Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax 2022-2026

Understanding the Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax

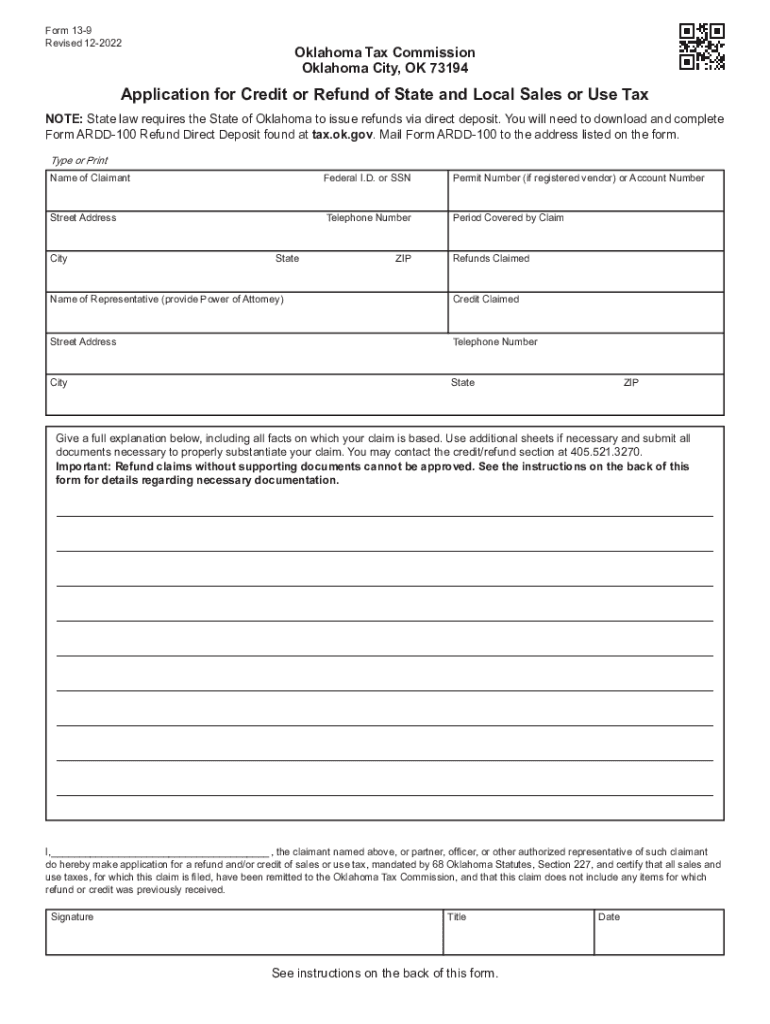

The Form 13 9 is a crucial document for individuals and businesses in Oklahoma seeking a credit or refund for state and local sales or use tax. This form is designed to facilitate the return of overpaid sales tax or to claim a refund for items that are exempt from taxation. Understanding the purpose and function of this form is essential for anyone looking to navigate Oklahoma's tax system effectively.

This application is particularly relevant for those who have made purchases that qualify for a refund, such as goods returned to a seller or items that were purchased for resale but were taxed incorrectly. The form helps ensure that taxpayers receive the appropriate credits or refunds they are entitled to under state law.

Steps to Complete the Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax

Completing the Form 13 9 requires careful attention to detail to ensure that all necessary information is accurately provided. Here are the key steps to follow:

- Gather all relevant documentation, including receipts and proof of payment for the items in question.

- Fill out the applicant's information section, including name, address, and contact details.

- Provide details about the purchases, including dates, amounts, and descriptions of the items for which you are requesting a refund.

- Indicate the reason for the refund request, ensuring it aligns with the criteria set forth by Oklahoma tax regulations.

- Review the completed form for accuracy, ensuring all sections are filled out completely.

- Submit the form via the preferred method, whether online, by mail, or in person, as specified by the Oklahoma Tax Commission.

Legal Use of the Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax

The Form 13 9 is legally recognized by the Oklahoma Tax Commission as the official application for claiming a credit or refund of sales or use tax. It is important for applicants to understand the legal framework surrounding this form. Submitting the form allows taxpayers to assert their rights under Oklahoma tax law, ensuring compliance and proper handling of tax matters.

Using this form appropriately can help avoid potential penalties or legal issues related to tax overpayments. It is advisable to consult with a tax professional if there are uncertainties regarding eligibility or the refund process.

Eligibility Criteria for the Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax

To qualify for a credit or refund using the Form 13 9, applicants must meet specific eligibility criteria established by the Oklahoma Tax Commission. Generally, eligibility includes:

- Proof of overpayment of sales or use tax on purchases.

- Documentation supporting the claim, such as receipts and invoices.

- Compliance with the time limits for filing a refund request, typically within three years of the date of purchase.

- Items must be eligible for tax exemption or refund under Oklahoma law.

Meeting these criteria is essential for a successful application and to ensure that the refund process proceeds smoothly.

Form Submission Methods for the Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax

Submitting the Form 13 9 can be done through various methods, providing flexibility for applicants. The available submission methods include:

- Online Submission: Many applicants prefer to submit the form electronically through the Oklahoma Tax Commission's online portal, which allows for quicker processing.

- Mail Submission: Applicants can print and mail the completed form to the designated address provided by the Oklahoma Tax Commission.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local tax office is an option.

Choosing the right submission method can impact the processing time and efficiency of the refund request.

Quick guide on how to complete form 13 9 application for credit or refund of state and local sales or use tax 699489787

Complete Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax effortlessly

- Find Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax and click on Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in a few clicks from any device you choose. Modify and eSign Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13 9 application for credit or refund of state and local sales or use tax 699489787

Create this form in 5 minutes!

How to create an eSignature for the form 13 9 application for credit or refund of state and local sales or use tax 699489787

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing the Oklahoma form state sales?

Completing the Oklahoma form state sales is straightforward with airSlate SignNow. You can easily upload the form, fill it out digitally, and send it for eSignature. This ensures a quick and efficient way to manage your sales documents without the hassle of printing and scanning.

-

How much does airSlate SignNow cost for handling Oklahoma form state sales?

airSlate SignNow offers different pricing plans that cater to various business needs, including those needing to handle Oklahoma form state sales. Our plans are designed to be cost-effective, ensuring you only pay for the features you need. You can choose a monthly or annual subscription to suit your budget.

-

What features does airSlate SignNow provide for Oklahoma form state sales?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage specifically for Oklahoma form state sales. These tools streamline the eSignature process, allowing you to manage your documents efficiently while ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for Oklahoma form state sales?

Yes, airSlate SignNow allows for seamless integration with various software platforms to enhance your experience with Oklahoma form state sales. Our integrations include popular tools like Google Drive, Dropbox, and CRM systems, enabling you to manage all your documents in one place.

-

Is airSlate SignNow secure for handling Oklahoma form state sales documents?

Absolutely! airSlate SignNow prioritizes the security of your documents related to Oklahoma form state sales. We utilize encryption, advanced authentication methods, and are compliant with industry-standard security protocols to ensure your data remains safe and confidential.

-

Will airSlate SignNow help me with compliance on Oklahoma form state sales?

Yes, airSlate SignNow is designed to help you maintain compliance when dealing with Oklahoma form state sales. Our platform provides features that ensure your documents are legally binding and compliant with state laws, making it easier for businesses to operate confidently.

-

How do I get started with airSlate SignNow for Oklahoma form state sales?

Getting started with airSlate SignNow for Oklahoma form state sales is simple. You can sign up for a free trial to explore our features, upload your forms, and start sending documents for eSignature. Our user-friendly interface will guide you through the setup process effortlessly.

Get more for Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

- Onlineform6

- Form 2 land registry

- Enrollment applicationchange form bcbstx

- Care 4 kids ct redetermination form

- Hris proforma pdf

- Nate holden performing arts center booking packet amp application for use ebonyrep

- Non represented party victoria only land title verification form at at 30 september

- Home contractor agreement template form

Find out other Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form