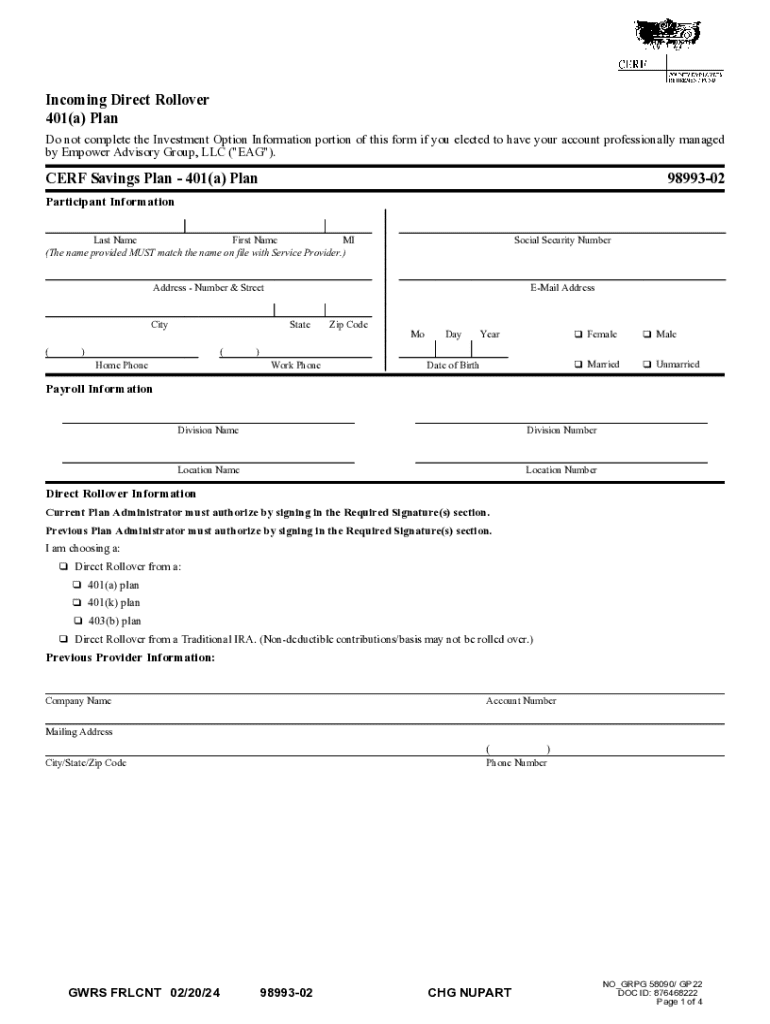

Incoming Direct Rollover 401a Plan 2024-2026

What is the Incoming Direct Rollover 401a Plan

The Incoming Direct Rollover 401a Plan allows individuals to transfer their retirement savings from a previous employer's 401(a) plan into a new qualified retirement plan without incurring taxes or penalties. This process is designed to help individuals consolidate their retirement funds, making it easier to manage their investments and prepare for retirement. The plan is specifically tailored for employees who have left their jobs and wish to maintain the tax-advantaged status of their retirement savings.

How to use the Incoming Direct Rollover 401a Plan

Utilizing the Incoming Direct Rollover 401a Plan involves several straightforward steps. First, you will need to contact your previous employer to request the necessary forms for initiating the rollover. Once you have the forms, fill them out accurately, ensuring that all information is complete. Next, submit the forms to your new retirement plan provider, who will guide you through the process of transferring the funds. It is essential to ensure that the transfer is made directly from one plan to another to avoid any tax implications.

Steps to complete the Incoming Direct Rollover 401a Plan

Completing the Incoming Direct Rollover 401a Plan involves the following steps:

- Contact your previous employer to request the rollover forms.

- Fill out the forms with accurate information regarding your previous and current retirement plans.

- Submit the completed forms to your new retirement plan provider.

- Confirm with both the old and new plan administrators that the transfer is processed.

- Monitor your new account to ensure that the funds have been deposited correctly.

Required Documents

To complete the Incoming Direct Rollover 401a Plan, you will typically need the following documents:

- Rollover request form from your previous employer.

- Account information for your new retirement plan.

- Identification documents, such as a driver’s license or Social Security number.

- Any additional forms required by your new retirement plan provider.

Eligibility Criteria

Eligibility for the Incoming Direct Rollover 401a Plan generally includes the following criteria:

- You must have a balance in your previous employer's 401(a) plan.

- You must be moving the funds to a qualified retirement plan, such as another 401(a), 401(k), or an IRA.

- You should not have taken a distribution from your previous plan that would disqualify you from rolling over the funds.

IRS Guidelines

The IRS provides specific guidelines regarding the rollover of retirement funds. It is crucial to follow these guidelines to avoid taxes and penalties. According to IRS regulations, the rollover must be completed within sixty days of receiving the funds to maintain tax-deferred status. Additionally, the funds must be transferred directly between the two retirement plans to qualify as a tax-free rollover. Understanding these guidelines can help ensure a smooth transition of your retirement savings.

Quick guide on how to complete incoming direct rollover 401a plan

Prepare Incoming Direct Rollover 401a Plan seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and electronically sign your documents swiftly without delays. Manage Incoming Direct Rollover 401a Plan on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest way to modify and electronically sign Incoming Direct Rollover 401a Plan without hassle

- Locate Incoming Direct Rollover 401a Plan and click Acquire Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet-ink signature.

- Review all the details and click on the Completed button to save your modifications.

- Select your preferred method for delivering your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Incoming Direct Rollover 401a Plan to ensure exceptional communication at any phase of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct incoming direct rollover 401a plan

Create this form in 5 minutes!

How to create an eSignature for the incoming direct rollover 401a plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the empower rollover form PDF?

The empower rollover form PDF is a digital document that allows users to easily manage and execute rollover transactions. With airSlate SignNow, you can fill out, sign, and send this form securely, streamlining the process for both individuals and businesses.

-

How does airSlate SignNow enhance the empower rollover form PDF process?

airSlate SignNow enhances the empower rollover form PDF process by providing a user-friendly interface for document management. Users can quickly fill out the form, add electronic signatures, and send it directly to recipients, reducing the time and effort involved in traditional methods.

-

Is there a cost associated with using the empower rollover form PDF on airSlate SignNow?

Yes, there is a cost associated with using the empower rollover form PDF on airSlate SignNow, but it is designed to be cost-effective. Various pricing plans are available to suit different business needs, ensuring that you get the best value for your investment.

-

What features are included with the empower rollover form PDF on airSlate SignNow?

The empower rollover form PDF on airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking. These features help ensure that your documents are processed efficiently and securely, enhancing your overall experience.

-

Can I integrate the empower rollover form PDF with other applications?

Yes, airSlate SignNow allows for seamless integration of the empower rollover form PDF with various applications. This means you can connect it with your CRM, cloud storage, and other tools to streamline your workflow and improve productivity.

-

What are the benefits of using the empower rollover form PDF?

Using the empower rollover form PDF offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the process, airSlate SignNow helps businesses save time and resources while ensuring compliance with legal standards.

-

How secure is the empower rollover form PDF on airSlate SignNow?

The empower rollover form PDF on airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that your sensitive information remains protected throughout the signing and submission process.

Get more for Incoming Direct Rollover 401a Plan

Find out other Incoming Direct Rollover 401a Plan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors