Form 990 Instructions

What is the Form 990 Instructions

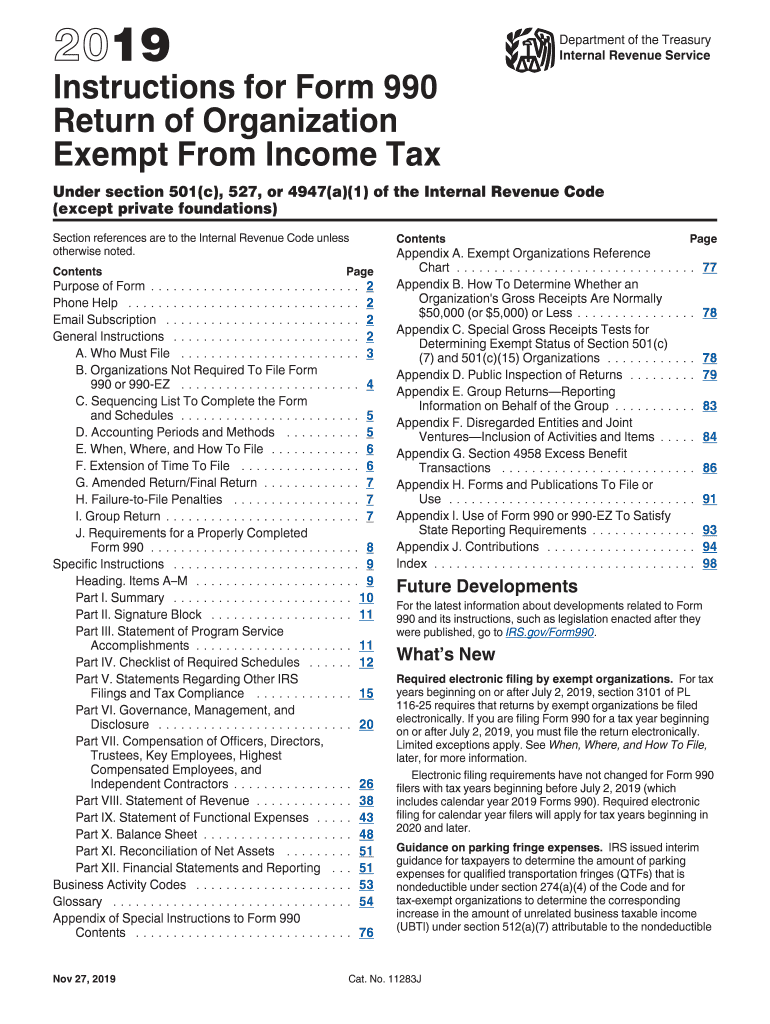

The Form 990 instructions provide essential guidance for tax-exempt organizations in the United States on how to complete the Form 990, which is the annual information return required by the Internal Revenue Service (IRS). This form is crucial for maintaining tax-exempt status and ensuring compliance with federal regulations. The instructions detail the necessary information that organizations must report, including financial data, governance practices, and compliance with public disclosure requirements. Understanding these instructions is vital for organizations to fulfill their obligations and avoid penalties.

Steps to complete the Form 990 Instructions

Completing the Form 990 requires careful attention to detail and adherence to the guidelines outlined in the instructions. Here are the key steps to follow:

- Gather necessary financial documents, including income statements, balance sheets, and expense reports.

- Review the specific sections of the Form 990 that apply to your organization, noting any required disclosures.

- Complete each section of the form accurately, ensuring that all figures are supported by documentation.

- Consult the instructions for any special requirements related to your organization’s activities or structure.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 990 Instructions

The legal use of the Form 990 instructions is fundamental for organizations to maintain compliance with IRS regulations. These instructions serve as a legal framework that outlines the requirements for reporting financial and operational information. Organizations must ensure that they adhere to these guidelines to avoid potential legal repercussions, including fines or loss of tax-exempt status. The instructions also help organizations understand their obligations regarding public disclosure and transparency, which are critical for maintaining public trust.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with Form 990 to ensure timely compliance. Generally, the Form 990 is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically falls on May fifteenth. It is important to note that if the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can apply for an automatic six-month extension if needed, but they must file Form 8868 to do so.

Required Documents

To complete the Form 990 accurately, organizations must gather and prepare several key documents. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Documentation of revenue sources, such as grants, donations, and program service revenue.

- Records of expenses, including salaries, operating costs, and any other expenditures.

- Governance documents, such as bylaws and board meeting minutes.

- Any additional documentation required for specific sections of the form, as outlined in the instructions.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Form 990. The most common methods include:

- Online Submission: Organizations can file electronically using the IRS e-file system, which is encouraged for faster processing.

- Mail Submission: Organizations may choose to mail a paper version of the form to the appropriate IRS address, based on their location.

- In-Person Submission: While less common, organizations can also submit forms in person at designated IRS offices, although this method is generally not recommended due to potential delays.

Quick guide on how to complete 2019 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

Complete Form 990 Instructions effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the proper form and securely save it online. airSlate SignNow equips you with all the features necessary to create, modify, and eSign your documents quickly without delays. Handle Form 990 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 990 Instructions with ease

- Locate Form 990 Instructions and then click Get Form to initiate.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that intention.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click the Done button to preserve your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 990 Instructions and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

How to generate an eSignature for the 2019 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization online

How to create an eSignature for the 2019 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization in Google Chrome

How to generate an eSignature for signing the 2019 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization in Gmail

How to create an eSignature for the 2019 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization straight from your smartphone

How to create an eSignature for the 2019 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization on iOS

How to generate an electronic signature for the 2019 Instructions For Form 990 Return Of Organization Exempt From Income Tax Instructions For Form 990 Return Of Organization on Android OS

People also ask

-

What are the key features of airSlate SignNow that relate to 2019 990 instructions?

airSlate SignNow offers a user-friendly platform that simplifies the e-signing process, crucial for completing 2019 990 instructions efficiently. Features such as document templates, customizable workflows, and audit trails ensure compliance and streamline submissions, making it easier for businesses to manage their tax documents.

-

How can airSlate SignNow help in preparing 2019 990 instructions?

Using airSlate SignNow, you can prepare 2019 990 instructions by easily importing documents and collecting electronic signatures from relevant stakeholders. This saves time on manual processes, allowing you to focus on ensuring the accuracy of your 990 forms while maintaining adherence to IRS guidelines.

-

Is airSlate SignNow a cost-effective solution for 2019 990 instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage 2019 990 instructions. With scalable pricing plans that fit various organizational sizes, you can benefit from its extensive features without straining your budget.

-

What integrations does airSlate SignNow offer for managing 2019 990 instructions?

airSlate SignNow seamlessly integrates with various third-party applications, enhancing the management of 2019 990 instructions. You can connect with cloud storage services and business solutions like Salesforce and Google Drive to facilitate document handling and secure storage.

-

How does airSlate SignNow ensure compliance with 2019 990 instructions?

With built-in compliance features, airSlate SignNow helps businesses follow the guidelines outlined in the 2019 990 instructions. Electronic signatures are legally binding, and the platform maintains an audit log, ensuring all actions taken on your documents are documented and compliant with regulations.

-

Can airSlate SignNow help to automate tasks related to 2019 990 instructions?

Absolutely! airSlate SignNow automates repetitive tasks associated with 2019 990 instructions, such as sending reminders for signatures and tracking document statuses. This automation can signNowly reduce administrative overhead and improve efficiency in managing tax submissions.

-

What support resources does airSlate SignNow provide for users dealing with 2019 990 instructions?

airSlate SignNow offers extensive support resources, including tutorials, FAQs, and customer service to assist users with 2019 990 instructions. Whether you need help navigating the platform or specific guidance on documents, the support team is ready to assist you.

Get more for Form 990 Instructions

- Rescind itin form

- Form y 203 department of taxation and finance new york state tax ny

- California 540 2017 2018 form

- Planilla declaracion 2016 form

- 2016 schedule 1299 c income tax subtractions and credits for individuals form

- Irs 1040 es payment voucher 2018 form

- Arizona form 140 ia arizona department of revenue

- How to file form ss4 step by step instructions

Find out other Form 990 Instructions

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free