STAR School Tax Relief Exemption Forms 2018-2026

What is the STAR School Tax Relief Exemption Form?

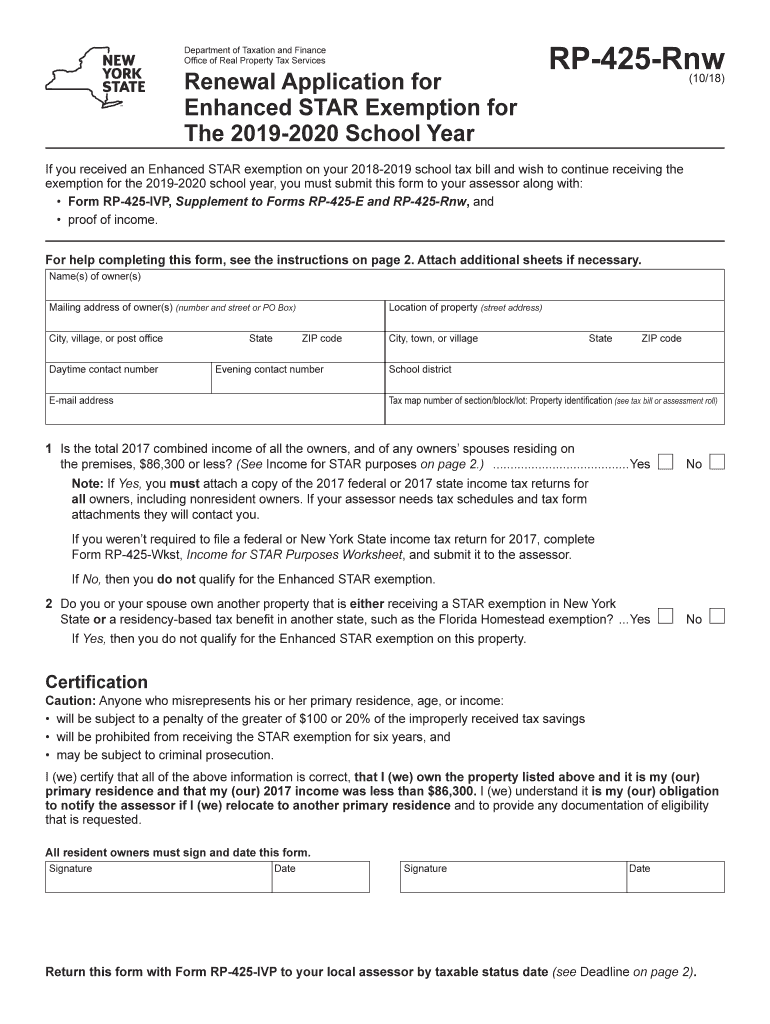

The STAR School Tax Relief Exemption Form is a document designed to provide property tax relief for eligible homeowners in the United States. This exemption aims to reduce the financial burden of property taxes for those who qualify, primarily benefiting individuals and families with lower incomes or those who meet specific criteria. The STAR program, which stands for School Tax Relief, is particularly focused on helping homeowners afford their school taxes, thereby promoting educational funding and community support.

Eligibility Criteria for the STAR School Tax Relief Exemption

To qualify for the STAR School Tax Relief Exemption, applicants must meet certain eligibility criteria. Generally, these include:

- Homeownership: The applicant must own and occupy the property as their primary residence.

- Income Limits: There are specific income thresholds that applicants must not exceed, which can vary by state.

- Age and Disability: Some states offer additional benefits for seniors or individuals with disabilities.

It is essential for applicants to review their state’s specific requirements, as these can differ significantly across the country.

Steps to Complete the STAR School Tax Relief Exemption Form

Completing the STAR School Tax Relief Exemption Form involves several key steps:

- Gather Required Information: Collect necessary documentation, such as proof of income, identification, and property details.

- Obtain the Form: Download the STAR School Tax Relief Exemption Form from your state’s tax authority website or request a physical copy.

- Fill Out the Form: Carefully complete all sections of the form, ensuring accuracy and completeness.

- Submit the Form: Follow the submission guidelines specific to your state, which may include online, mail, or in-person options.

Taking the time to ensure all information is accurate can help prevent delays in processing.

How to Obtain the STAR School Tax Relief Exemption Form

The STAR School Tax Relief Exemption Form can typically be obtained through your state’s tax authority website. Most states provide a downloadable version of the form, which can be filled out electronically or printed for manual completion. Additionally, local tax offices may offer physical copies of the form. It is advisable to check for any updates or changes to the form annually, as requirements may evolve.

Form Submission Methods for the STAR School Tax Relief Exemption

Submitting the STAR School Tax Relief Exemption Form can be done through various methods, depending on state regulations:

- Online Submission: Many states allow for electronic submission through their tax authority websites, providing a quick and efficient way to file.

- Mail: Applicants can print the completed form and send it via postal mail to the designated tax office.

- In-Person: Some local tax offices accept submissions in person, which may also provide an opportunity to ask questions directly.

Be mindful of submission deadlines to ensure timely processing of your application.

Key Elements of the STAR School Tax Relief Exemption Form

The STAR School Tax Relief Exemption Form typically includes several critical components that applicants need to complete:

- Personal Information: This section requires the homeowner's name, address, and contact details.

- Property Information: Details about the property, including its location and assessed value, must be provided.

- Income Information: Applicants may need to disclose their total household income to verify eligibility.

- Signature: A signature is usually required to certify that the information provided is accurate and truthful.

Completing these sections accurately is vital for the approval of the exemption.

Quick guide on how to complete star school tax relief exemption forms

Complete STAR School Tax Relief Exemption Forms seamlessly on any device

Digital document management has become widely adopted by organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly without unnecessary holdups. Manage STAR School Tax Relief Exemption Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and electronically sign STAR School Tax Relief Exemption Forms with ease

- Find STAR School Tax Relief Exemption Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign STAR School Tax Relief Exemption Forms and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct star school tax relief exemption forms

Create this form in 5 minutes!

How to create an eSignature for the star school tax relief exemption forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is star school tax relief?

Star school tax relief is a financial benefit designed to assist educational institutions in managing their tax obligations. This relief can help schools reduce their overall tax burden, allowing them to allocate more resources towards educational programs and student services.

-

How can airSlate SignNow help with star school tax relief documentation?

AirSlate SignNow simplifies the process of managing documents related to star school tax relief. With our eSigning capabilities, schools can quickly prepare, send, and sign necessary forms, ensuring compliance and efficiency in handling tax relief applications.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to accommodate various needs, including those related to star school tax relief. Our cost-effective solutions ensure that educational institutions can access essential features without straining their budgets.

-

What features does airSlate SignNow provide for tax relief applications?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing star school tax relief applications. These tools streamline the documentation process, making it easier for schools to apply for and receive tax relief.

-

How does airSlate SignNow ensure the security of tax-related documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents related to star school tax relief. We utilize advanced encryption and compliance measures to protect all data, ensuring that your tax documents remain confidential and secure.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow offers integrations with various software solutions that can assist in managing star school tax relief. This allows schools to streamline their workflows and ensure that all tax-related processes are efficiently handled within their existing systems.

-

What benefits does airSlate SignNow provide for educational institutions?

By using airSlate SignNow, educational institutions can enhance their operational efficiency, especially when dealing with star school tax relief. Our platform reduces paperwork, speeds up the signing process, and ultimately helps schools focus more on their core mission of education.

Get more for STAR School Tax Relief Exemption Forms

Find out other STAR School Tax Relief Exemption Forms

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe