Form 538 S Claim for Credit Refund of Sales Tax 2023

What is the Form 538 S Claim For Credit Refund Of Sales Tax

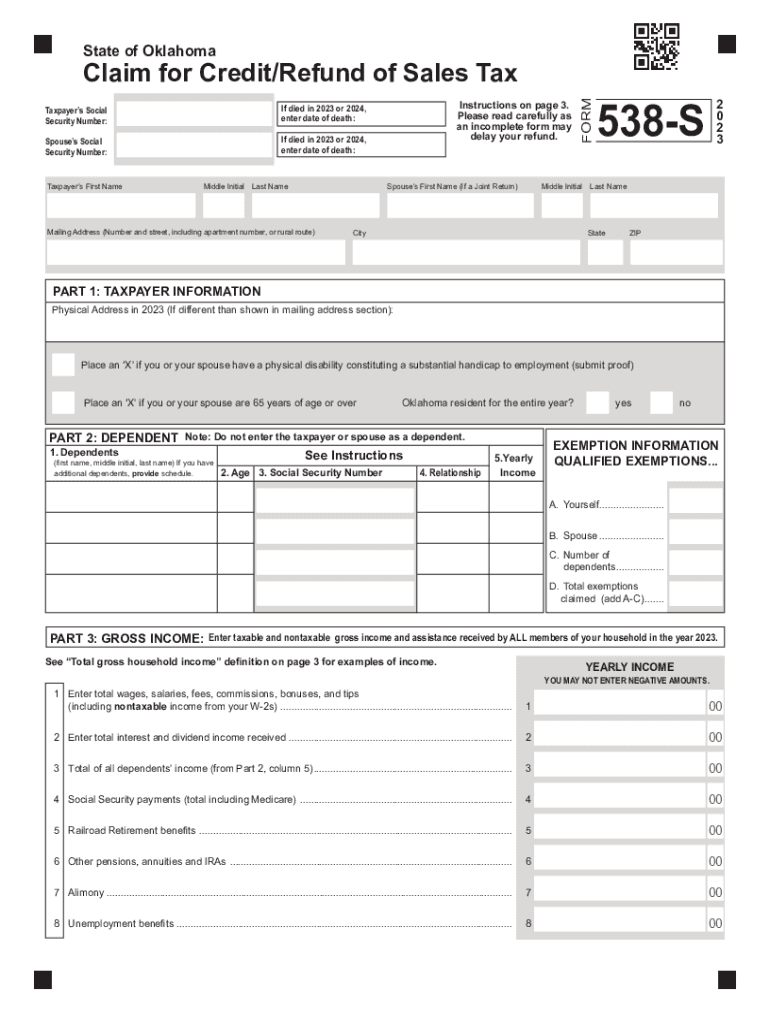

The Form 538 S is a tax form used in Oklahoma to claim a credit refund for sales tax paid on purchases. This form is specifically designed for individuals and businesses who have overpaid sales tax and wish to receive a refund. It is important for taxpayers to understand the purpose of this form to ensure they can accurately claim any eligible refunds.

How to use the Form 538 S Claim For Credit Refund Of Sales Tax

To use the Form 538 S, taxpayers must first obtain the form from the Oklahoma Tax Commission or other authorized sources. After acquiring the form, individuals should fill it out with the required information, including details about the sales tax paid and the reasons for the refund claim. Once completed, the form must be submitted according to the specified guidelines to ensure processing.

Steps to complete the Form 538 S Claim For Credit Refund Of Sales Tax

Completing the Form 538 S involves several steps:

- Gather necessary documentation, including receipts and proof of sales tax paid.

- Fill out the personal or business information section accurately.

- Detail the sales tax amounts and the reason for the refund claim.

- Review the form for accuracy and completeness.

- Submit the form via the preferred method outlined by the Oklahoma Tax Commission.

Eligibility Criteria

Eligibility for the Form 538 S credit refund typically requires that the claimant has paid sales tax on eligible purchases and has documentation to support the claim. Taxpayers must ensure they meet all criteria set forth by the Oklahoma Tax Commission, including any specific conditions related to the type of goods or services purchased.

Required Documents

When filing the Form 538 S, taxpayers must include certain documents to support their claim. Required documents may include:

- Receipts or invoices showing sales tax paid.

- Proof of eligibility for the refund, such as exemption certificates if applicable.

- Any additional documentation requested by the Oklahoma Tax Commission to substantiate the claim.

Form Submission Methods

The Form 538 S can be submitted through various methods, including:

- Online submission through the Oklahoma Tax Commission's website.

- Mailing the completed form to the designated address provided by the Tax Commission.

- In-person submission at local tax offices, if available.

Quick guide on how to complete form 538 s claim for credit refund of sales tax

Complete Form 538 S Claim For Credit Refund Of Sales Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly and without delays. Manage Form 538 S Claim For Credit Refund Of Sales Tax on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The most efficient way to alter and eSign Form 538 S Claim For Credit Refund Of Sales Tax with ease

- Find Form 538 S Claim For Credit Refund Of Sales Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 538 S Claim For Credit Refund Of Sales Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 538 s claim for credit refund of sales tax

Create this form in 5 minutes!

How to create an eSignature for the form 538 s claim for credit refund of sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Form 538 S, and how can I get the instructions?

The Oklahoma Form 538 S is a crucial tax document for individuals and businesses in the state of Oklahoma. To obtain the Oklahoma Form 538 S instructions, you can visit the official state tax website or use platforms like airSlate SignNow that facilitate the creation and signing of such forms.

-

How does airSlate SignNow help with the Oklahoma Form 538 S instructions?

airSlate SignNow provides an intuitive platform that simplifies the process of obtaining and completing the Oklahoma Form 538 S instructions. With its user-friendly interface, you can easily navigate through the necessary steps to ensure your document is filled out correctly.

-

Are the Oklahoma Form 538 S instructions included in your pricing plan?

Yes, the Oklahoma Form 538 S instructions are accessible as part of airSlate SignNow's subscription plans. Our pricing is designed to be cost-effective while providing essential tools for document management and eSigning, including detailed instructions for various forms.

-

Can I integrate my existing tools with airSlate SignNow for managing Oklahoma Form 538 S instructions?

Absolutely! airSlate SignNow supports integration with a variety of third-party applications, making it easy to manage your Oklahoma Form 538 S instructions alongside your favorite tools. This integration streamlines your workflow and enhances efficiency within your document management processes.

-

What features can I utilize for the Oklahoma Form 538 S instructions on airSlate SignNow?

With airSlate SignNow, you can utilize features like document templates, secure eSigning, and real-time collaboration specifically for the Oklahoma Form 538 S instructions. These features ensure that your tax documentation process is smooth and efficient, reducing the likelihood of errors.

-

What are the benefits of using airSlate SignNow for Oklahoma Form 538 S instructions?

Using airSlate SignNow for your Oklahoma Form 538 S instructions offers numerous benefits, including enhanced security, ease of use, and the ability to track your document’s progress. This ensures you’ll never miss a deadline while keeping your sensitive information safe.

-

Is there customer support available for questions about Oklahoma Form 538 S instructions?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions regarding Oklahoma Form 538 S instructions. You can signNow out through chat, email, or phone to get prompt assistance and resolve any queries effectively.

Get more for Form 538 S Claim For Credit Refund Of Sales Tax

- Advanced open water diver form

- Application for bingo raffles license colorado secretary of state sos state co form

- Oakwoodorgemailapps form

- Declaratieformulier vervoerskosten pgb

- Dws ffn child care provider initial approval application form

- Form mo nri missouri income percentage

- Sewer lateral inspection and testing report form city of lakeport

- Independent contractor commission agreement template form

Find out other Form 538 S Claim For Credit Refund Of Sales Tax

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free