Ny Stater Realestate Tax Refund Form

Understanding the New York Stater Real Estate Tax Refund

The New York Stater Real Estate Tax Refund is a program designed to provide financial relief to eligible homeowners. This refund is aimed at reducing the burden of property taxes for residents who meet specific criteria. It is important for homeowners to understand the eligibility requirements and the process involved in claiming this refund. The program is particularly beneficial for those who have recently purchased property or have experienced significant changes in their financial situation.

Steps to Complete the New York Stater Real Estate Tax Refund

Completing the New York Stater Real Estate Tax Refund involves several key steps:

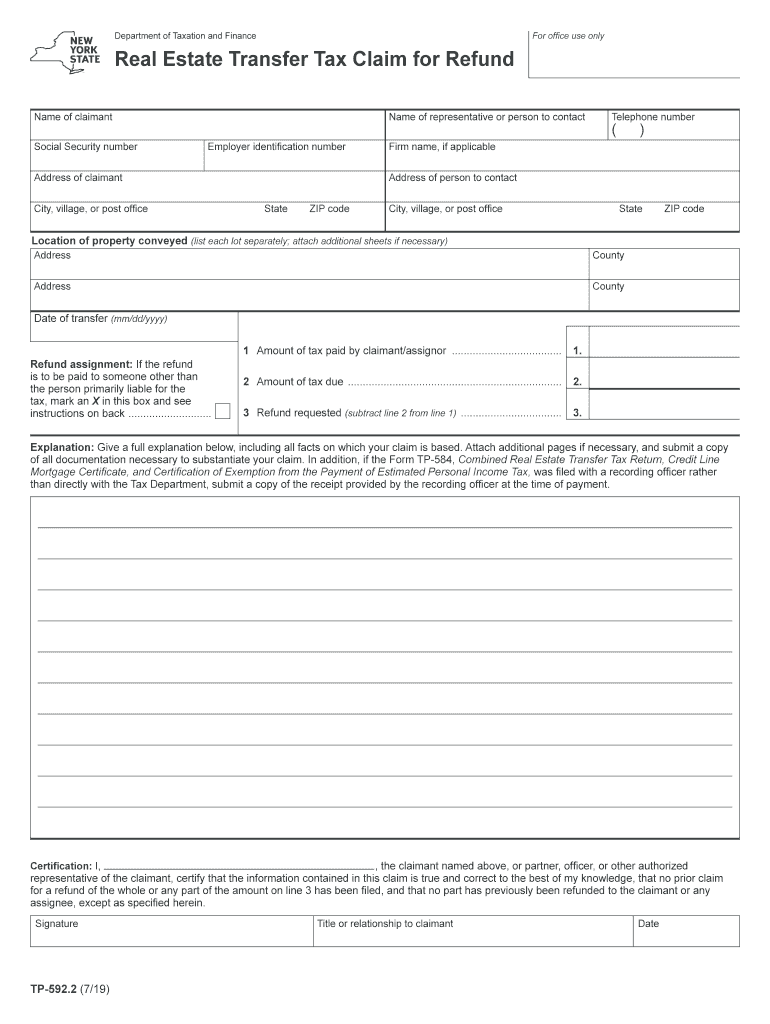

- Gather necessary documentation, including proof of ownership and tax payment records.

- Review the eligibility criteria to ensure you qualify for the refund.

- Fill out the required forms accurately, paying close attention to details.

- Submit the completed forms along with any supporting documents by the specified deadline.

Following these steps carefully can help ensure a smooth application process and increase the likelihood of receiving the refund.

Required Documents for the New York Stater Real Estate Tax Refund

To successfully apply for the New York Stater Real Estate Tax Refund, certain documents are required. These typically include:

- Proof of property ownership, such as a deed or mortgage statement.

- Tax payment receipts or statements showing the amount paid.

- Identification documents, such as a driver's license or Social Security number.

Having these documents ready can facilitate the application process and help avoid delays.

Eligibility Criteria for the New York Stater Real Estate Tax Refund

Eligibility for the New York Stater Real Estate Tax Refund is determined by several factors, including:

- Ownership of the property for which the refund is being claimed.

- Income level, which may affect qualification for the program.

- Property tax payments made during the tax year in question.

It is essential to review these criteria thoroughly to confirm eligibility before applying.

Form Submission Methods for the New York Stater Real Estate Tax Refund

Applicants have several options for submitting their forms for the New York Stater Real Estate Tax Refund:

- Online submission through the official state tax website, which is often the quickest method.

- Mailing the completed forms to the designated tax office address.

- In-person submission at local tax offices, which may provide immediate assistance.

Choosing the most convenient submission method can help streamline the process and ensure timely receipt of the refund.

Important Filing Deadlines for the New York Stater Real Estate Tax Refund

Filing deadlines are critical for ensuring that applications for the New York Stater Real Estate Tax Refund are submitted on time. Typically, these deadlines align with the annual tax filing season. It is advisable to check the specific dates each year, as they may vary. Missing the deadline can result in disqualification from receiving the refund, so staying informed is essential.

Quick guide on how to complete form tp 5922719real estate transfer tax claim for refundtp5922

Complete Ny Stater Realestate Tax Refund effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Ny Stater Realestate Tax Refund on any device utilizing airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Ny Stater Realestate Tax Refund with ease

- Locate Ny Stater Realestate Tax Refund and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Ny Stater Realestate Tax Refund and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tp 5922719real estate transfer tax claim for refundtp5922

How to make an electronic signature for your Form Tp 5922719real Estate Transfer Tax Claim For Refundtp5922 in the online mode

How to generate an eSignature for the Form Tp 5922719real Estate Transfer Tax Claim For Refundtp5922 in Chrome

How to generate an eSignature for putting it on the Form Tp 5922719real Estate Transfer Tax Claim For Refundtp5922 in Gmail

How to make an eSignature for the Form Tp 5922719real Estate Transfer Tax Claim For Refundtp5922 straight from your mobile device

How to generate an eSignature for the Form Tp 5922719real Estate Transfer Tax Claim For Refundtp5922 on iOS devices

How to make an electronic signature for the Form Tp 5922719real Estate Transfer Tax Claim For Refundtp5922 on Android devices

People also ask

-

What is tp 592 2 and how does it relate to airSlate SignNow?

The tp 592 2 refers to a specific form used for tax reporting, and airSlate SignNow makes it easy to electronically sign and send such documents. With our platform, you can quickly generate, send, and track the tp 592 2, ensuring compliance and efficiency in your business operations.

-

How does airSlate SignNow ensure security for documents like tp 592 2?

AirSlate SignNow uses advanced security measures including encryption and two-factor authentication to keep your documents secure. When handling sensitive documents such as tp 592 2, our solution provides a safe environment to store, sign, and share your information.

-

What are the pricing plans for airSlate SignNow when handling forms like tp 592 2?

Our pricing plans are designed to be cost-effective, catering to a range of business needs. You can choose from different tiers depending on your volume of documents, such as tp 592 2, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with other applications for managing tp 592 2?

Yes, airSlate SignNow offers seamless integrations with multiple applications like CRMs and cloud storage solutions. This allows you to automate workflows and manage documents like tp 592 2 more efficiently across platforms.

-

What features of airSlate SignNow help streamline the process of signing tp 592 2?

AirSlate SignNow offers features such as custom templates, a user-friendly interface, and mobile access that simplify the signing process. This ensures that users can complete their tp 592 2 forms quickly and efficiently from any device.

-

How can airSlate SignNow improve the turnaround time for forms such as tp 592 2?

With airSlate SignNow, the turnaround time for documents like tp 592 2 can be drastically reduced. Our platform allows for instant notifications and real-time tracking, ensuring all parties involved are aware of the signing status.

-

Is there customer support available for issues with tp 592 2 in airSlate SignNow?

Absolutely! Our dedicated customer support team is available to assist you with any issues related to tp 592 2 or any other documents. We provide resources and personalized support to help you utilize airSlate SignNow effectively.

Get more for Ny Stater Realestate Tax Refund

- Edd supplementary certificate form

- Gpc 03a ama ras form marin emergency medical services ems marinhhs

- Otec dental lab 616367495 form

- Stanford health care she please send she request form

- Responsibility statement for supervision of a speech language pathology assistant 77s 60 rev 522 slpa supervision requirements form

- Ilwu pma coastwise indemnity plan medicare supplemental form

- Radnet san bernardino form

- Www michigan govdocumentsmdhhsgretchen whitmer department of health and human services form

Find out other Ny Stater Realestate Tax Refund

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP