DOR Business Tax Forms in Gov 2020

Understanding the DOR Business Tax Forms in Indiana

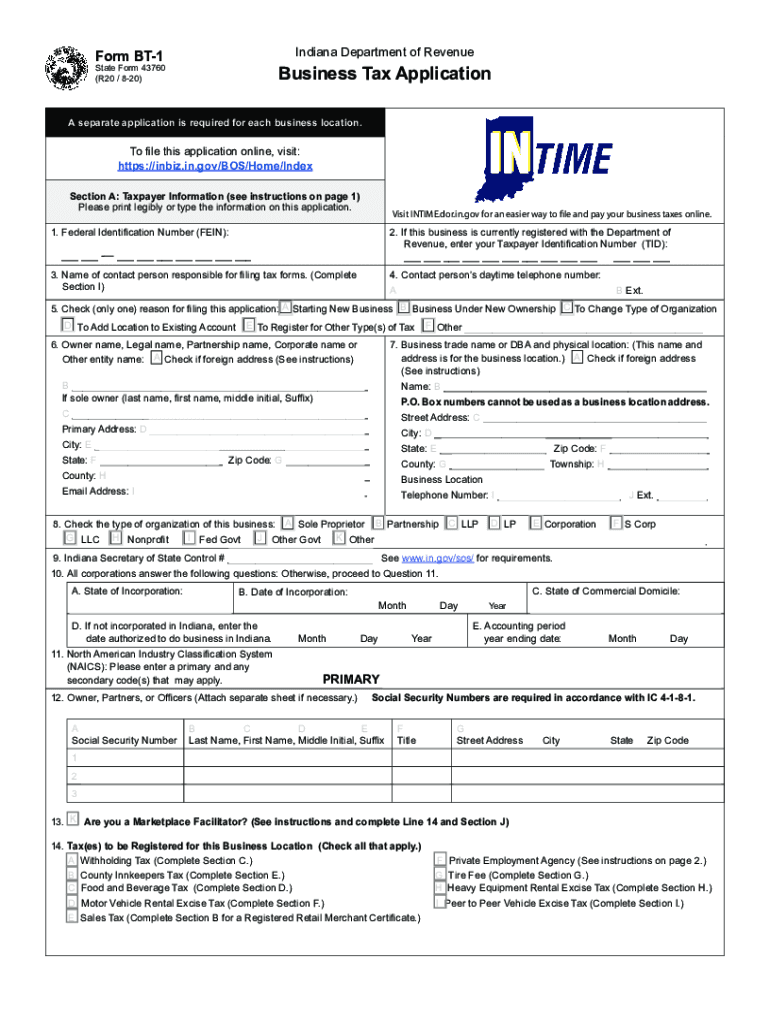

The Department of Revenue (DOR) in Indiana provides various business tax forms, including the BT-1 Revenue form. This form is essential for businesses operating within the state to report their revenue accurately. Understanding the purpose and requirements of these forms is crucial for compliance and effective tax management.

Steps to Complete the DOR Business Tax Forms in Indiana

Completing the DOR Business Tax Forms, such as the BT-1 Revenue form, involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Ensure you have the correct form version for the current tax year.

- Fill out the form accurately, providing all required information, such as business name, address, and revenue details.

- Review the completed form for any errors or omissions before submission.

Required Documents for the DOR Business Tax Forms in Indiana

When preparing to submit the BT-1 Revenue form, businesses need to collect specific documents:

- Financial statements that detail revenue and expenses.

- Previous tax returns, if applicable, to ensure consistency.

- Any supporting documentation for deductions or credits claimed.

Filing Deadlines for the DOR Business Tax Forms in Indiana

Filing deadlines for the BT-1 Revenue form are critical to avoid penalties. Generally, businesses must submit their forms by the due date specified by the Indiana DOR, which is typically aligned with the annual tax filing period. It is advisable to check the Indiana DOR website or consult with a tax professional for specific deadlines relevant to your business.

Legal Use of the DOR Business Tax Forms in Indiana

The legal use of the DOR Business Tax Forms, including the BT-1 Revenue form, requires adherence to state tax laws and regulations. Accurate completion and timely submission ensure compliance and help avoid potential legal issues, such as fines or audits. Utilizing a reliable eSignature solution can enhance the legal standing of your submitted forms.

Form Submission Methods for the DOR Business Tax Forms in Indiana

Businesses can submit the BT-1 Revenue form through various methods:

- Online submission via the Indiana DOR’s e-filing system.

- Mailing a printed version of the form to the appropriate DOR office.

- In-person submission at designated DOR locations, if applicable.

Penalties for Non-Compliance with DOR Business Tax Forms in Indiana

Failure to comply with the requirements of the DOR Business Tax Forms can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand these consequences and ensure timely and accurate filing to maintain compliance.

Quick guide on how to complete dor business tax forms ingov 536478856

Manage DOR Business Tax Forms IN gov effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your documents swiftly without any holdups. Handle DOR Business Tax Forms IN gov on any system with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign DOR Business Tax Forms IN gov easily

- Obtain DOR Business Tax Forms IN gov and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to finalize your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes requiring the printing of new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and eSign DOR Business Tax Forms IN gov and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor business tax forms ingov 536478856

Create this form in 5 minutes!

How to create an eSignature for the dor business tax forms ingov 536478856

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is BT 1 revenue, and how does it relate to airSlate SignNow?

BT 1 revenue refers to the first tier of business revenue generation strategies. airSlate SignNow enhances BT 1 revenue by offering an efficient electronic signing solution that streamlines document workflows, leading to quicker transactions and increased revenue generation.

-

How does airSlate SignNow help businesses increase their BT 1 revenue?

By automating the signing process, airSlate SignNow allows businesses to close deals faster, thus boosting their BT 1 revenue. The platform's user-friendly features enable teams to send, sign, and manage documents efficiently, improving overall productivity.

-

What pricing options does airSlate SignNow offer for businesses looking to improve their BT 1 revenue?

airSlate SignNow offers several pricing tiers to accommodate different business needs, which can signNowly contribute to improving BT 1 revenue. With affordable plans that provide robust features, businesses can select the option that best aligns with their revenue goals.

-

What features does airSlate SignNow provide that contribute to enhancing BT 1 revenue?

Key features of airSlate SignNow that support BT 1 revenue include customizable templates, automated workflows, and real-time tracking of document status. These features enable businesses to streamline their operations and facilitate quicker decision-making, resulting in faster revenue realization.

-

Can airSlate SignNow integrate with other tools to support BT 1 revenue growth?

Yes, airSlate SignNow integrates seamlessly with various business applications like CRM and ERP systems, which can boost BT 1 revenue. These integrations help maintain a cohesive workflow, ensuring that all team members can collaborate efficiently and close deals faster.

-

What are the benefits of using airSlate SignNow for increasing BT 1 revenue?

Using airSlate SignNow helps businesses reduce the time spent on document management, allowing them to focus on activities that drive BT 1 revenue. The platform enhances customer satisfaction through quicker response times and a simplified signing process, which can lead to increased sales.

-

How does airSlate SignNow ensure the security of documents while pursuing BT 1 revenue?

airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect documents during transactions. This focus on security enables businesses to confidently pursue BT 1 revenue without the risk of data bsignNowes or compliance issues.

Get more for DOR Business Tax Forms IN gov

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497430585 form

- Wisconsin repair form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings wisconsin form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises wisconsin form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles wisconsin form

- Letter from tenant to landlord about landlords failure to make repairs wisconsin form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497430591 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession wisconsin form

Find out other DOR Business Tax Forms IN gov

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself