Nj 1040 Form

What is the NJ 1040 Form

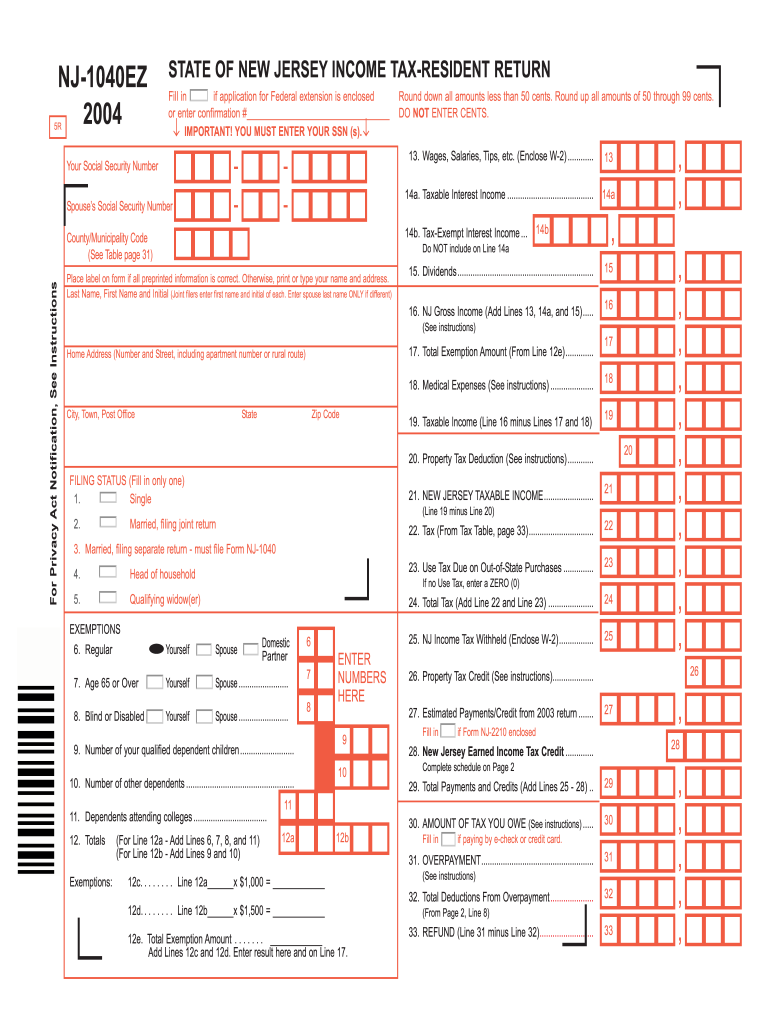

The NJ 1040 Form is the primary income tax return used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, allowing them to detail their earnings, deductions, and credits. The NJ 1040 is specifically designed for residents, ensuring that all applicable state tax laws and regulations are adhered to during the filing process.

How to use the NJ 1040 Form

Using the NJ 1040 Form involves several steps to ensure accurate reporting of income and tax obligations. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the information is compiled, individuals can begin filling out the form by entering their income details, claiming deductions, and applying any relevant tax credits. It is important to review the completed form for accuracy before submission to avoid potential penalties.

Steps to complete the NJ 1040 Form

Completing the NJ 1040 Form requires careful attention to detail. Here are the key steps:

- Gather all income documents, including W-2s and 1099s.

- Fill out personal information, including name, address, and Social Security number.

- Report total income from all sources.

- Claim deductions available to New Jersey residents, such as property tax deductions or retirement contributions.

- Calculate the total tax due or refund expected.

- Sign and date the form before submission.

Required Documents

To successfully file the NJ 1040 Form, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or interest.

- Documentation for any deductions claimed, such as receipts for medical expenses or property taxes.

Form Submission Methods

The NJ 1040 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New Jersey Division of Taxation website.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated tax offices, if applicable.

Penalties for Non-Compliance

Failure to file the NJ 1040 Form or inaccuracies in the submission can lead to penalties. Common consequences include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid tax amounts.

- Potential audits or further scrutiny from the New Jersey Division of Taxation.

Quick guide on how to complete new jersey 1040 ez printable form

Complete Nj 1040 Form effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, amend, and electronically sign your documents swiftly without delays. Handle Nj 1040 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Nj 1040 Form without any hassle

- Obtain Nj 1040 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, mundane form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nj 1040 Form and ensure outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

What are the new Schenzen visa requirements? How do I fill out the online form?

You can find every detail you are looking for about a Schengen tourist Visa in the following article. You can download the form and take a print out or fill it electronically.10 answers you need to know about Schengen Tourist Visa in 2018Thank you for upvoting

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the new jersey 1040 ez printable form

How to make an electronic signature for the New Jersey 1040 Ez Printable Form online

How to make an electronic signature for the New Jersey 1040 Ez Printable Form in Google Chrome

How to make an electronic signature for signing the New Jersey 1040 Ez Printable Form in Gmail

How to generate an eSignature for the New Jersey 1040 Ez Printable Form straight from your mobile device

How to generate an electronic signature for the New Jersey 1040 Ez Printable Form on iOS devices

How to generate an eSignature for the New Jersey 1040 Ez Printable Form on Android

People also ask

-

What is an NJ income tax resident return?

An NJ income tax resident return is a tax form filed by individuals who are considered residents of New Jersey for tax purposes. This return reports all income earned during the tax year and determines the tax owed to the state. Filing this return is essential for compliance with New Jersey tax laws.

-

How can airSlate SignNow assist with filing an NJ income tax resident return?

airSlate SignNow provides a streamlined solution for eSigning and sending necessary documents related to your NJ income tax resident return. With its user-friendly interface, users can easily gather signatures and securely store tax documents. This simplifies the filing process, ensuring you're compliant and organized.

-

Is there a cost associated with using airSlate SignNow for NJ income tax resident returns?

Yes, airSlate SignNow offers a cost-effective subscription model that provides full access to its features for managing your NJ income tax resident return tasks. Pricing plans are designed to accommodate varying needs, making it affordable for individuals and businesses alike. Investing in this solution can save you time and improve the accuracy of your tax filings.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features like secure eSigning, document templates, and automated workflows to enhance your tax document management process. For your NJ income tax resident return, these tools help ensure compliance and accuracy. Additionally, you can track document status and set reminders to never miss a deadline.

-

Can I integrate airSlate SignNow with other software for my NJ income tax resident return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, which can help facilitate the efficient handling of your NJ income tax resident return. Integrations enable a smooth transfer of data, making tax preparation faster and reducing the risk of errors.

-

What benefits can I expect from using airSlate SignNow for my NJ income tax resident return?

Using airSlate SignNow for your NJ income tax resident return provides benefits such as increased efficiency, reduced paperwork, and enhanced security for your sensitive documents. It helps you stay organized and compliant with tax regulations, making your filing experience much simpler. This ultimately leads to peace of mind during tax season.

-

How secure is my data when using airSlate SignNow for tax filings?

airSlate SignNow prioritizes the security of your data, employing advanced encryption and secure storage protocol for all documents associated with your NJ income tax resident return. This ensures that your personal and financial information remains confidential and protected from unauthorized access. Trust in SignNow for your document management needs.

Get more for Nj 1040 Form

Find out other Nj 1040 Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document