763 S Form

What is the 763 S

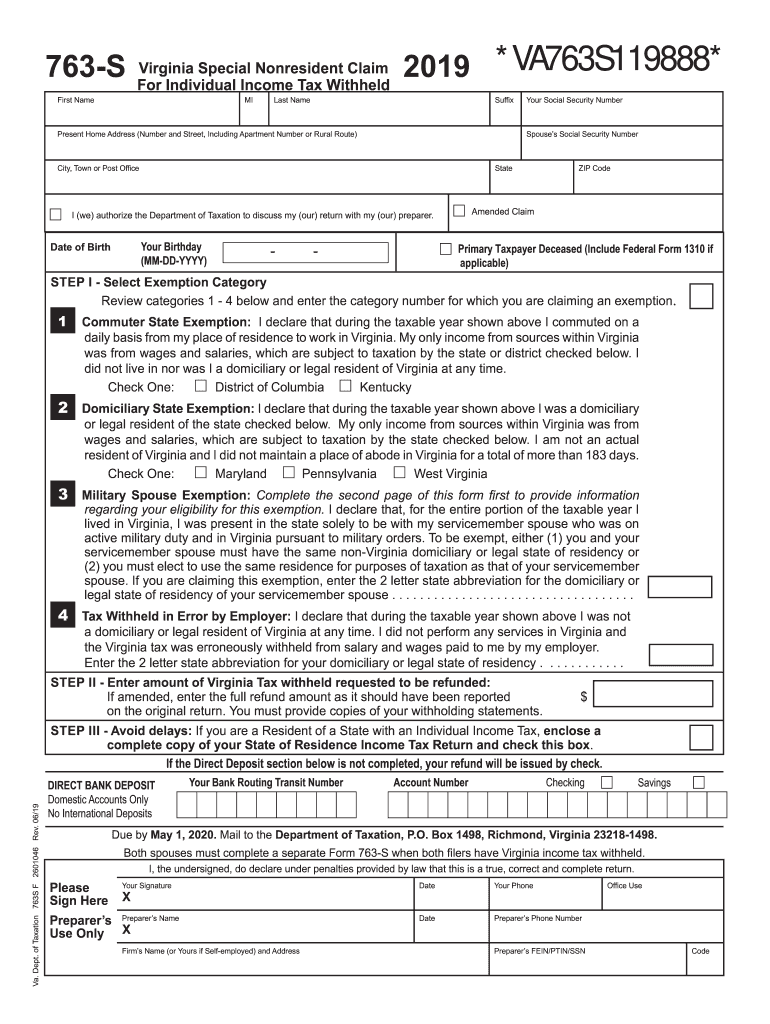

The 763 S form, also known as the Virginia Individual Income Tax Nonresident Form, is used by individuals who are not residents of Virginia but have earned income within the state. This form allows nonresidents to report their Virginia-sourced income and calculate the tax owed to the state. Understanding the purpose and requirements of the 763 S is essential for compliance with Virginia tax laws.

How to use the 763 S

To effectively use the 763 S form, nonresidents must gather all relevant income information earned in Virginia. This includes wages, salaries, and any other income sources. After collecting the necessary data, individuals can fill out the form by providing personal information, detailing income earned, and calculating the tax owed. It is crucial to follow the instructions provided on the form carefully to ensure accurate reporting.

Steps to complete the 763 S

Completing the 763 S form involves several key steps:

- Gather all income documents related to Virginia earnings.

- Fill in personal identification details, including name, address, and Social Security number.

- Report all Virginia-sourced income on the appropriate lines of the form.

- Calculate the total tax owed based on the income reported.

- Sign and date the form to certify the information provided is accurate.

Legal use of the 763 S

The 763 S form is legally binding when completed accurately and submitted in accordance with Virginia tax regulations. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Virginia Department of Taxation. This includes filing the form by the designated deadlines and providing truthful information regarding income. Noncompliance can lead to penalties, making it essential to understand the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the 763 S form are typically aligned with Virginia's tax return due dates. Generally, nonresidents must submit their forms by May first of the year following the tax year in question. It is important to keep track of any changes to deadlines or extensions that may be announced by the Virginia Department of Taxation to avoid late penalties.

Required Documents

When completing the 763 S form, individuals must have several documents on hand, including:

- W-2 forms from employers for Virginia income.

- 1099 forms for any additional income earned in Virginia.

- Records of any deductions or credits that may apply.

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The 763 S form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the Virginia Department of Taxation's website, which offers a user-friendly interface for electronic submissions. Alternatively, individuals can mail their completed forms to the appropriate tax office or deliver them in person at designated locations. Each method has its own processing times, so it is advisable to choose one that aligns with individual needs.

Quick guide on how to complete 2019 form 763s virginia special nonresident claim for individual income tax withheld

Complete 763 S easily on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage 763 S on any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign 763 S effortlessly

- Find 763 S and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign 763 S to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 763s virginia special nonresident claim for individual income tax withheld

How to generate an electronic signature for your 2019 Form 763s Virginia Special Nonresident Claim For Individual Income Tax Withheld online

How to make an electronic signature for your 2019 Form 763s Virginia Special Nonresident Claim For Individual Income Tax Withheld in Google Chrome

How to make an electronic signature for putting it on the 2019 Form 763s Virginia Special Nonresident Claim For Individual Income Tax Withheld in Gmail

How to make an electronic signature for the 2019 Form 763s Virginia Special Nonresident Claim For Individual Income Tax Withheld right from your mobile device

How to generate an eSignature for the 2019 Form 763s Virginia Special Nonresident Claim For Individual Income Tax Withheld on iOS devices

How to make an electronic signature for the 2019 Form 763s Virginia Special Nonresident Claim For Individual Income Tax Withheld on Android

People also ask

-

What are 763 s instructions for using airSlate SignNow?

The 763 s instructions refer to the guidelines provided by airSlate SignNow for effectively utilizing their eSignature features. These instructions help users navigate the platform, ensuring they can send and manage documents efficiently. By following the 763 s instructions, users can take full advantage of the software's capabilities, making the process seamless.

-

How can I get pricing information based on 763 s instructions?

To obtain pricing information that aligns with the 763 s instructions, you can visit the pricing section on the airSlate SignNow website. The pricing plans are designed to accommodate various business needs, providing transparent details on costs. Ensure to review the plans that include features relevant to your requirements outlined in the 763 s instructions.

-

What features are highlighted in the 763 s instructions for airSlate SignNow?

The 763 s instructions detail key features of airSlate SignNow, including document editing, secure eSigning, and cloud storage options. These features are tailored to enhance user experience and efficiency in document management. By leveraging these features, businesses can streamline their workflows while adhering to the best practices mentioned in the 763 s instructions.

-

What benefits can I expect from following the 763 s instructions?

By following the 763 s instructions, you can unlock several benefits of using airSlate SignNow, such as increased productivity through simplified workflows and improved contract management. These instructions are designed to optimize your use of the platform, leading to faster document turnaround times. Additionally, businesses can achieve better compliance and security when utilizing the service per the 763 s instructions.

-

Are there any integrations covered in the 763 s instructions?

Yes, the 763 s instructions include information on various integrations available with airSlate SignNow. These integrations facilitate seamless connections to popular applications and tools that businesses commonly use. By following the guidelines in the 763 s instructions, users can enhance their experience and leverage the full potential of their software ecosystem.

-

How does airSlate SignNow ensure compliance as per the 763 s instructions?

airSlate SignNow ensures compliance with industry regulations, as outlined in the 763 s instructions, by utilizing secure encryption and secure data storage practices. This commitment to compliance is critical for businesses handling sensitive information. By adhering to the 763 s instructions, users can confidently use the platform while maintaining necessary legal standards.

-

What support is available for users following the 763 s instructions?

For users following the 763 s instructions, airSlate SignNow offers comprehensive support options, including live chat, email, and an extensive knowledge base. These resources provide guidance and troubleshooting assistance to ensure smooth usage of the platform. The support team is dedicated to helping you understand and implement the steps in the 763 s instructions effectively.

Get more for 763 S

- Bellwood neighborhood watch scholarship fund corporation scholarship application date i form

- Star of tomorrow application edit form

- 60 general incident report form template page 4 to

- Extending or renewing your medical cannabis registry e card form

- This slip is due to mrs form

- Access connection permit certificate form dotd

- Endowment gift agreement form tlcbr

- Note this form is to be filled out by the patient and parent prior to seeing the physician

Find out other 763 S

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter