Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F 2020

What is the Tax Information for the Permanent Fund Division?

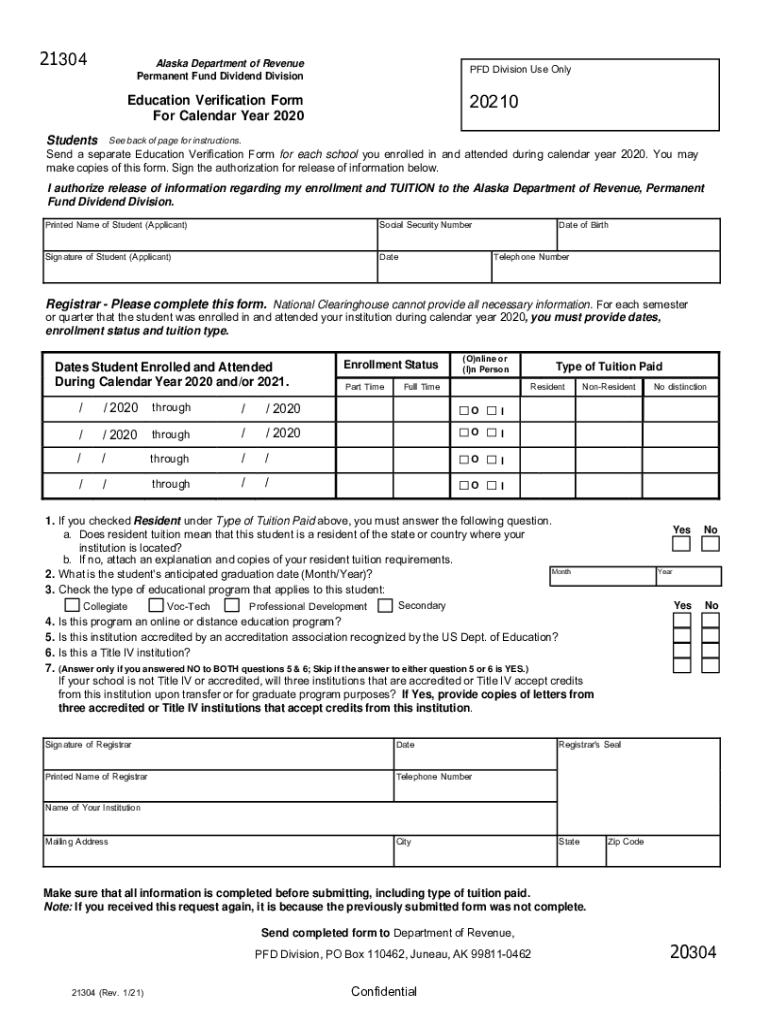

The Tax Information related to the Permanent Fund Division encompasses guidelines and details regarding the Permanent Fund Dividend (PFD) in Alaska. This program distributes a portion of the state’s oil revenue to eligible residents. The information includes eligibility criteria, application processes, and the calculation of dividends. Understanding this tax information is essential for residents to ensure compliance and maximize their benefits from the fund.

How to Use the Tax Information for the Permanent Fund Division

Utilizing the Tax Information for the Permanent Fund Division involves understanding the specific requirements and processes associated with the Permanent Fund Dividend. Residents should familiarize themselves with the eligibility criteria, required documentation, and submission methods. This knowledge will help individuals navigate the application process effectively and ensure they receive their dividends promptly.

Steps to Complete the Tax Information for the Permanent Fund Division

Completing the Tax Information for the Permanent Fund Division requires several key steps:

- Review eligibility criteria to confirm qualification for the Permanent Fund Dividend.

- Gather necessary documents, including proof of residency and identification.

- Complete the application form accurately, ensuring all information is current and correct.

- Submit the application through the designated method, whether online, by mail, or in person.

- Monitor the application status and respond promptly to any requests for additional information.

Key Elements of the Tax Information for the Permanent Fund Division

Key elements of the Tax Information for the Permanent Fund Division include:

- Eligibility Criteria: Requirements that must be met to qualify for the dividend.

- Application Process: Steps to apply for the dividend, including necessary forms.

- Filing Deadlines: Important dates for submitting applications to ensure timely processing.

- Required Documents: Documentation needed to support the application.

Legal Use of the Tax Information for the Permanent Fund Division

The legal use of the Tax Information for the Permanent Fund Division ensures that residents comply with state laws regarding the Permanent Fund Dividend. This includes understanding the implications of misreporting information, the importance of submitting accurate details, and the potential penalties for non-compliance. Residents should be aware of their rights and responsibilities when participating in this program.

IRS Guidelines Related to the Permanent Fund Dividend

IRS guidelines provide essential information regarding the tax implications of receiving the Permanent Fund Dividend. Residents must report this income on their federal tax returns, and understanding the relevant IRS regulations can help ensure proper reporting. It is advisable to consult IRS publications or a tax professional for specific guidance on how the dividend affects individual tax situations.

Quick guide on how to complete tax information permanent fund divisionpermanent fund dividend division informationpermanent fund divisionhome alaskapermanent

Effortlessly Prepare Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F on Any Gadget

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and Electronically Sign Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F Effortlessly

- Find Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or blackout sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax information permanent fund divisionpermanent fund dividend division informationpermanent fund divisionhome alaskapermanent

Create this form in 5 minutes!

How to create an eSignature for the tax information permanent fund divisionpermanent fund dividend division informationpermanent fund divisionhome alaskapermanent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Information Permanent Fund Division?

The Tax Information Permanent Fund Division provides essential details regarding the Permanent Fund Dividend in Alaska. This division ensures that residents understand their eligibility and the application process for receiving dividends. For comprehensive insights, visit the Permanent Fund Division Home in Alaska.

-

How can I apply for the Permanent Fund Dividend?

To apply for the Permanent Fund Dividend, you must complete an application through the Permanent Fund Division's official website. Ensure you meet the eligibility criteria outlined in the Tax Information Permanent Fund Division guidelines. The application process is straightforward and designed to assist Alaskan residents.

-

What are the benefits of the Permanent Fund Dividend?

The Permanent Fund Dividend provides Alaskan residents with an annual payment derived from the state's oil revenues. This financial benefit supports residents in various ways, enhancing their quality of life. For detailed Tax Information Permanent Fund Division, refer to the official resources available online.

-

What is the deadline for applying for the Permanent Fund Dividend?

The deadline for applying for the Permanent Fund Dividend typically falls on March 31st of each year. It is crucial to submit your application on time to ensure you receive your dividend. For more specific Tax Information Permanent Fund Division, check the official Alaska Permanent Fund Division website.

-

Are there any fees associated with the Permanent Fund Dividend application?

There are no fees associated with applying for the Permanent Fund Dividend through the Permanent Fund Division. The application process is free, ensuring that all eligible Alaskan residents can access this benefit without financial barriers. For more details, refer to the Tax Information Permanent Fund Division resources.

-

How is the amount of the Permanent Fund Dividend determined?

The amount of the Permanent Fund Dividend is determined based on the earnings of the Permanent Fund and the number of eligible applicants. Each year, the Permanent Fund Division calculates the dividend amount, which is then announced publicly. For the latest Tax Information Permanent Fund Division, visit the official website.

-

Can I check the status of my Permanent Fund Dividend application?

Yes, you can check the status of your Permanent Fund Dividend application through the Permanent Fund Division's online portal. This feature allows you to stay updated on your application progress and any necessary actions. For more information, refer to the Tax Information Permanent Fund Division section on the website.

Get more for Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F

- Abc 299 form

- Application for the designation of an officiant of a marriage or civil form

- Open share small group discussion worksheet forgiveness form

- Publication 4681 internal revenue service irs form

- B 01 republic of the philippines city of imus province of cavite office of the building official application for building form

- Application for health coverage and help paying costs nh gov nh form

- Funeral planning form whitton baptist church whittonbaptist org

- Fitness letter from doctor form

Find out other Tax Information Permanent Fund DivisionPermanent Fund Dividend Division InformationPermanent Fund DivisionHome AlaskaPermanent F

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney