GI Gift Form

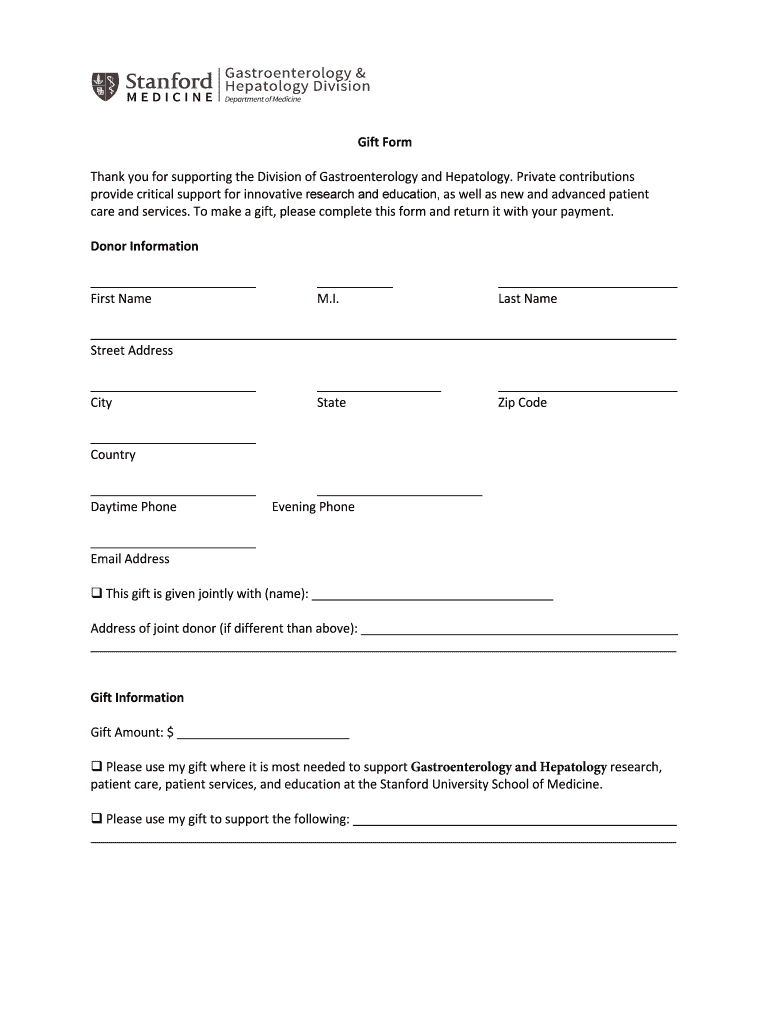

What is the GI Gift Form

The GI Gift Form is a specific document used in the context of gifting assets or property to individuals, often within military or veteran communities. This form facilitates the legal transfer of ownership and ensures that the transaction is documented properly for tax purposes. It is essential for both the giver and the recipient to understand the implications of the gift, including any potential tax liabilities that may arise.

How to use the GI Gift Form

Using the GI Gift Form involves several straightforward steps. First, the donor must fill out the form with accurate information regarding the gift, including details about the asset being transferred. Both parties should review the completed form to ensure all information is correct. Once finalized, the form must be signed by the donor and, in some cases, the recipient. It is advisable to keep a copy of the signed form for personal records and potential future tax reporting.

Steps to complete the GI Gift Form

Completing the GI Gift Form requires careful attention to detail. Here are the key steps:

- Obtain the GI Gift Form from a reliable source.

- Fill in the donor's and recipient's information, including names and addresses.

- Describe the asset being gifted, including its value and any relevant identification numbers.

- Sign and date the form to validate the transaction.

- Provide any additional documentation if required, such as proof of ownership.

Required Documents

To complete the GI Gift Form effectively, certain documents may be necessary. These can include:

- Proof of ownership of the asset being gifted, such as a title or deed.

- Identification for both the donor and recipient, typically a government-issued ID.

- Any previous tax documents related to the asset, if applicable.

Legal use of the GI Gift Form

The GI Gift Form serves a legal purpose by documenting the transfer of property or assets. It is crucial to ensure that the form is filled out accurately to avoid any legal disputes in the future. Additionally, understanding the tax implications of gifting is vital, as the IRS has specific guidelines that govern the value of gifts and potential tax responsibilities for both the donor and recipient.

Filing Deadlines / Important Dates

When using the GI Gift Form, it is important to be aware of any relevant deadlines. Typically, gifts must be reported in the tax year they are given. The IRS requires that any gifts exceeding a certain value be reported on tax returns. Keeping track of these deadlines can help avoid penalties and ensure compliance with tax regulations.

Quick guide on how to complete gi gift form

Accomplish GI Gift Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Manage GI Gift Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign GI Gift Form with ease

- Locate GI Gift Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your selection. Edit and eSign GI Gift Form and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gi gift form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GI Gift Form?

A GI Gift Form is a document used to facilitate the gifting process for General Instruction (GI) purposes. It allows individuals to formally document their intent to give a gift, ensuring that all necessary information is captured. Using airSlate SignNow, you can easily create and eSign your GI Gift Form online.

-

How can airSlate SignNow help with GI Gift Forms?

airSlate SignNow streamlines the process of creating and signing GI Gift Forms. Our platform provides an easy-to-use interface that allows you to customize your forms and send them for eSignature quickly. This ensures that your GI Gift Form is completed efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for GI Gift Forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and designed to provide value for users who frequently handle GI Gift Forms. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for GI Gift Forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for GI Gift Forms. These features enhance the user experience and ensure that your forms are processed efficiently. Additionally, you can integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with other applications for GI Gift Forms?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your GI Gift Form process with tools you already use. This integration capability enhances productivity and ensures a seamless workflow for managing your documents.

-

What are the benefits of using airSlate SignNow for GI Gift Forms?

Using airSlate SignNow for GI Gift Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your forms digitally, saving time and resources. Additionally, eSigning ensures that your documents are legally binding and secure.

-

How secure is the information on my GI Gift Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect the information on your GI Gift Form. This ensures that your data remains confidential and secure throughout the signing process.

Get more for GI Gift Form

Find out other GI Gift Form

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement