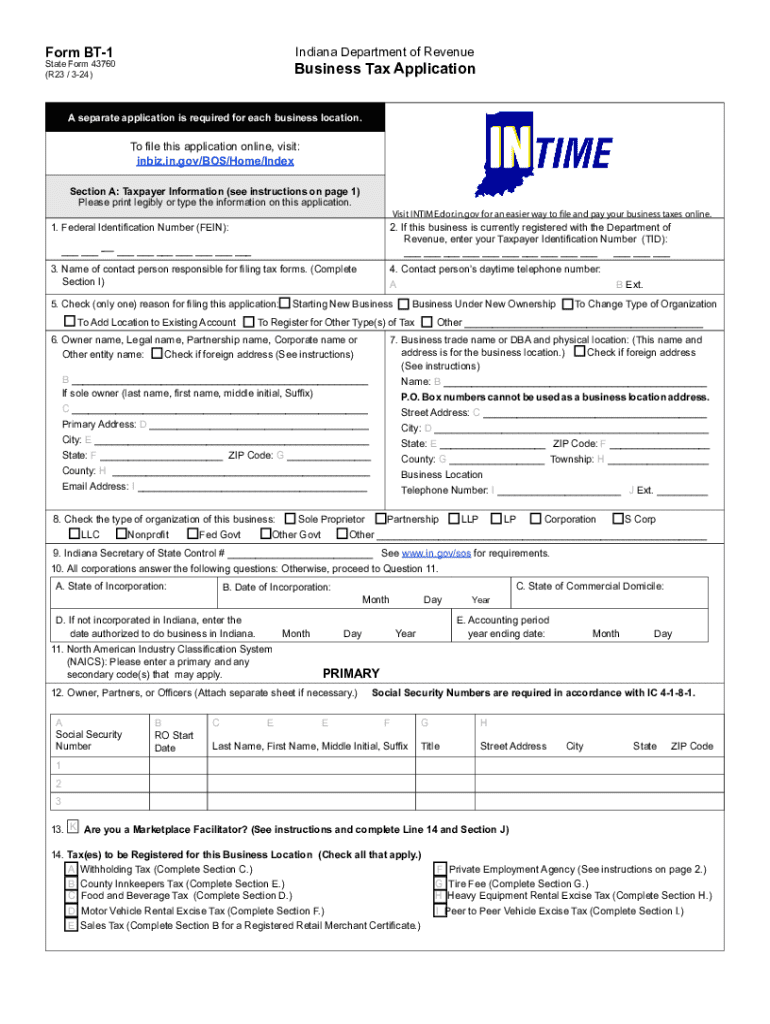

Indiana Department of Revenue Business Tax Application 2024-2026

What is the Indiana Department of Revenue Business Tax Application

The Indiana Department of Revenue Business Tax Application, commonly referred to as the Indiana BT form, is a crucial document for businesses operating within the state. This application is designed to register businesses for various tax obligations, including sales tax, income tax, and other state-specific taxes. Completing this form is essential for compliance with Indiana tax laws and helps ensure that businesses are properly accounted for in the state's revenue system.

Steps to Complete the Indiana Department of Revenue Business Tax Application

Completing the Indiana BT form involves several key steps:

- Gather Required Information: Collect all necessary business details, including the legal name, address, and type of business entity.

- Identify Tax Obligations: Determine which taxes your business needs to register for, such as sales tax or corporate income tax.

- Fill Out the Form: Carefully complete the Indiana BT form, ensuring all fields are accurately filled to avoid delays.

- Review for Accuracy: Double-check all information for completeness and correctness before submission.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person.

Required Documents

To successfully complete the Indiana BT form, businesses must provide several supporting documents, including:

- Federal Employer Identification Number (EIN), if applicable

- Business formation documents, such as Articles of Incorporation or Organization

- Proof of business address, which may include a utility bill or lease agreement

- Any previous tax identification numbers, if applicable

Form Submission Methods

The Indiana BT form can be submitted through various methods to accommodate different business needs:

- Online Submission: Businesses can complete and submit the form electronically via the Indiana Department of Revenue website.

- Mail Submission: Print the completed form and send it to the designated address provided on the form.

- In-Person Submission: Visit a local Indiana Department of Revenue office to submit the form directly.

Eligibility Criteria

To be eligible for the Indiana BT form, businesses must meet specific criteria, including:

- Being legally registered to operate in Indiana

- Having a physical presence in the state or conducting business activities within Indiana

- Meeting the revenue thresholds for tax registration, which may vary based on the type of business

Penalties for Non-Compliance

Failing to file the Indiana BT form or register for required taxes can result in significant penalties. These may include:

- Fines for late registration or filing

- Interest on unpaid taxes

- Potential legal action from the Indiana Department of Revenue

It is crucial for businesses to stay compliant to avoid these repercussions and ensure smooth operations.

Create this form in 5 minutes or less

Find and fill out the correct indiana department of revenue business tax application

Create this form in 5 minutes!

How to create an eSignature for the indiana department of revenue business tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana BT form and how can airSlate SignNow help?

The Indiana BT form is a document required for various business transactions in Indiana. airSlate SignNow simplifies the process by allowing users to easily create, send, and eSign the Indiana BT form online, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the Indiana BT form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion of the Indiana BT form, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the Indiana BT form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Indiana BT form. These tools enhance the user experience and ensure that all necessary steps are completed efficiently.

-

Can I integrate airSlate SignNow with other applications for the Indiana BT form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Indiana BT form alongside your existing workflows. This integration capability enhances productivity and streamlines document management.

-

How does airSlate SignNow ensure the security of the Indiana BT form?

airSlate SignNow prioritizes security by employing advanced encryption and authentication measures for the Indiana BT form. This ensures that your documents are protected and that sensitive information remains confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for the Indiana BT form?

Using airSlate SignNow for the Indiana BT form offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. These advantages help businesses save time and resources while ensuring compliance with Indiana regulations.

-

Is it easy to use airSlate SignNow for the Indiana BT form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the Indiana BT form. The intuitive interface guides users through each step, ensuring a smooth experience even for those unfamiliar with digital document management.

Get more for Indiana Department Of Revenue Business Tax Application

Find out other Indiana Department Of Revenue Business Tax Application

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free