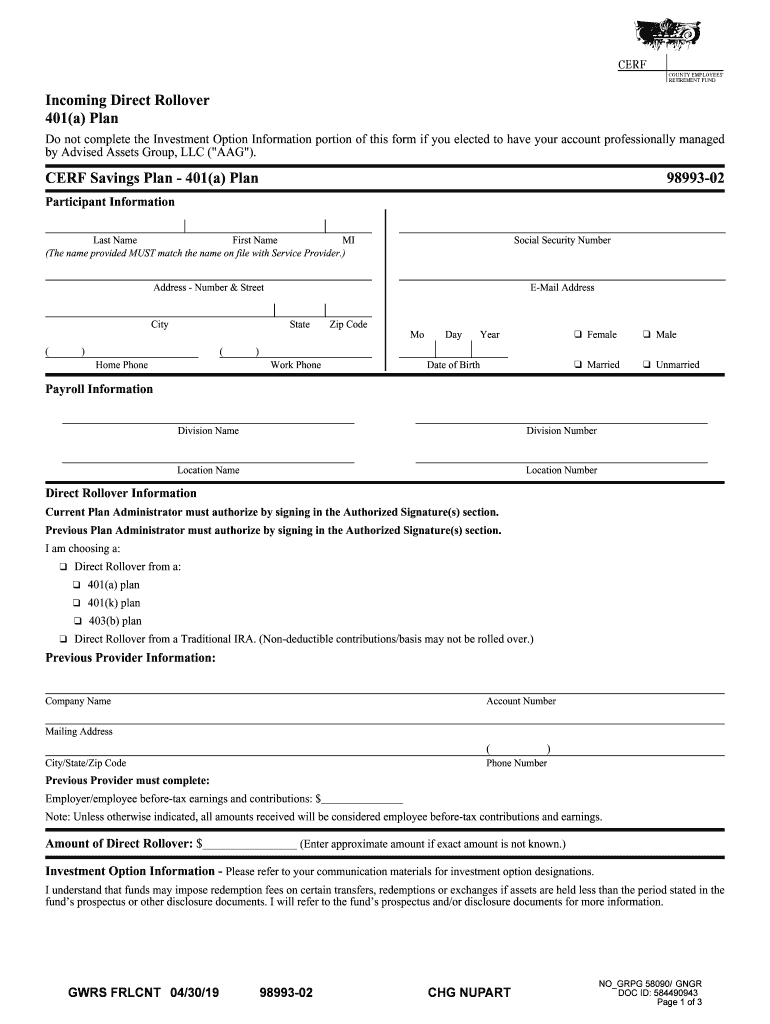

Incoming Direct Rollover County Employees' Retirement Fund 2019

What is the Incoming Direct Rollover County Employees' Retirement Fund

The Incoming Direct Rollover County Employees' Retirement Fund is a financial instrument designed to facilitate the transfer of retirement savings from one qualified plan to another without incurring tax penalties. This process allows county employees to move their retirement funds directly into a new retirement account, ensuring that their savings continue to grow tax-deferred. It is particularly beneficial for employees who are changing jobs or retiring, as it helps maintain the integrity of their retirement savings while providing flexibility in managing their investments.

Steps to complete the Incoming Direct Rollover County Employees' Retirement Fund

Completing the Incoming Direct Rollover involves several key steps:

- Identify the retirement account from which you are rolling over funds.

- Contact your current plan administrator to request the rollover paperwork.

- Fill out the necessary forms accurately, ensuring all information matches your current account details.

- Submit the completed forms to your current plan administrator for processing.

- Confirm with the receiving retirement account provider that the funds have been successfully transferred.

Required Documents

To initiate the Incoming Direct Rollover, you will typically need the following documents:

- Rollover request form from your current retirement plan.

- Account information for the new retirement account.

- Identification documents, such as a government-issued ID.

- Any additional documentation required by the receiving institution.

Eligibility Criteria

Eligibility for the Incoming Direct Rollover depends on several factors, including:

- Your current employment status with the county.

- The type of retirement plan you are rolling over from.

- The receiving account must be a qualified retirement plan, such as an IRA or another employer-sponsored plan.

Legal use of the Incoming Direct Rollover County Employees' Retirement Fund

The Incoming Direct Rollover is governed by IRS regulations, which stipulate that funds must be transferred directly between accounts to avoid taxation. This legal framework ensures that employees can manage their retirement savings without incurring unnecessary tax liabilities. Compliance with these regulations is crucial for maintaining the tax-deferred status of the funds throughout the rollover process.

IRS Guidelines

The IRS provides specific guidelines regarding the Incoming Direct Rollover, including:

- Funds must be transferred directly from one qualified plan to another.

- Participants must complete the rollover within 60 days to avoid penalties.

- Documentation of the rollover must be maintained for tax reporting purposes.

Quick guide on how to complete incoming direct rollover county employees retirement fund

Complete Incoming Direct Rollover County Employees' Retirement Fund seamlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Incoming Direct Rollover County Employees' Retirement Fund on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Incoming Direct Rollover County Employees' Retirement Fund with ease

- Find Incoming Direct Rollover County Employees' Retirement Fund and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Incoming Direct Rollover County Employees' Retirement Fund and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct incoming direct rollover county employees retirement fund

Create this form in 5 minutes!

How to create an eSignature for the incoming direct rollover county employees retirement fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Incoming Direct Rollover County Employees' Retirement Fund?

An Incoming Direct Rollover County Employees' Retirement Fund refers to the process of transferring retirement funds from one retirement account to another without incurring taxes. This allows county employees to manage their retirement savings more effectively while maintaining tax-deferred status. Understanding this process is crucial for maximizing retirement benefits.

-

How can airSlate SignNow assist with Incoming Direct Rollover County Employees' Retirement Fund documentation?

airSlate SignNow simplifies the documentation process for Incoming Direct Rollover County Employees' Retirement Fund by providing an easy-to-use platform for eSigning and sending necessary forms. This ensures that all paperwork is completed accurately and efficiently, reducing the risk of errors. Our solution streamlines the entire process, making it hassle-free for county employees.

-

What are the benefits of using airSlate SignNow for Incoming Direct Rollover County Employees' Retirement Fund?

Using airSlate SignNow for Incoming Direct Rollover County Employees' Retirement Fund offers numerous benefits, including time savings, enhanced security, and improved compliance. Our platform allows users to sign documents electronically, which speeds up the rollover process. Additionally, it provides a secure environment for sensitive financial information.

-

Are there any costs associated with using airSlate SignNow for Incoming Direct Rollover County Employees' Retirement Fund?

Yes, there are costs associated with using airSlate SignNow, but we offer competitive pricing tailored to meet the needs of county employees. Our plans are designed to be cost-effective while providing robust features for managing Incoming Direct Rollover County Employees' Retirement Fund documentation. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Incoming Direct Rollover County Employees' Retirement Fund?

airSlate SignNow offers a variety of features for managing Incoming Direct Rollover County Employees' Retirement Fund, including customizable templates, automated workflows, and real-time tracking. These features help streamline the signing process and ensure that all necessary documents are completed and submitted on time. Our platform is designed to enhance user experience and efficiency.

-

Can airSlate SignNow integrate with other financial tools for Incoming Direct Rollover County Employees' Retirement Fund?

Yes, airSlate SignNow can integrate with various financial tools and software to facilitate the management of Incoming Direct Rollover County Employees' Retirement Fund. This integration allows for seamless data transfer and enhances overall workflow efficiency. By connecting with your existing systems, you can simplify the rollover process even further.

-

How secure is airSlate SignNow for handling Incoming Direct Rollover County Employees' Retirement Fund documents?

Security is a top priority at airSlate SignNow, especially when handling Incoming Direct Rollover County Employees' Retirement Fund documents. Our platform employs advanced encryption and security protocols to protect sensitive information. Users can trust that their data is safe and secure throughout the entire signing and document management process.

Get more for Incoming Direct Rollover County Employees' Retirement Fund

Find out other Incoming Direct Rollover County Employees' Retirement Fund

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure