File 941 Online Form 2018

What is Form 941?

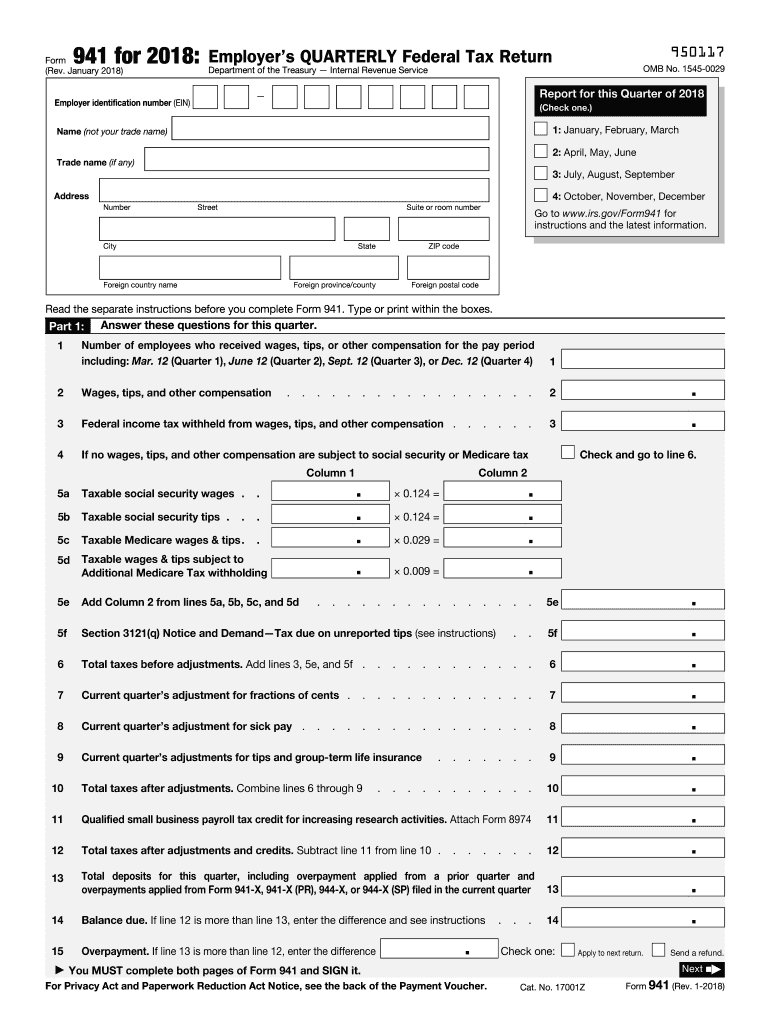

Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document that employers in the United States must file with the Internal Revenue Service (IRS). This form provides detailed information regarding wages paid to employees, federal income tax withheld, and contributions to Social Security and Medicare. Employers are required to submit this form quarterly, even if there are no wages to report. The data included in Form 941 helps ensure compliance with federal tax obligations and maintains transparency in business operations.

Key Elements of Form 941

The 941 form consists of several key components that employers must accurately complete. These include:

- Number of employees and total wages paid during the quarter.

- Federal income tax withheld from employee wages.

- Social Security and Medicare taxes, including any adjustments.

- Information on the employer's business, such as the name and address.

- Signature of the employer or authorized representative.

Each section of the form must be filled out with precision to avoid penalties and ensure proper reporting of tax obligations.

Steps to Complete Form 941

Completing Form 941 involves several steps to ensure accuracy and compliance:

- Gather necessary information, including employee wages, tax withheld, and business details.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or by mail, depending on your preference.

Following these steps can help streamline the filing process and reduce the likelihood of mistakes.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing Form 941. The form is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30.

- Second quarter (April to June): Due by July 31.

- Third quarter (July to September): Due by October 31.

- Fourth quarter (October to December): Due by January 31 of the following year.

Timely filing is essential to avoid penalties and interest on any taxes owed.

Form Submission Methods

Employers have several options for submitting Form 941. These methods include:

- Electronic filing through the IRS e-file system, which is often faster and more efficient.

- Mailing a paper copy of the form to the appropriate IRS address based on the employer's location.

- Submitting the form in person at designated IRS offices, if needed.

Choosing the right submission method can help ensure that the form is processed promptly and accurately.

Penalties for Non-Compliance

Failure to file Form 941 on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Failure-to-file penalty, which is typically a percentage of the unpaid tax.

- Failure-to-pay penalty for not paying the tax owed by the due date.

- Interest on unpaid taxes, which accrues over time until the balance is paid in full.

Understanding these penalties emphasizes the importance of timely and accurate filing of Form 941.

Quick guide on how to complete file 941 online 2018 form

Discover the most efficient method to complete and endorse your File 941 Online Form

Are you still spending time creating your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to finalize and sign your File 941 Online Form and related forms for public services. Our intelligent electronic signature solution grants you everything needed to handle paperwork swiftly and in accordance with official standards - powerful PDF editing, managing, securing, signing, and sharing tools readily available within a user-friendly interface.

Only a few simple steps are needed to complete and endorse your File 941 Online Form:

- Upload the editable template to the editor using the Get Form button.

- Review the information you must include in your File 941 Online Form.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is important or Redact areas that are no longer relevant.

- Select Sign to create a legally binding electronic signature using any method you choose.

- Add the Date next to your signature and finish your task with the Done button.

Store your completed File 941 Online Form in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our solution also provides flexible sharing options. There's no need to print your templates when sending them to the appropriate public office - send them via email, fax, or request a USPS “snail mail” delivery from your account. Give it a go now!

Create this form in 5 minutes or less

Find and fill out the correct file 941 online 2018 form

FAQs

-

When is the IRS 2018 Form 941 due?

Form 941 is filed quarterly.For Q1, January - March, the form is due April 30thFor Q2, April - June, the form is due July 31stFor Q3, July - September, the form is due October 31stFor Q4, October - December, the form is due January 31stThe above just references when the forms are due, not the associated payments, which depends on other factors.You can refer to the IRS business calendar for this and other forms and due dates: IRS Tax Calendar for Businesses and Self Employed

-

What is the penalty for failing to file an IRS Form 941 2018?

The penalties are for not paying the 941 tax on time according to the payment schedule, which depends on the amount of tax. Small companies may be required to pay only quarterly or monthly, but larger companies have payments due within 3 business days after every payroll. The penalties depend on how late the payments are, bit they go up rapidly, and can be 100% if there is no payment.There is often no penalty for not filing the 941 on time if the payments have been made, but the IRS will be sending you a lot of mail to get it filed.

-

How long does it take the IRS to accept or reject an IRS Form 941 return?

If you e-file, you should get your e-file acknowledgement back within the hour. Your software provider should provide you with your ack code, which they receive from the IRS.The IRS servers are lightning fast now after they upgraded them a few years ago after the Russians hacked into them back in 2015. (IRS believes Russians are behind tax return data bsignNow - CNNPolitics). No more waiting 24 -48 hours for an ack code, even though they still tell you officially that’s how long it will take.If you paper file, the whole process slows down to a crawl, and if you make a mistake, the interest and penalties add up before you even know there’s a problem.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

Create this form in 5 minutes!

How to create an eSignature for the file 941 online 2018 form

How to make an eSignature for your File 941 Online 2018 Form online

How to create an electronic signature for your File 941 Online 2018 Form in Chrome

How to generate an eSignature for putting it on the File 941 Online 2018 Form in Gmail

How to generate an electronic signature for the File 941 Online 2018 Form from your mobile device

How to generate an electronic signature for the File 941 Online 2018 Form on iOS devices

How to generate an electronic signature for the File 941 Online 2018 Form on Android devices

People also ask

-

What is the process to File 941 Online Form using airSlate SignNow?

To File 941 Online Form with airSlate SignNow, simply upload your document, fill in the required fields, and add electronic signatures as needed. Our intuitive platform guides you through each step, ensuring a smooth filing experience. Once completed, you can securely send your 941 form directly to the IRS.

-

Is there a cost associated with filing the 941 form using airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, there is a subscription fee for ongoing access to features, including filing the 941 Online Form. Our pricing plans are designed to be cost-effective for businesses of all sizes, ensuring you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for filing the 941 Online Form?

airSlate SignNow provides numerous features for filing the 941 Online Form, including customizable templates, real-time tracking, and secure cloud storage. Additionally, our platform supports electronic signatures, making it easier to get necessary approvals quickly and efficiently.

-

Can I integrate airSlate SignNow with other software for filing the 941 Online Form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, including CRM and accounting software, to enhance your filing process. This integration allows you to automatically pull in data, making it easier to File 941 Online Form without manual entry.

-

What are the benefits of using airSlate SignNow for filing my 941 form?

Using airSlate SignNow to File 941 Online Form offers numerous benefits, including increased efficiency, reduced errors, and a streamlined workflow. Our electronic signature capabilities also speed up the approval process, ensuring you meet deadlines without stress.

-

Is it safe to use airSlate SignNow for filing sensitive documents like the 941 form?

Yes, airSlate SignNow prioritizes your security. When you File 941 Online Form with our platform, your data is protected through advanced encryption protocols and secure storage measures, ensuring that your sensitive information remains confidential.

-

How can I access support if I have questions about filing the 941 Online Form?

If you have questions about filing the 941 Online Form, airSlate SignNow offers robust customer support through multiple channels, including live chat, email, and a comprehensive knowledge base. Our team is dedicated to helping you navigate the eSigning process smoothly.

Get more for File 941 Online Form

Find out other File 941 Online Form

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself