Ow 8 Es Form

What is the OW-8 ES?

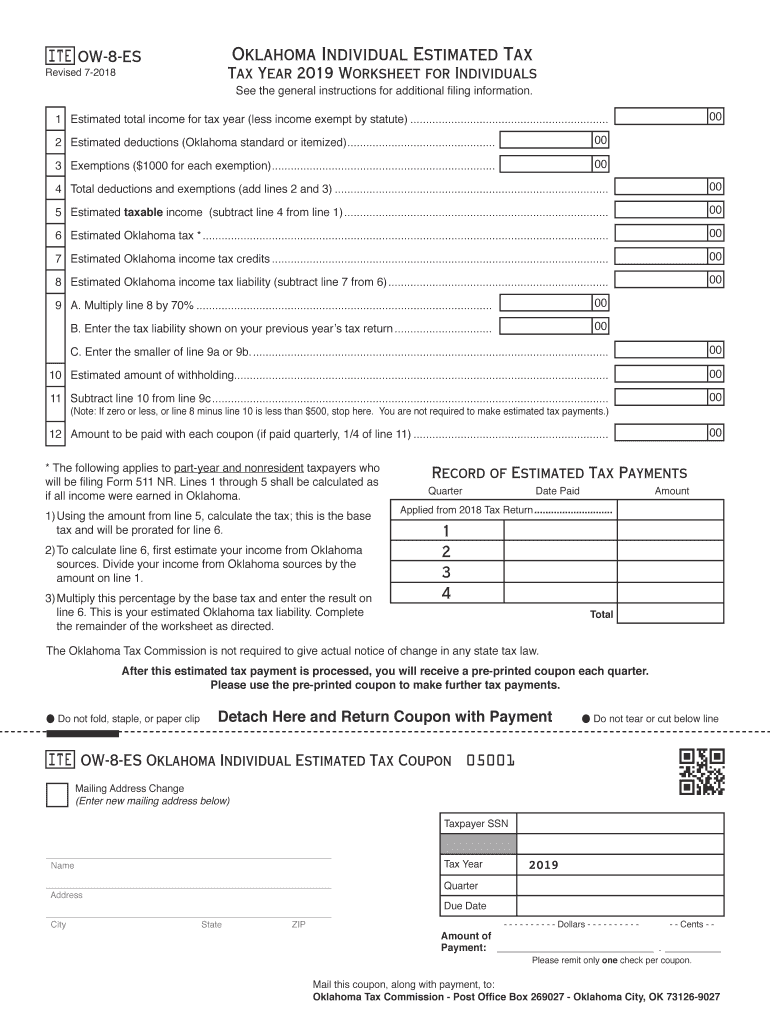

The OW-8 ES form is an Oklahoma state tax document used primarily for individual estimated tax payments. This form is essential for taxpayers who expect to owe tax of $1,000 or more when filing their annual return. It allows individuals to make quarterly estimated tax payments, ensuring they meet their tax obligations throughout the year. The form is specifically designed for residents of Oklahoma and is a critical part of managing state tax responsibilities effectively.

How to Use the OW-8 ES

Using the OW-8 ES form involves a few straightforward steps. First, determine your expected tax liability for the year, which will guide your estimated payment amounts. Next, complete the form with accurate personal information and the calculated estimated tax. The OW-8 ES allows you to specify payment amounts for each quarter, helping to distribute your tax payments evenly throughout the year. Finally, submit the form along with your payments by the specified deadlines to avoid penalties.

Steps to Complete the OW-8 ES

Completing the OW-8 ES form requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including previous tax returns and income statements.

- Calculate your expected annual income and tax liability for the current year.

- Fill out the OW-8 ES form, providing your name, address, and Social Security number.

- Enter the estimated tax amounts for each quarter based on your calculations.

- Review the form for accuracy before submission.

Legal Use of the OW-8 ES

The OW-8 ES form is legally recognized for making estimated tax payments in Oklahoma. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Oklahoma Tax Commission. Proper use of the form helps avoid underpayment penalties and ensures that taxpayers fulfill their legal obligations. It is crucial to keep records of all submitted forms and payments for future reference and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the OW-8 ES form are critical for taxpayers to avoid penalties. Estimated tax payments are typically due on the 15th day of April, June, September, and January of the following year. Mark these dates on your calendar to ensure timely submissions. Missing these deadlines can result in interest and penalties, making it essential to stay organized and proactive in managing your tax responsibilities.

Who Issues the Form

The OW-8 ES form is issued by the Oklahoma Tax Commission. This state agency is responsible for administering tax laws and ensuring compliance among residents. The commission provides guidelines and resources to help taxpayers understand their obligations and the proper use of the OW-8 ES form. For any questions regarding the form or tax obligations, taxpayers can reach out directly to the Oklahoma Tax Commission for assistance.

Quick guide on how to complete tax year 2019 worksheet for individuals

Effortlessly Prepare Ow 8 Es on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing for the acquisition of the requisite form and secure online storage. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without hindrance. Manage Ow 8 Es on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Ow 8 Es effortlessly

- Find Ow 8 Es and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether it be by email, SMS, invite link, or download it to your computer.

Put aside worries about lost or misfiled documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Ow 8 Es to guarantee effective communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax year 2019 worksheet for individuals

How to create an electronic signature for your Tax Year 2019 Worksheet For Individuals online

How to create an eSignature for your Tax Year 2019 Worksheet For Individuals in Chrome

How to make an eSignature for putting it on the Tax Year 2019 Worksheet For Individuals in Gmail

How to make an eSignature for the Tax Year 2019 Worksheet For Individuals straight from your smartphone

How to create an eSignature for the Tax Year 2019 Worksheet For Individuals on iOS devices

How to make an eSignature for the Tax Year 2019 Worksheet For Individuals on Android devices

People also ask

-

What is the otc form ow 8 es and how is it used?

The otc form ow 8 es is a specialized document used for electronic signatures and workflows. It streamlines the process of obtaining signatures, ensuring that all parties can sign from anywhere, at any time. This enhances convenience and speeds up the transaction process.

-

How can airSlate SignNow help me manage the otc form ow 8 es?

airSlate SignNow provides user-friendly tools specifically designed to manage the otc form ow 8 es efficiently. Users can easily upload, edit, and send the form for signatures, all while benefiting from advanced security features. This ensures that your documents remain confidential and compliant.

-

Is there a cost associated with using the otc form ow 8 es through airSlate SignNow?

Yes, there is a cost associated with using the otc form ow 8 es through airSlate SignNow, but it is designed to be cost-effective. Our pricing plans cater to various business sizes, providing flexible options for unlimited access to essential features. This makes it an affordable solution for managing electronic documents.

-

What are the key features of airSlate SignNow for the otc form ow 8 es?

airSlate SignNow offers numerous features for the otc form ow 8 es, including customizable templates, automated workflows, and real-time tracking of documents. These capabilities help users save time and improve document management efficiency. Additionally, users can access customer support to assist with any queries.

-

Can I integrate other applications with airSlate SignNow for the otc form ow 8 es?

Absolutely! airSlate SignNow allows integrations with various applications such as Google Drive, Salesforce, and more, enhancing the use of the otc form ow 8 es. This interoperability streamlines your workflow, as documents can be easily shared and tracked across platforms you already use.

-

What are the benefits of using airSlate SignNow for the otc form ow 8 es?

Using airSlate SignNow for the otc form ow 8 es provides numerous benefits, including improved efficiency, reduced processing time, and enhanced accuracy. It eliminates the need for physical paperwork, allowing for eco-friendly practices. Additionally, its advanced security measures ensure that all signed documents are protected.

-

Is there a trial available for using the otc form ow 8 es via airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore features related to the otc form ow 8 es without any commitment. This trial period enables potential customers to test the software's capabilities and determine if it meets their needs before making a purchase. It's a risk-free way to experience our service.

Get more for Ow 8 Es

Find out other Ow 8 Es

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online