Hmrc Vat1 2022

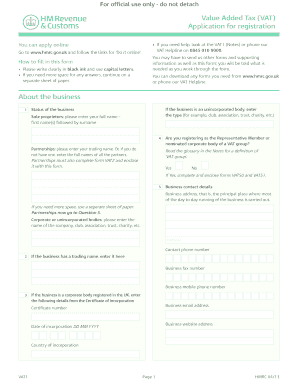

What is the HMRC VAT1?

The HMRC VAT1 is a form used in the United Kingdom for businesses to register for Value Added Tax (VAT). It is essential for businesses whose taxable turnover exceeds the VAT registration threshold, which is currently set at a specific amount determined by HMRC. Completing the VAT1 form allows businesses to obtain a VAT registration number, enabling them to charge VAT on their sales and reclaim VAT on their purchases. This form is crucial for compliance with tax regulations and helps businesses manage their VAT obligations effectively.

How to Use the HMRC VAT1

Using the HMRC VAT1 form involves several steps. First, businesses must gather necessary information, including details about the business structure, turnover, and expected taxable supplies. Next, the form can be completed online or via paper submission. It is important to ensure all information is accurate to avoid delays in processing. Once submitted, businesses will receive a VAT registration number if approved, which should be used on all VAT-related transactions. Proper use of the VAT1 form helps ensure compliance with tax laws and facilitates smooth business operations.

Steps to Complete the HMRC VAT1

Completing the HMRC VAT1 form requires careful attention to detail. Here are the steps involved:

- Gather necessary business information, including name, address, and business structure.

- Determine the expected taxable turnover and nature of supplies.

- Access the HMRC VAT1 form online or obtain a paper version.

- Fill out the form, ensuring all sections are completed accurately.

- Submit the form online or mail it to the designated HMRC address.

- Await confirmation of VAT registration, which may take several weeks.

Required Documents for HMRC VAT1

When completing the HMRC VAT1 form, certain documents may be required to support the application. These can include:

- Proof of business identity, such as a business registration certificate.

- Financial records demonstrating turnover, such as profit and loss statements.

- Details of any existing VAT registrations, if applicable.

- Information on the nature of goods or services provided.

Having these documents ready can streamline the registration process and reduce the likelihood of delays.

Legal Use of the HMRC VAT1

The HMRC VAT1 form is legally required for businesses that meet specific criteria regarding taxable turnover. Failure to register when required can result in penalties and interest on unpaid VAT. It is important for businesses to understand their obligations under VAT law and to ensure they complete the VAT1 form correctly. Legal compliance not only protects the business from fines but also establishes credibility with customers and suppliers.

Filing Deadlines for HMRC VAT1

Filing deadlines for the HMRC VAT1 form are crucial for businesses to avoid penalties. Generally, businesses should register for VAT as soon as they anticipate exceeding the VAT threshold. It is advisable to submit the VAT1 form well in advance of the expected turnover increase. Once registered, businesses must adhere to ongoing VAT filing deadlines, which typically occur quarterly or annually, depending on the chosen VAT accounting scheme.

Quick guide on how to complete hmrc vat1

Effortlessly prepare Hmrc Vat1 on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without complications. Manage Hmrc Vat1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Hmrc Vat1 with minimal effort

- Obtain Hmrc Vat1 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow designed for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow addresses all your document management requirements with just a few clicks from your device of choice. Alter and eSign Hmrc Vat1 to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hmrc vat1

Create this form in 5 minutes!

How to create an eSignature for the hmrc vat1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is HMRC VAT1 and how does it relate to airSlate SignNow?

HMRC VAT1 is a form used for VAT registration in the UK. With airSlate SignNow, you can easily eSign and send your HMRC VAT1 documents securely, ensuring compliance and efficiency in your VAT registration process.

-

How can airSlate SignNow help with submitting HMRC VAT1 forms?

airSlate SignNow streamlines the submission of HMRC VAT1 forms by allowing you to eSign documents electronically. This not only saves time but also reduces the risk of errors, making your VAT registration process smoother.

-

What are the pricing options for using airSlate SignNow for HMRC VAT1?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic eSigning features or advanced document management for HMRC VAT1, there’s a plan that fits your budget.

-

Are there any features specifically designed for handling HMRC VAT1 documents?

Yes, airSlate SignNow includes features such as customizable templates and secure storage that are ideal for managing HMRC VAT1 documents. These features enhance your workflow and ensure that your VAT forms are always accessible and organized.

-

What benefits does airSlate SignNow provide for businesses dealing with HMRC VAT1?

Using airSlate SignNow for HMRC VAT1 offers numerous benefits, including faster processing times and improved accuracy. The platform’s user-friendly interface makes it easy for businesses to manage their VAT registration efficiently.

-

Can I integrate airSlate SignNow with other tools for HMRC VAT1 processing?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for HMRC VAT1 processing. This integration allows you to automate tasks and keep all your documents in one place.

-

Is airSlate SignNow secure for handling sensitive HMRC VAT1 information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your HMRC VAT1 information is protected. With advanced encryption and secure access controls, you can trust that your sensitive data is safe.

Get more for Hmrc Vat1

- Not press application format

- S initial words form

- Ap physics 1 exam multiple choice pdf form

- Saga cash ct form

- New york state vicuna license form

- Cfstes professional certification state fire marshal ca gov form

- City of philadelphia fire alarm systems inspector license renewal form

- Registration fee and payment form btransradialworldbbcomb

Find out other Hmrc Vat1

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form