Csatf Stipend Form

What is the Csatf Stipend Form

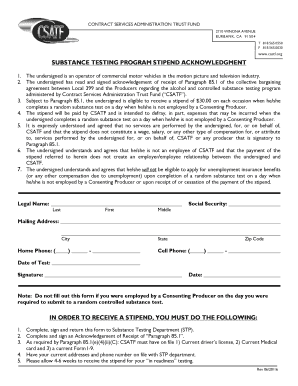

The Csatf Stipend Form is a document used to apply for stipends provided by the California State Athletic Foundation (CSATF). This form is essential for individuals seeking financial support for athletic-related expenses. It serves as a formal request for funding, ensuring that applicants meet the necessary criteria set forth by the foundation.

How to use the Csatf Stipend Form

Using the Csatf Stipend Form involves several straightforward steps. First, applicants should carefully read the instructions provided with the form to understand eligibility requirements and necessary documentation. Next, fill out the form with accurate personal information, including contact details and the purpose of the stipend request. Once completed, submit the form through the designated submission method, ensuring that all required documents are attached.

Steps to complete the Csatf Stipend Form

Completing the Csatf Stipend Form requires attention to detail. Follow these steps:

- Gather necessary documents, such as proof of athletic participation and financial need.

- Fill out personal information, including your name, address, and contact details.

- Provide a detailed explanation of how the stipend will be used.

- Review the form for accuracy and completeness.

- Submit the form either online, by mail, or in person, as specified in the guidelines.

Eligibility Criteria

To qualify for the Csatf Stipend, applicants must meet specific eligibility criteria. Generally, this includes being an active participant in a recognized athletic program and demonstrating financial need. Additional requirements may vary based on the specific stipends offered, so it's crucial to review the guidelines associated with the form for any updates or changes.

Form Submission Methods

The Csatf Stipend Form can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online via the official CSATF website, mail it to the designated address, or deliver it in person to the appropriate office. Each method has its own processing times, so applicants should consider this when deciding how to submit their forms.

Required Documents

When applying for a stipend using the Csatf Stipend Form, applicants must include several required documents to support their request. Commonly required documents include:

- Proof of enrollment in an athletic program.

- Financial statements demonstrating need.

- Any additional documentation specified in the form instructions.

Ensuring that all required documents are submitted will help facilitate a smoother review process.

Quick guide on how to complete csatf stipend form

Complete Csatf Stipend Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed files, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Csatf Stipend Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Csatf Stipend Form without stress

- Obtain Csatf Stipend Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive data with tools specifically designed by airSlate SignNow for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to store your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Csatf Stipend Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the csatf stipend form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Csatf Stipend Form?

The Csatf Stipend Form is a document designed for applicants to request stipends related to the California State Arts Fund. This form streamlines the application process, ensuring that all necessary information is collected efficiently.

-

How can I access the Csatf Stipend Form?

You can easily access the Csatf Stipend Form through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the Csatf Stipend Form to begin your application.

-

Is there a cost associated with using the Csatf Stipend Form?

Using the Csatf Stipend Form on airSlate SignNow is part of our cost-effective solution. While there may be subscription fees for premium features, accessing and submitting the Csatf Stipend Form itself is free for users.

-

What features does the Csatf Stipend Form offer?

The Csatf Stipend Form includes features such as electronic signatures, customizable fields, and secure document storage. These features enhance the user experience, making it easier to complete and submit your stipend request.

-

How does the Csatf Stipend Form benefit users?

The Csatf Stipend Form benefits users by simplifying the application process and reducing paperwork. With airSlate SignNow, you can fill out, sign, and submit the form digitally, saving time and ensuring accuracy.

-

Can I integrate the Csatf Stipend Form with other applications?

Yes, the Csatf Stipend Form can be integrated with various applications through airSlate SignNow's API. This allows for seamless data transfer and enhances your workflow by connecting with tools you already use.

-

What support is available for users of the Csatf Stipend Form?

airSlate SignNow offers comprehensive support for users of the Csatf Stipend Form. You can access tutorials, FAQs, and customer support to assist you with any questions or issues you may encounter.

Get more for Csatf Stipend Form

- Quitclaim gift deed from individual to husband and wife new hampshire form

- Nh warranty deed 497318573 form

- Nh form deed

- New hampshire deed search 497318576 form

- New hampshire warranty deed form

- Quitclaim deed three individuals to one individual new hampshire form

- New hampshire husband form

- Heirship affidavit descent new hampshire form

Find out other Csatf Stipend Form

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word