Indiana Rrmc Application 2019

Understanding the Indiana business sales tax form

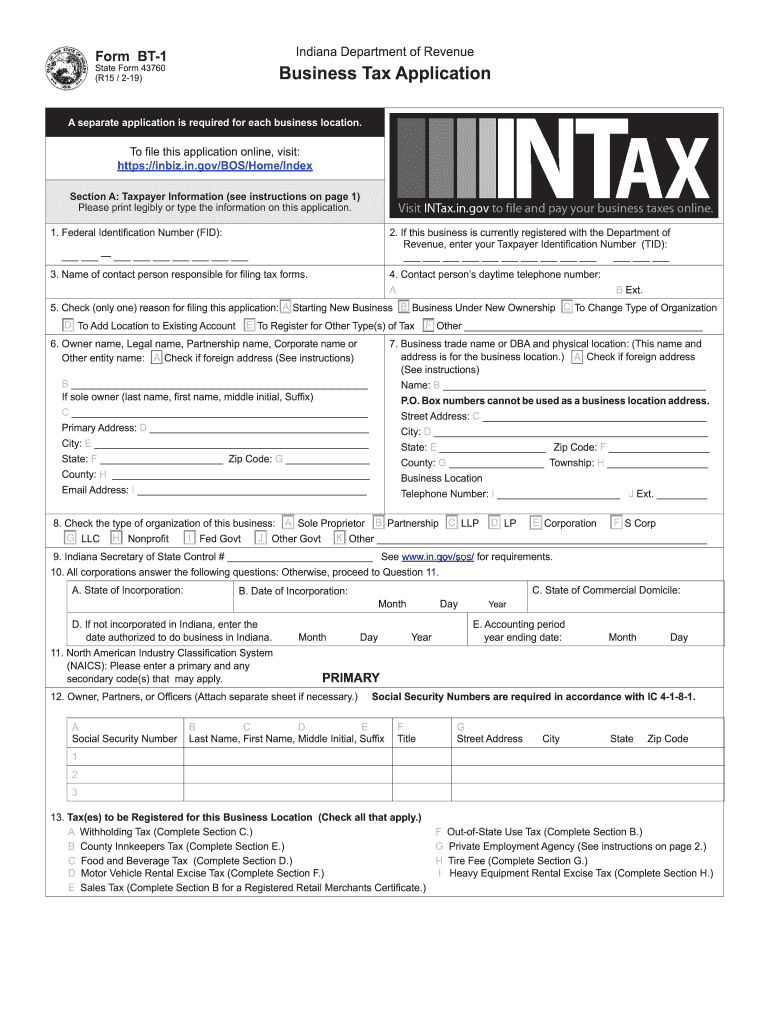

The Indiana business sales tax form, also known as the Indiana BT-1 form, is essential for businesses operating within the state to register for sales tax collection. This form is required for businesses that sell tangible personal property or certain services subject to sales tax. Completing this form accurately ensures compliance with state tax regulations and allows businesses to operate legally.

Steps to complete the Indiana business sales tax form

Filling out the Indiana business sales tax form involves several key steps:

- Gather necessary business information, including your business name, address, and federal Employer Identification Number (EIN).

- Identify the type of business entity you are operating, such as a sole proprietorship, partnership, or corporation.

- Complete the form by providing details about your business activities and expected sales.

- Review the form for accuracy to avoid any potential issues with the Indiana Department of Revenue.

- Submit the completed form online or via mail, depending on your preference.

Required documents for the Indiana business sales tax form

To successfully complete the Indiana business sales tax form, you will need to provide certain documents:

- Your federal Employer Identification Number (EIN).

- Proof of business registration in Indiana, if applicable.

- Details of your business activities and expected sales volume.

Form submission methods for the Indiana business sales tax form

The Indiana business sales tax form can be submitted through various methods:

- Online submission via the Indiana Department of Revenue's website, which allows for quicker processing.

- Mailing a printed copy of the form to the appropriate state office.

- In-person submission at designated state offices, if preferred.

Legal use of the Indiana business sales tax form

Utilizing the Indiana business sales tax form is legally required for businesses that engage in taxable sales. This form not only registers your business for sales tax collection but also ensures compliance with Indiana tax laws. Properly completing and submitting the form protects your business from potential fines and legal issues related to tax non-compliance.

Penalties for non-compliance with Indiana sales tax regulations

Failure to file the Indiana business sales tax form or to collect sales tax appropriately can result in significant penalties. These may include:

- Fines imposed by the Indiana Department of Revenue.

- Interest on unpaid taxes.

- Potential legal action against the business.

Eligibility criteria for submitting the Indiana business sales tax form

To be eligible to submit the Indiana business sales tax form, businesses must meet the following criteria:

- Engage in sales of tangible personal property or taxable services.

- Have a physical presence or nexus in Indiana.

- Be registered as a legal business entity in the state.

Quick guide on how to complete to file this application online visit

Effortlessly Prepare Indiana Rrmc Application on Any Device

Digital document management has become popular among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Indiana Rrmc Application on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Indiana Rrmc Application effortlessly

- Find Indiana Rrmc Application and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize relevant sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form—via email, SMS, or invitation link—or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Indiana Rrmc Application and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct to file this application online visit

Create this form in 5 minutes!

How to create an eSignature for the to file this application online visit

How to create an eSignature for the To File This Application Online Visit in the online mode

How to generate an electronic signature for the To File This Application Online Visit in Chrome

How to make an eSignature for putting it on the To File This Application Online Visit in Gmail

How to make an electronic signature for the To File This Application Online Visit straight from your smartphone

How to make an electronic signature for the To File This Application Online Visit on iOS devices

How to make an electronic signature for the To File This Application Online Visit on Android devices

People also ask

-

What is the Indiana business sales tax form and why is it important?

The Indiana business sales tax form is a critical document that businesses must file to report sales tax collected on taxable goods and services. It ensures compliance with state tax laws and helps businesses avoid penalties. By accurately completing the Indiana business sales tax form, you maintain good standing with the state and support local economic development.

-

How can airSlate SignNow help me with the Indiana business sales tax form?

airSlate SignNow streamlines the process of completing and eSigning the Indiana business sales tax form. Our user-friendly platform allows you to easily fill out the form electronically and send it directly to the appropriate authorities. This saves you time and ensures accuracy in your tax submissions.

-

Is there a cost associated with using airSlate SignNow for the Indiana business sales tax form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for handling documents like the Indiana business sales tax form. You can choose a plan based on your volume of use, and there are options for monthly or annual subscriptions. This transparency in pricing helps you budget effectively for your document management needs.

-

What features does airSlate SignNow offer for the Indiana business sales tax form?

AirSlate SignNow includes several features to optimize the process of handling the Indiana business sales tax form. These features include easy document creation, eSignature capabilities, and secure cloud storage for your tax forms. Additionally, our platform offers templates for quick access, ensuring you have everything you need to complete the form accurately.

-

Are there integration options available for the Indiana business sales tax form with airSlate SignNow?

Yes, airSlate SignNow integrates with various accounting and business management tools to streamline the completion of the Indiana business sales tax form. This ensures that data flows seamlessly between platforms, reducing manual entry errors. With integrations, you can easily import necessary financial data directly into your tax form.

-

How secure is my information when using airSlate SignNow for the Indiana business sales tax form?

Security is a top priority at airSlate SignNow. When you submit or store the Indiana business sales tax form, your data is encrypted and protected by robust security measures. Our platform also complies with major data protection regulations, giving you peace of mind regarding the confidentiality of your information.

-

Can I store past Indiana business sales tax forms in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including previous Indiana business sales tax forms. You can easily access, review, and organize all your tax forms at any time, making it convenient for future reference or audits.

Get more for Indiana Rrmc Application

- Medicare advantage waiver of liability form a non contract provider on his or her own behalf may request a reconsideration for

- Rx updated sunceram png form

- Lidocaine patch prior authorization request form 519964190

- Medical record information release

- Due august 1 scan and email to yhmedicalr form

- Modified city of hope patient questionnaire and call care cover letters form

- Breast cancer radiation therapy treatment plan checklist form

- Initial evaluation subjective history worksheet form

Find out other Indiana Rrmc Application

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy