CDTFA CA Department of Tax and Fee Administration California Form

What is the CDTFA CA Department Of Tax And Fee Administration California

The California Department of Tax and Fee Administration (CDTFA) is a state agency responsible for the administration of various tax and fee programs in California. This includes sales and use taxes, fuel taxes, and various other fees related to specific industries. The CDTFA ensures compliance with state tax laws and provides resources for taxpayers to understand their obligations. It plays a crucial role in collecting revenue that funds essential public services and infrastructure within the state.

How to use the CDTFA CA Department Of Tax And Fee Administration California

Using the CDTFA involves several steps, depending on the specific tax or fee program applicable to your situation. Taxpayers can access a range of online services through the CDTFA website, including filing returns, making payments, and checking account status. It is essential to familiarize yourself with the specific requirements for your tax type, as the CDTFA provides detailed guidance and resources to assist in the process.

Steps to complete the CDTFA CA Department Of Tax And Fee Administration California

Completing your obligations with the CDTFA typically involves the following steps:

- Determine the applicable tax or fee program based on your business activities.

- Gather necessary documentation, including sales records and previous tax filings.

- Access the CDTFA online portal to file your return or make payments.

- Review your submission for accuracy before finalizing.

- Keep a copy of your submission and any confirmation for your records.

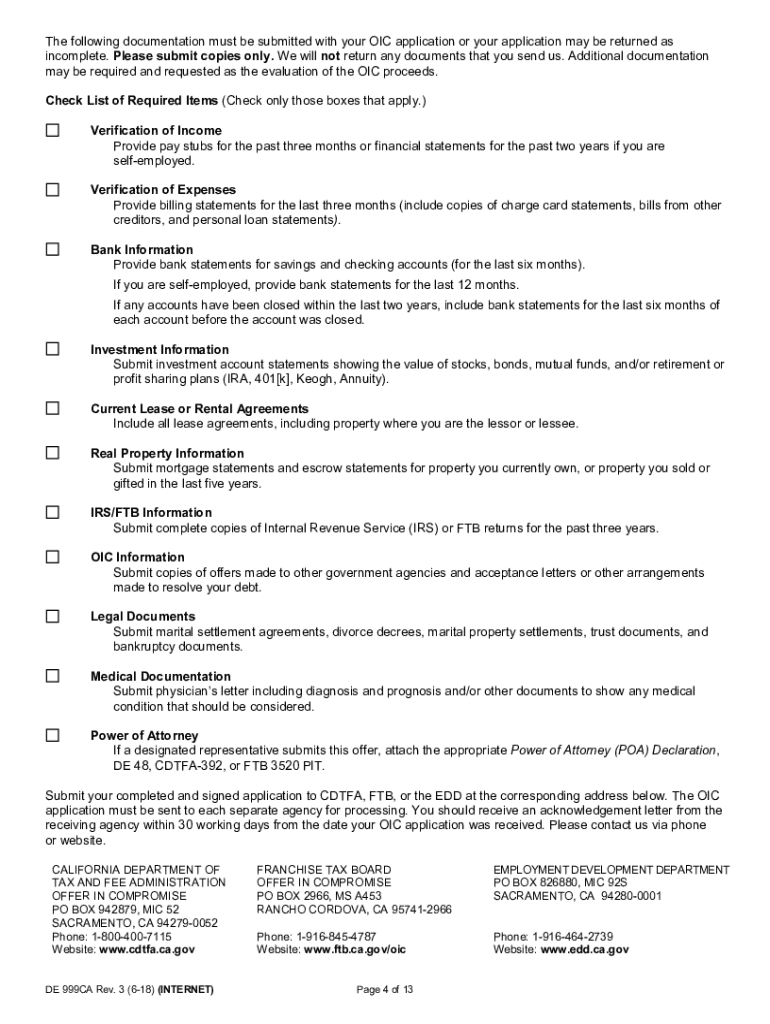

Required Documents

When dealing with the CDTFA, certain documents are generally required to ensure compliance. These may include:

- Sales records and invoices to substantiate reported sales.

- Previous tax returns for reference and consistency.

- Any relevant correspondence from the CDTFA regarding your tax account.

Having these documents ready can streamline the filing process and help avoid potential issues with compliance.

Penalties for Non-Compliance

Failure to comply with CDTFA regulations can result in various penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid tax amounts, accruing from the due date.

- Possible legal action for persistent non-compliance.

It is crucial to stay informed about your tax obligations to avoid these penalties and ensure timely compliance with state regulations.

Form Submission Methods

The CDTFA provides multiple methods for submitting forms and payments. Taxpayers can choose from:

- Online submissions through the CDTFA website, which is often the quickest and most efficient method.

- Mailing physical forms to the designated CDTFA address.

- In-person submissions at local CDTFA offices, if necessary.

Each method has its own guidelines and processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete cdtfa ca department of tax and fee administration california

Easily Prepare CDTFA CA Department Of Tax And Fee Administration California on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents quickly without delays. Handle CDTFA CA Department Of Tax And Fee Administration California on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and eSign CDTFA CA Department Of Tax And Fee Administration California

- Locate CDTFA CA Department Of Tax And Fee Administration California and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information with specific tools that airSlate SignNow offers for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and holds the same legal status as a conventional hand-signed signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text (SMS), invite link, or download it to your PC.

Eliminate the issues of lost or misplaced files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign CDTFA CA Department Of Tax And Fee Administration California to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cdtfa ca department of tax and fee administration california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CDTFA CA Department Of Tax And Fee Administration California?

The CDTFA CA Department Of Tax And Fee Administration California is a state agency responsible for administering California's sales and use tax laws, as well as various other tax and fee programs. Understanding its functions can help businesses comply with tax regulations effectively.

-

How can airSlate SignNow help with CDTFA CA Department Of Tax And Fee Administration California compliance?

airSlate SignNow provides an efficient way to manage and eSign documents related to tax compliance, including those required by the CDTFA CA Department Of Tax And Fee Administration California. By streamlining document workflows, businesses can ensure timely submissions and reduce the risk of errors.

-

What features does airSlate SignNow offer for businesses dealing with CDTFA CA Department Of Tax And Fee Administration California?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for businesses interacting with the CDTFA CA Department Of Tax And Fee Administration California. These tools enhance efficiency and ensure compliance with state regulations.

-

Is airSlate SignNow cost-effective for small businesses needing to interact with the CDTFA CA Department Of Tax And Fee Administration California?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With competitive pricing plans, it allows businesses to manage their document signing needs without incurring high costs, making it easier to comply with the CDTFA CA Department Of Tax And Fee Administration California.

-

Can airSlate SignNow integrate with other software for managing CDTFA CA Department Of Tax And Fee Administration California documents?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing businesses to manage their documents related to the CDTFA CA Department Of Tax And Fee Administration California efficiently. This integration helps streamline workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for CDTFA CA Department Of Tax And Fee Administration California documentation?

Using airSlate SignNow for CDTFA CA Department Of Tax And Fee Administration California documentation offers numerous benefits, including faster turnaround times, improved accuracy, and enhanced security. These advantages help businesses maintain compliance and reduce the stress associated with tax documentation.

-

How secure is airSlate SignNow when handling documents for the CDTFA CA Department Of Tax And Fee Administration California?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents related to the CDTFA CA Department Of Tax And Fee Administration California are handled securely, protecting sensitive information from unauthorized access.

Get more for CDTFA CA Department Of Tax And Fee Administration California

Find out other CDTFA CA Department Of Tax And Fee Administration California

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document