Draft of the "core" Form 990

What is the Draft Of The "core" Form 990

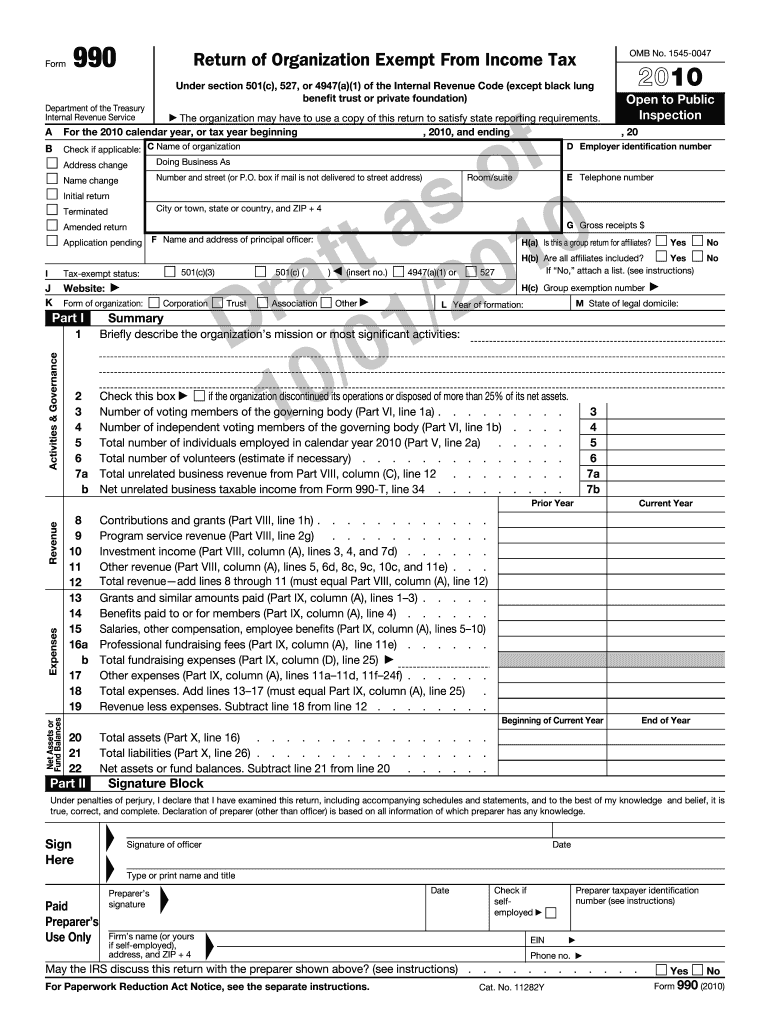

The Draft Of The "core" Form 990 is a crucial document used by tax-exempt organizations in the United States to report their financial information to the Internal Revenue Service (IRS). This form provides transparency regarding the organization's activities, governance, and financial status. It is essential for maintaining tax-exempt status and ensuring compliance with federal regulations. The draft version allows organizations to review and prepare for the final submission, incorporating any updates or changes required by the IRS.

Key elements of the Draft Of The "core" Form 990

The Draft Of The "core" Form 990 includes several key components that organizations must complete. These elements typically cover:

- Organization Information: Basic details about the organization, including its name, address, and mission.

- Financial Statements: Detailed financial data, including revenue, expenses, and net assets.

- Governance Structure: Information on the board of directors and key management personnel.

- Program Service Accomplishments: Descriptions of the organization’s major programs and their impact.

- Compliance Information: Questions regarding compliance with public support tests and other regulatory requirements.

Steps to complete the Draft Of The "core" Form 990

Completing the Draft Of The "core" Form 990 involves several steps to ensure accuracy and compliance:

- Gather Financial Records: Collect all relevant financial documents, including income statements and balance sheets.

- Review Governance Policies: Ensure that governance policies are up-to-date and reflect current practices.

- Complete Each Section: Fill out each section of the draft form carefully, ensuring all required information is provided.

- Consult IRS Guidelines: Refer to IRS instructions for any specific requirements related to your organization.

- Review and Revise: Have multiple stakeholders review the draft for accuracy and completeness.

- Finalize the Form: Prepare the final version for submission once all revisions are made.

How to obtain the Draft Of The "core" Form 990

Organizations can obtain the Draft Of The "core" Form 990 through the IRS website or by contacting the IRS directly. The draft form is typically available for a limited time before the official version is released. It is important to check for updates regularly to ensure that the most current draft is being used for preparation. Additionally, many tax preparation software solutions may offer access to the draft form as part of their services.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Draft Of The "core" Form 990 is essential for compliance. Generally, the form must be filed by the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this typically means a deadline of May fifteenth. Organizations can apply for an extension if needed, but it is crucial to submit any extension requests before the original deadline.

Legal use of the Draft Of The "core" Form 990

The Draft Of The "core" Form 990 serves as a preliminary document that organizations can use to prepare for their official filing with the IRS. While the draft itself is not submitted to the IRS, it is a valuable tool for ensuring that all necessary information is gathered and organized. Organizations must ensure that the final version complies with all IRS regulations and accurately reflects their financial activities and governance.

Quick guide on how to complete draft of the quotcorequot form 990

Complete Draft Of The "core" Form 990 effortlessly on any device

Online document management has become widely accepted by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents quickly without delays. Manage Draft Of The "core" Form 990 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Draft Of The "core" Form 990 without hassle

- Locate Draft Of The "core" Form 990 and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Draft Of The "core" Form 990 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the draft of the quotcorequot form 990

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Draft Of The "core" Form 990?

The Draft Of The "core" Form 990 is a comprehensive document that nonprofit organizations must file annually with the IRS. It provides detailed information about the organization's finances, governance, and activities. Understanding this draft is crucial for ensuring compliance and transparency.

-

How can airSlate SignNow help with the Draft Of The "core" Form 990?

airSlate SignNow simplifies the process of preparing and signing the Draft Of The "core" Form 990. Our platform allows users to easily upload, edit, and eSign documents, ensuring that your filings are accurate and submitted on time. This streamlines the compliance process for nonprofits.

-

What features does airSlate SignNow offer for managing the Draft Of The "core" Form 990?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage for managing the Draft Of The "core" Form 990. These tools help organizations efficiently prepare their filings while maintaining compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for the Draft Of The "core" Form 990?

Yes, airSlate SignNow offers various pricing plans to accommodate different organizational needs. Each plan provides access to essential features for managing the Draft Of The "core" Form 990, ensuring that you can choose an option that fits your budget while still receiving quality service.

-

Can I integrate airSlate SignNow with other software for the Draft Of The "core" Form 990?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and nonprofit management software. This allows you to streamline your workflow when preparing the Draft Of The "core" Form 990, making it easier to gather necessary data and finalize your filings.

-

What are the benefits of using airSlate SignNow for the Draft Of The "core" Form 990?

Using airSlate SignNow for the Draft Of The "core" Form 990 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, allowing you to focus on your organization's mission.

-

How does airSlate SignNow ensure the security of the Draft Of The "core" Form 990?

airSlate SignNow prioritizes security by employing advanced encryption and secure cloud storage for all documents, including the Draft Of The "core" Form 990. This ensures that sensitive information is protected and only accessible to authorized users, maintaining your organization's confidentiality.

Get more for Draft Of The "core" Form 990

- Wwwsignnowcomfill and sign pdf form108976employment and social development canada canada signnow

- Fa 4170vnotice of motion and motion to change form

- Residency letter from a homeless shelter form

- Wwwcourseherocomfile83111769pptc040pdf save reset form protected when completed b

- Taxcoloradogovcontact us by mailcontact us by maildepartment of revenue colorado form

- Cr 701 motion request to quash warrant and set hearing form

- Adult hepatitis form

- Sinp 100 22 form

Find out other Draft Of The "core" Form 990

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF