Mo W 4 Form

What is the Mo W-4?

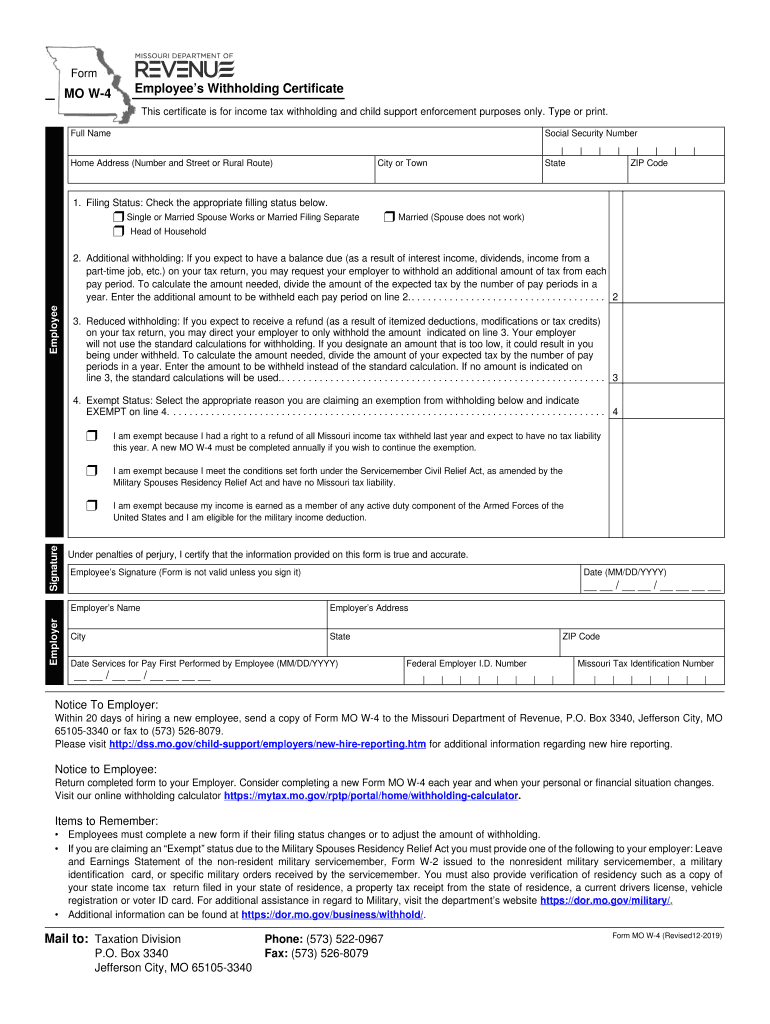

The Mo W-4, officially known as the Missouri Employee's Withholding Certificate, is a crucial tax form used by employees in Missouri to determine the amount of state income tax to withhold from their paychecks. This form allows employees to specify their filing status, number of allowances, and any additional amount they wish to withhold. Proper completion of the Mo W-4 ensures that employees meet their tax obligations and helps avoid under-withholding, which could lead to a tax bill at the end of the year.

Steps to complete the Mo W-4

Filling out the Mo W-4 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Determine the number of allowances you are claiming. This affects how much tax is withheld from your paycheck.

- If you want additional amounts withheld, specify that in the appropriate section.

- Sign and date the form to validate it.

Once completed, submit the Mo W-4 to your employer's payroll department to ensure accurate withholding.

Legal use of the Mo W-4

The Mo W-4 is legally recognized as a binding document when filled out correctly. It complies with state tax regulations, which require employers to withhold state income tax based on the information provided. To ensure its legal validity, the form must be signed by the employee, and any changes in personal circumstances, such as marital status or number of dependents, should prompt a new form submission. Employers are required to keep these forms on file for compliance purposes.

How to obtain the Mo W-4

Obtaining the Mo W-4 is straightforward. Employees can request the form from their employer, or it can be downloaded directly from the Missouri Department of Revenue's website. The form is available in a printable format, allowing for easy completion. Additionally, many payroll software systems provide the Mo W-4 as part of their documentation, making it accessible for employees managing their tax information digitally.

Filing Deadlines / Important Dates

While the Mo W-4 does not have a specific filing deadline like annual tax returns, it is essential to submit it promptly when starting a new job or when personal circumstances change. Employers typically require the Mo W-4 to be on file before processing payroll. For annual tax filings, employees should be aware of the state tax return deadlines to ensure that any adjustments made on the Mo W-4 are reflected in their year-end tax calculations.

Examples of using the Mo W-4

Employees may use the Mo W-4 in various scenarios, such as:

- A new employee completing the form upon hire to establish their withholding preferences.

- An employee who recently married and needs to adjust their withholding status and number of allowances.

- A worker who has had a child and wants to claim additional allowances to reduce their tax withholding.

These examples illustrate how the Mo W-4 can be utilized to align tax withholding with personal financial situations.

Quick guide on how to complete form mo w 4 employees withholding certificate

Effortlessly Complete Mo W 4 on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Manage Mo W 4 on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to Modify and eSign Mo W 4 with Ease

- Locate Mo W 4 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require re-printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from your chosen device. Modify and eSign Mo W 4 to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo w 4 employees withholding certificate

How to create an electronic signature for the Form Mo W 4 Employees Withholding Certificate in the online mode

How to generate an electronic signature for the Form Mo W 4 Employees Withholding Certificate in Google Chrome

How to create an eSignature for signing the Form Mo W 4 Employees Withholding Certificate in Gmail

How to create an electronic signature for the Form Mo W 4 Employees Withholding Certificate right from your mobile device

How to generate an electronic signature for the Form Mo W 4 Employees Withholding Certificate on iOS devices

How to create an eSignature for the Form Mo W 4 Employees Withholding Certificate on Android OS

People also ask

-

What is the mo w 4 2019 form, and why is it important?

The mo w 4 2019 form is a tax form that allows employees in Missouri to determine their state income tax withholding. Completing this form accurately ensures that the correct amount of taxes is withheld from your paycheck. Understanding the mo w 4 2019 is essential for effective financial planning and avoiding tax liabilities.

-

How can I complete and sign the mo w 4 2019 document electronically?

With airSlate SignNow, you can easily complete and eSign the mo w 4 2019 form online. Our platform offers a user-friendly interface that allows you to fill out the document and securely sign it in just a few clicks. This process is straightforward and convenient, streamlining your tax documentation needs.

-

What features does airSlate SignNow offer for managing the mo w 4 2019 form?

airSlate SignNow provides various features to help you manage the mo w 4 2019 form effectively. You can create templates, gather signatures, and track the status of your documents in real time. These tools enhance your productivity and ensure that all your tax-related documents are organized and accessible.

-

Is airSlate SignNow cost-effective for small businesses handling the mo w 4 2019 forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to handle mo w 4 2019 forms. With competitive pricing and flexible plans, it enables businesses to take advantage of advanced electronic signing capabilities without breaking the bank. You'll save time and resources in the document signing process.

-

Can I integrate airSlate SignNow with other software for handling mo w 4 2019 forms?

Absolutely! airSlate SignNow supports integration with various software applications, which can streamline your workflow when dealing with the mo w 4 2019 form. By connecting with tools like CRM and document management systems, you can enhance the efficiency of your document processes and ensure seamless data transfer.

-

What are the benefits of using airSlate SignNow for the mo w 4 2019 form?

Using airSlate SignNow for the mo w 4 2019 form offers numerous benefits, including enhanced security and efficiency. Electronic signing eliminates the need for physical paperwork, reducing the risk of errors and delays. Additionally, you can conveniently store your completed forms and access them anytime, ensuring compliance and proper record-keeping.

-

How does airSlate SignNow ensure the security of my mo w 4 2019 documents?

airSlate SignNow prioritizes the security of your mo w 4 2019 documents by employing robust encryption and compliance measures. Our platform complies with industry standards to safeguard sensitive information during the signing process. With features like audit trails, you can track document access and modifications for added peace of mind.

Get more for Mo W 4

- Interactions of pyridine nucleotides with redox forms of the flavin jbc

- Local alignment of rna sequences with arbitrary scoring schemes mpi inf mpg form

- The distribution of pyridine nucleotides in cellular frac cancerres aacrjournals form

- Application of long pcr method to identification of variations in jcm asm form

- The influence of the size and nature of basic activators on clostridium perfringens polynucleotide phosphorylase catalysed form

- Uracil dna n glycosylase distributively interacts with duplex jbc form

- New and notable ncbi nlm nih form

- Puppy sell contract template form

Find out other Mo W 4

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF