Nys Individual 2023-2026

Understanding the NYS Individual

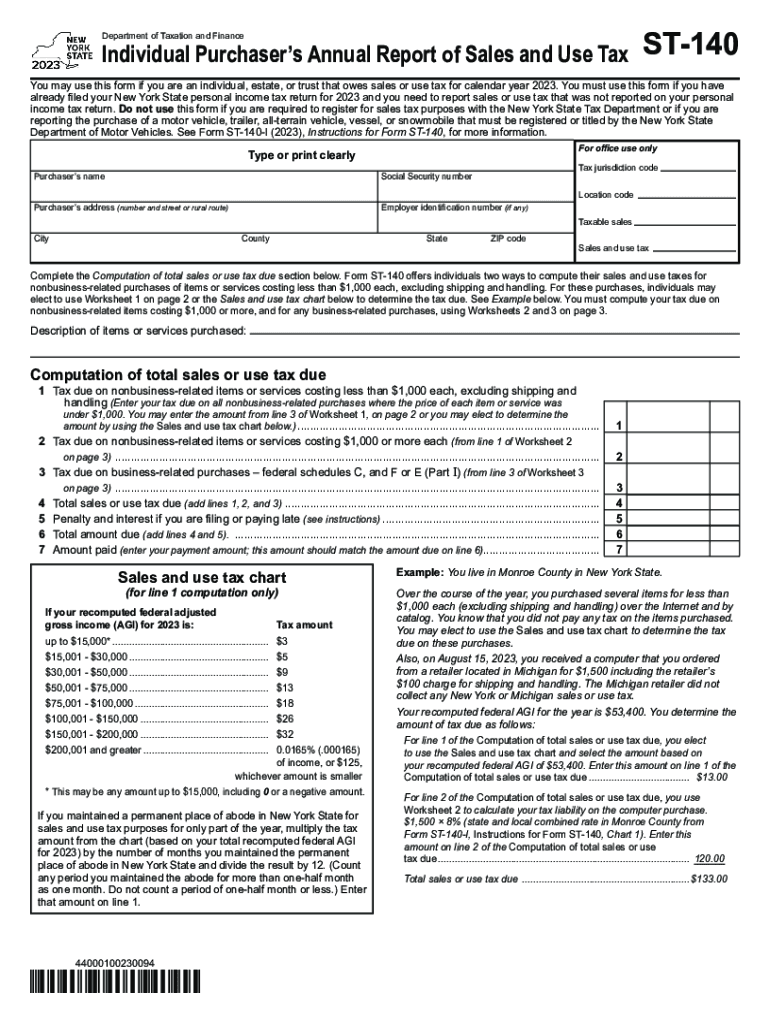

The NYS Individual is a crucial form for residents of New York State who need to report their income and calculate their tax obligations. This form plays a significant role in ensuring compliance with state tax laws. It is essential for individuals who earn income within the state, including wages, self-employment income, and other sources of revenue. The NYS Individual form is designed to capture various income types and applicable deductions, ensuring that taxpayers can accurately report their financial situation.

Steps to Complete the NYS Individual

Completing the NYS Individual form involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, which can affect your tax rate and eligibility for certain credits. After that, fill out the form by entering your income, deductions, and credits. It's important to double-check all entries for accuracy. Finally, review the form for completeness and submit it by the deadline to avoid penalties.

Required Documents for the NYS Individual

When preparing to file the NYS Individual form, certain documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for self-employment or other income

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents organized will streamline the filing process and help ensure that all necessary information is included.

Filing Deadlines for the NYS Individual

It is important to be aware of the filing deadlines for the NYS Individual form to avoid penalties. Typically, the deadline for filing is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider the possibility of filing for an extension if they are unable to complete their forms on time, but it is crucial to pay any estimated taxes owed to avoid interest and penalties.

Form Submission Methods

There are several methods available for submitting the NYS Individual form. Taxpayers can choose to file online through approved e-filing services, which offer a convenient and efficient way to submit forms. Alternatively, individuals may opt to mail their completed forms to the appropriate state tax office. In-person submissions are also possible at designated tax offices. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Penalties for Non-Compliance

Failing to file the NYS Individual form or submitting it late can result in penalties. The state imposes fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes, increasing the total amount due. It is essential for taxpayers to understand these consequences and to file their forms accurately and on time to avoid unnecessary financial burdens.

Quick guide on how to complete nys individual

Complete Nys Individual effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers a superb eco-conscious alternative to conventional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Nys Individual on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The optimal way to modify and eSign Nys Individual with ease

- Find Nys Individual and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize key sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal authority as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choice. Modify and eSign Nys Individual and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys individual

Create this form in 5 minutes!

How to create an eSignature for the nys individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYS form annual and how can airSlate SignNow help with it?

The NYS form annual is a required document for various businesses in New York State to report their annual income and expenses. airSlate SignNow simplifies the completion and submission of the NYS form annual by allowing users to easily eSign and send the document electronically. This streamlines the process, ensuring compliance and saving valuable time.

-

What features does airSlate SignNow offer for managing the NYS form annual?

airSlate SignNow offers features like customizable templates, advanced eSignature capabilities, and document tracking specifically for managing the NYS form annual. Users can create, edit, and send the form with secure sign-offs to ensure all legal requirements are met. Additionally, real-time notifications keep you updated on the signing process.

-

How does airSlate SignNow's pricing structure work for the NYS form annual?

airSlate SignNow has a flexible pricing structure tailored to meet the needs of different businesses needing to handle the NYS form annual. Plans vary based on the number of users and additional features required. We offer an affordable solution optimized for efficiency and ease, ensuring you only pay for what you need.

-

Can airSlate SignNow integrate with other software to manage the NYS form annual?

Yes, airSlate SignNow easily integrates with various business applications, such as CRM and accounting software, to enhance the management of the NYS form annual. These integrations allow for seamless data transfer, reducing the need for manual entry and ensuring accuracy. Streamlining your workflow ensures that all documents are managed efficiently.

-

What are the benefits of using airSlate SignNow for the NYS form annual?

Using airSlate SignNow for the NYS form annual offers numerous benefits, including reduced paperwork, faster turnaround times for signatures, and enhanced document security. The electronic signature feature eliminates the hassles of pen and paper, making it a cost-effective solution for any business. By simplifying the signing process, you can focus more on running your business.

-

Is it easy to use airSlate SignNow for filling out the NYS form annual?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to fill out the NYS form annual. With its intuitive interface, users can quickly navigate through the template, fill in necessary data, and send it for signing without any steep learning curve. Our platform empowers quick and efficient document management.

-

What security measures does airSlate SignNow implement for the NYS form annual?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the NYS form annual. We implement industry-standard encryption, multi-factor authentication, and regular security audits to ensure your data is protected. You can have peace of mind knowing that your documents are secure while utilizing our platform.

Get more for Nys Individual

- Cocodoc comform8647662 adult medical releaseadult medical release form fillable printable ampamp blank pdf

- Arkansas state crime lab forms

- Roi authorization english form

- Www lhcaz gov docs default sourceadditional health information amp epi pen form

- U s department of labor issues third installment of qampampampas form

- Standard glucose testing record sheet diabetes patientuse form

- Upmc western marylandhome form

- Rncpatientintakeform doc

Find out other Nys Individual

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple