Of

Find out other Additional Income Form Independent University Of

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple