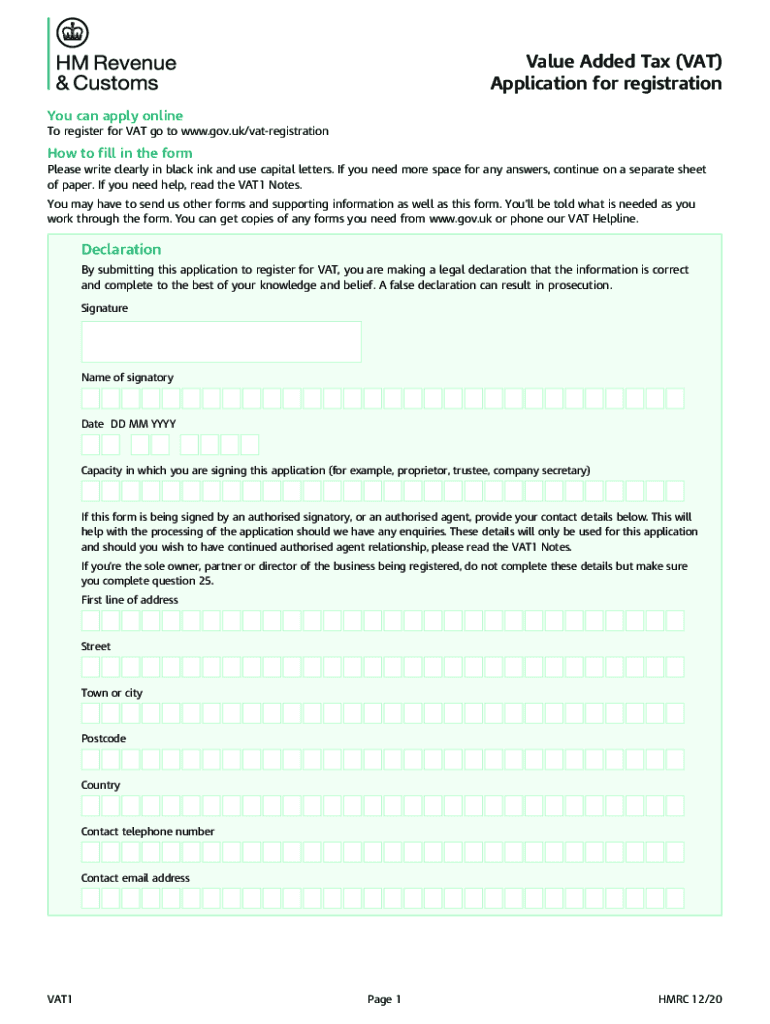

Value Added Tax VAT Application for Registration Gov Uk 2020

Understanding the VAT Registration Form

The VAT registration form is essential for businesses that reach a certain revenue threshold. This form enables companies to register for Value Added Tax (VAT) with the appropriate tax authorities. Completing this registration is crucial for compliance with tax laws and allows businesses to charge VAT on their sales, reclaim VAT on purchases, and maintain proper financial records.

Steps to Complete the VAT Registration Form

Completing the VAT registration form involves several key steps:

- Gather necessary information, including business details, financial records, and identification numbers.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form online or via mail, depending on the preferred method of the tax authority.

Required Documents for VAT Registration

When filling out the VAT registration form, certain documents are typically required:

- Proof of business identity, such as a business license or registration certificate.

- Financial statements or sales projections to demonstrate revenue levels.

- Identification numbers, including Employer Identification Number (EIN) or Social Security Number (SSN).

Eligibility Criteria for VAT Registration

To qualify for VAT registration, businesses must meet specific criteria:

- Annual taxable turnover exceeds the established threshold set by the IRS.

- Engagement in taxable activities, such as selling goods or providing services.

- Willingness to comply with VAT regulations and maintain accurate records.

Form Submission Methods

The VAT registration form can be submitted through various methods, including:

- Online submission via the tax authority's official website, which is often the fastest option.

- Mailing a hard copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

IRS Guidelines for VAT Registration

The IRS provides specific guidelines regarding VAT registration, which include:

- Detailed instructions on how to fill out the VAT registration form.

- Information on deadlines for registration and filing.

- Clarification on penalties for late registration or non-compliance.

Quick guide on how to complete value added tax vat application for registration govuk

Effortlessly Prepare Value Added Tax VAT Application For Registration Gov uk on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and eSign your documents quickly and without delays. Manage Value Added Tax VAT Application For Registration Gov uk on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

Edit and eSign Value Added Tax VAT Application For Registration Gov uk with Ease

- Obtain Value Added Tax VAT Application For Registration Gov uk and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors requiring you to print new copies. airSlate SignNow meets your document management needs with just a few clicks on any device of your choice. Edit and eSign Value Added Tax VAT Application For Registration Gov uk to ensure exceptional communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct value added tax vat application for registration govuk

Create this form in 5 minutes!

How to create an eSignature for the value added tax vat application for registration govuk

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is a VAT registration form, and why do I need it?

A VAT registration form is a document required for businesses that need to register for Value Added Tax in their country. Completing this form is essential for legal compliance and allows a business to charge VAT on its services or products. It ensures you can reclaim VAT on expenses, benefiting your company's cash flow.

-

How does airSlate SignNow assist with the VAT registration form process?

airSlate SignNow provides a streamlined solution that allows you to eSign and manage your VAT registration form quickly and efficiently. By using our platform, you can easily fill out the necessary information and send it securely for signatures. This not only saves time but also simplifies the documentation process.

-

Are there any fees associated with using airSlate SignNow for VAT registration forms?

There are varying pricing plans available for airSlate SignNow, depending on your business needs. These plans are designed to be cost-effective and provide great value for features, including assistance with VAT registration forms. Review our pricing page to find the option that suits your requirements best.

-

What features does airSlate SignNow offer for managing VAT registration forms?

airSlate SignNow offers several features specifically designed for handling VAT registration forms, such as document templates, secure cloud storage, and custom workflows. Our platform also includes real-time tracking and notifications, ensuring you are aware of the status of your documents. These features streamline the submission process and enhance your productivity.

-

Is it easy to integrate airSlate SignNow with other software for VAT registrations?

Yes, airSlate SignNow seamlessly integrates with various business applications, such as CRMs and accounting software, to optimize your VAT registration form process. This integration ensures that your data flows smoothly between platforms, enhancing overall operational efficiency. Set up is straightforward, allowing you to focus more on your business.

-

Can I use airSlate SignNow to store my completed VAT registration forms?

Absolutely! airSlate SignNow offers secure cloud storage, allowing you to store all your completed VAT registration forms in one accessible location. This feature ensures that your documents are safe and easily retrievable when needed, simplifying your compliance processes. You can manage and organize your forms effortlessly.

-

What are the benefits of using airSlate SignNow for VAT registration forms?

Using airSlate SignNow for your VAT registration forms means you benefit from a user-friendly interface that simplifies document management. Other advantages include faster turnaround times for signatures, enhanced security features, and the ability to track the status of your forms. This ultimately supports better compliance and improved cash flow for your business.

Get more for Value Added Tax VAT Application For Registration Gov uk

- Quitclaim deed from corporation to husband and wife wyoming form

- Warranty deed from corporation to husband and wife wyoming form

- Quitclaim deed from corporation to individual wyoming form

- Warranty deed from corporation to individual wyoming form

- Wy llc online form

- Quitclaim deed from corporation to llc wyoming form

- Quitclaim deed from corporation to corporation wyoming form

- Warranty deed from corporation to corporation wyoming form

Find out other Value Added Tax VAT Application For Registration Gov uk

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple