990 Ez Form

What is the 990 EZ form?

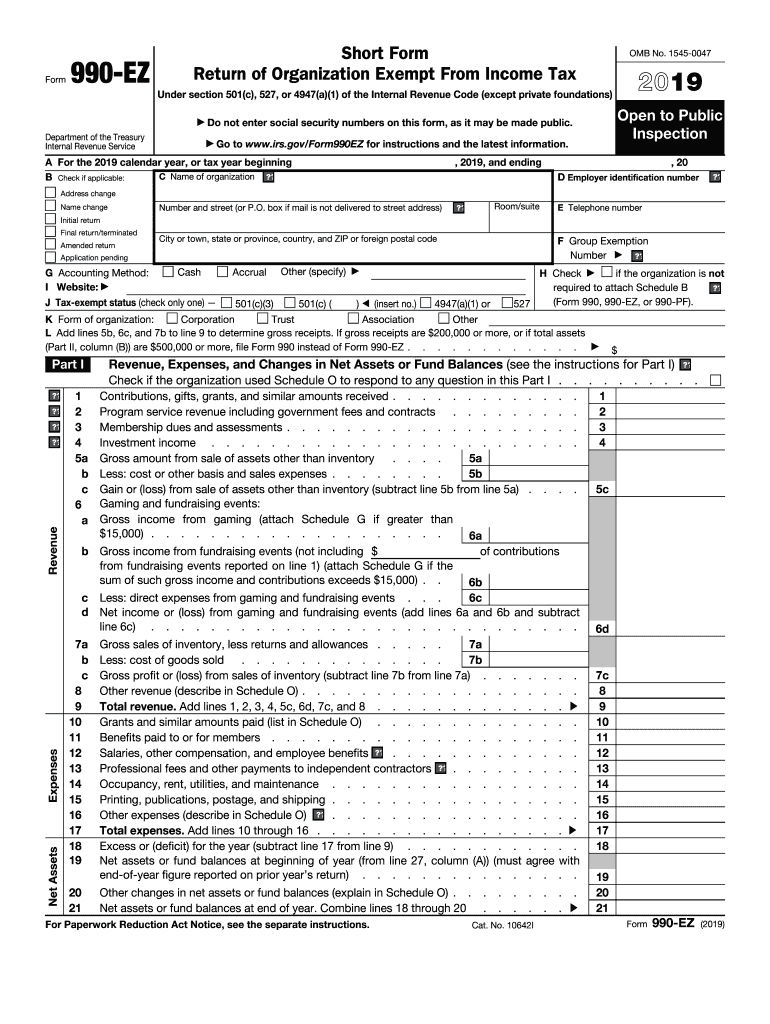

The 990 EZ form is a simplified version of the IRS Form 990, which is used by tax-exempt organizations to provide the IRS with information about their financial activities. This form is specifically designed for smaller organizations that meet certain criteria, making it easier to complete and file. The 990 EZ form for 2019 allows eligible organizations to report their income, expenses, and other essential financial data without the complexity of the full Form 990. It is important for organizations to understand the requirements and ensure they qualify to use this form.

Steps to complete the 990 EZ form

Completing the 990 EZ form involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather financial records: Collect all necessary financial documents, including income statements, balance sheets, and expense reports.

- Determine eligibility: Confirm that your organization meets the criteria to use the 990 EZ form, typically based on gross receipts and total assets.

- Fill out the form: Carefully complete each section of the form, including income, expenses, and any required schedules.

- Review for accuracy: Double-check all entries for accuracy and completeness to avoid potential penalties.

- File the form: Submit the completed form to the IRS by the appropriate deadline, either electronically or by mail.

Legal use of the 990 EZ form

The legal use of the 990 EZ form is governed by IRS regulations, which dictate how tax-exempt organizations must report their financial information. To ensure compliance, organizations must accurately complete the form and file it by the designated deadlines. Failure to comply with these regulations can result in penalties, including fines or loss of tax-exempt status. It is crucial for organizations to maintain accurate records and adhere to all legal requirements associated with the 990 EZ form.

Filing Deadlines / Important Dates

Filing deadlines for the 990 EZ form are critical for maintaining compliance with IRS regulations. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the 990 EZ form for 2019 must be filed by May fifteen, 2020. Organizations can apply for an extension if needed, but it is essential to ensure that the form is submitted on time to avoid penalties.

Who Issues the 990 EZ form?

The 990 EZ form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. Organizations must obtain the form directly from the IRS or through authorized tax software. It is important for organizations to use the correct version of the form for the appropriate tax year to ensure compliance with IRS regulations.

Examples of using the 990 EZ form

Organizations often use the 990 EZ form to report their financial activities when they qualify as tax-exempt entities. Common examples include small charities, religious organizations, and educational institutions that operate with limited revenue. By utilizing the 990 EZ form, these organizations can fulfill their reporting obligations while benefiting from a streamlined process that reduces the administrative burden associated with more complex forms.

Quick guide on how to complete error to display the webpage again internet explorer needs

Complete 990 Ez effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly and without delays. Manage 990 Ez on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and eSign 990 Ez with ease

- Locate 990 Ez and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 990 Ez and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the error to display the webpage again internet explorer needs

How to generate an eSignature for the Error To Display The Webpage Again Internet Explorer Needs in the online mode

How to make an electronic signature for your Error To Display The Webpage Again Internet Explorer Needs in Chrome

How to generate an eSignature for signing the Error To Display The Webpage Again Internet Explorer Needs in Gmail

How to create an eSignature for the Error To Display The Webpage Again Internet Explorer Needs from your mobile device

How to create an electronic signature for the Error To Display The Webpage Again Internet Explorer Needs on iOS

How to make an eSignature for the Error To Display The Webpage Again Internet Explorer Needs on Android devices

People also ask

-

What is the 990 Ez form and how does it relate to airSlate SignNow?

The 990 Ez form is a simplified version of the IRS Form 990, designed for small tax-exempt organizations. With airSlate SignNow, users can easily eSign and send the 990 Ez form securely and efficiently, streamlining the submission process for nonprofit organizations.

-

How does airSlate SignNow simplify the 990 Ez filing process?

airSlate SignNow offers an intuitive interface that allows users to fill out and eSign the 990 Ez form online. This digital solution eliminates the need for printing and mailing, saving time and reducing the risk of errors during filing.

-

What are the pricing options for using airSlate SignNow for 990 Ez forms?

airSlate SignNow provides flexible pricing plans to accommodate different organizational needs. Users can choose from monthly or annual subscriptions, ensuring that the cost-effective solution is accessible for anyone needing to manage 990 Ez filings.

-

Can I integrate airSlate SignNow with other accounting software for 990 Ez processing?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easy to manage your 990 Ez filings alongside your financial records. This integration helps streamline your workflow, ensuring all necessary documents are in sync.

-

What features does airSlate SignNow offer for managing 990 Ez documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for 990 Ez forms. These tools enhance the efficiency of the filing process, ensuring compliance and organization for tax-exempt entities.

-

Is airSlate SignNow secure for filing sensitive 990 Ez information?

Absolutely! airSlate SignNow prioritizes security with advanced encryption protocols to protect sensitive data in 990 Ez filings. Users can rest assured that their information is safe and compliant with data protection regulations.

-

What benefits can organizations expect when using airSlate SignNow for 990 Ez forms?

Organizations can expect increased efficiency and reduced administrative burden when using airSlate SignNow for 990 Ez forms. The ability to eSign documents quickly and manage them digitally streamlines the entire process, allowing organizations to focus on their mission.

Get more for 990 Ez

- Human resources department city of groton and form

- Background check authorization form pdfeforms background check authorization consent forms pdf background check authorization

- North conway water precinct fire department application form

- Town of wethersfield wethersfield volunteer fire department form

- Licensing and regulation south carolina department of labor form

- Department of employment service form

- City of frostburg careers and employmentindeed com form

- Sandy spring volunteer fire department montgomery form

Find out other 990 Ez

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document