How to Register for VAT on EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister for VAT 2022-2026

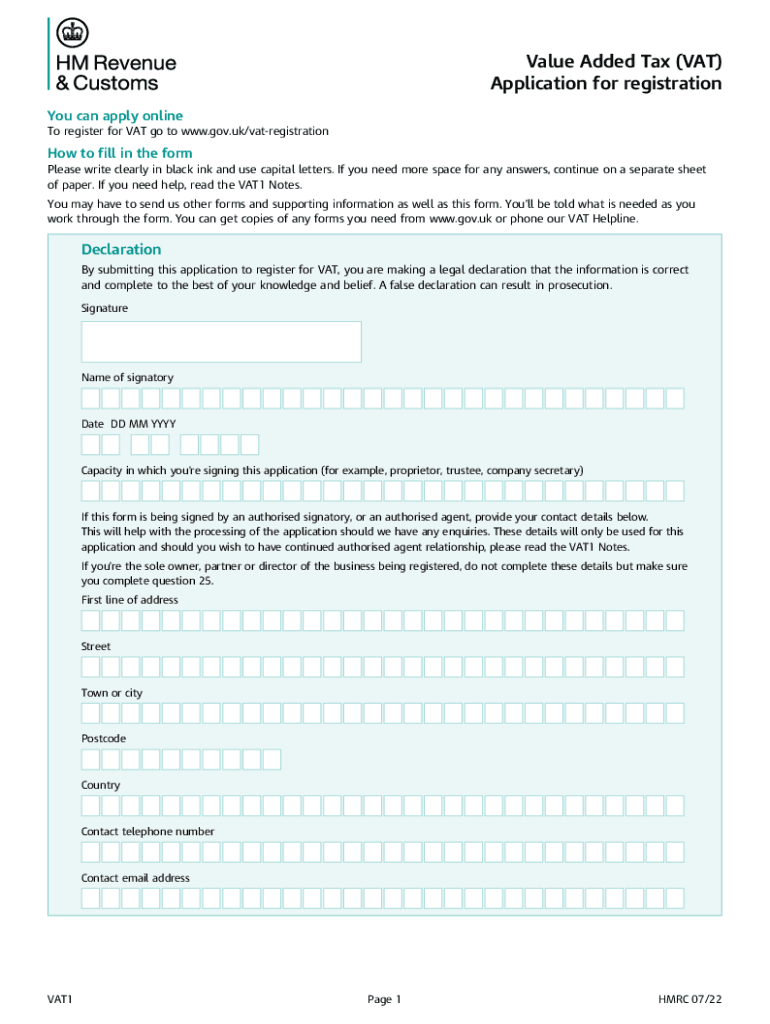

Steps to complete the VAT 1 form

Completing the VAT 1 form is a straightforward process that requires careful attention to detail. Here are the key steps to ensure accurate submission:

- Gather necessary information, including your business name, address, and tax identification number.

- Fill out the VAT 1 form, ensuring all sections are completed accurately. Pay special attention to the eligibility criteria for VAT registration.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail, depending on your preference and the guidelines provided by the relevant tax authority.

Required documents for VAT registration

When applying for VAT registration using the VAT 1 form, specific documents are necessary to support your application. These typically include:

- A copy of your business registration documents.

- Proof of identity for the business owner or authorized representative.

- Financial statements or bank statements that demonstrate business activity.

- Any additional documentation requested by the tax authority to verify your business operations.

Eligibility criteria for VAT registration

Understanding the eligibility criteria for VAT registration is crucial before completing the VAT 1 form. Generally, businesses must meet the following requirements:

- Your business must exceed a certain revenue threshold, which varies by state.

- You must be engaged in taxable activities, such as selling goods or providing services.

- Businesses operating in specific sectors may have additional requirements or exemptions.

Form submission methods

The VAT 1 form can be submitted through various methods, allowing flexibility based on your needs:

- Online submission: Many states offer an online portal for easier and faster processing.

- Mail submission: You can print the completed form and send it via postal service to the designated tax office.

- In-person submission: Some businesses may prefer to submit the form directly at a local tax office for immediate assistance.

IRS guidelines for VAT registration

While VAT is not directly governed by the IRS, understanding federal tax guidelines can help ensure compliance with overall tax obligations. Key points include:

- Maintain accurate records of all sales and purchases to support your VAT claims.

- Ensure timely filing of all tax returns to avoid penalties.

- Stay informed about any changes in tax laws that may affect your business operations.

Penalties for non-compliance

Failing to comply with VAT registration requirements can lead to significant penalties. Common consequences include:

- Fines imposed for late registration or failure to submit the VAT 1 form.

- Interest on unpaid VAT amounts, which can accumulate over time.

- Potential audits or increased scrutiny from tax authorities.

Quick guide on how to complete how to register for vat on efilingsouth african revenue servicevat registration online application formcheck vatregister for

Effortlessly Complete How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can acquire the requisite form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT with Ease

- Find How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to register for vat on efilingsouth african revenue servicevat registration online application formcheck vatregister for

Create this form in 5 minutes!

How to create an eSignature for the how to register for vat on efilingsouth african revenue servicevat registration online application formcheck vatregister for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT registration form and why do I need it?

A VAT registration form is a document used to officially register for Value Added Tax. You need it to collect VAT from customers and ensure compliance with tax authorities. Completing the VAT registration form accurately avoids potential fines and ensures smooth business operations.

-

How does airSlate SignNow simplify the VAT registration form process?

airSlate SignNow streamlines the VAT registration form process by allowing you to fill out, sign, and send the form electronically. This reduces paperwork and minimizes errors, ensuring that you submit your VAT registration form efficiently. Our easy-to-use platform enhances productivity and compliance.

-

Is using airSlate SignNow for VAT registration forms cost-effective?

Yes, using airSlate SignNow is a cost-effective solution for handling VAT registration forms. Our pricing plans are designed to fit businesses of all sizes, helping you save time and resources in document management. This way, you can focus on your core business activities while ensuring compliance.

-

What features does airSlate SignNow offer for VAT registration forms?

airSlate SignNow offers a variety of features for VAT registration forms, including customizable templates, electronic signatures, and real-time tracking. These features streamline the process, ensuring you can manage and submit your VAT registration form efficiently. Our platform also integrates with various tools to enhance your experience.

-

Can airSlate SignNow integrate with other software for completing VAT registration forms?

Absolutely! airSlate SignNow seamlessly integrates with various popular software applications, making it easy to manage your VAT registration forms alongside your existing workflows. This versatility allows for better organization and collaboration, ensuring that your VAT registration form process is smooth and efficient.

-

How secure is the data submitted through airSlate SignNow for VAT registration forms?

Data submitted through airSlate SignNow is secured with advanced encryption and compliance with industry standards. This means your VAT registration form and any personal information are handled with the utmost care, ensuring confidentiality and protection against unauthorized access. You can trust us to keep your information safe.

-

What benefits can I expect from using airSlate SignNow for VAT registration forms?

Using airSlate SignNow for VAT registration forms provides numerous benefits including reduced processing time, minimized paperwork, and enhanced accuracy. Our user-friendly interface and electronic signature capabilities facilitate a more efficient process, allowing you to focus on growing your business while maintaining compliance.

Get more for How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT

Find out other How To Register For VAT On EFilingSouth African Revenue ServiceVat Registration Online Application FormCheck VATRegister For VAT

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors