W 3 Form 2017

Annual Reporting - Form W-3

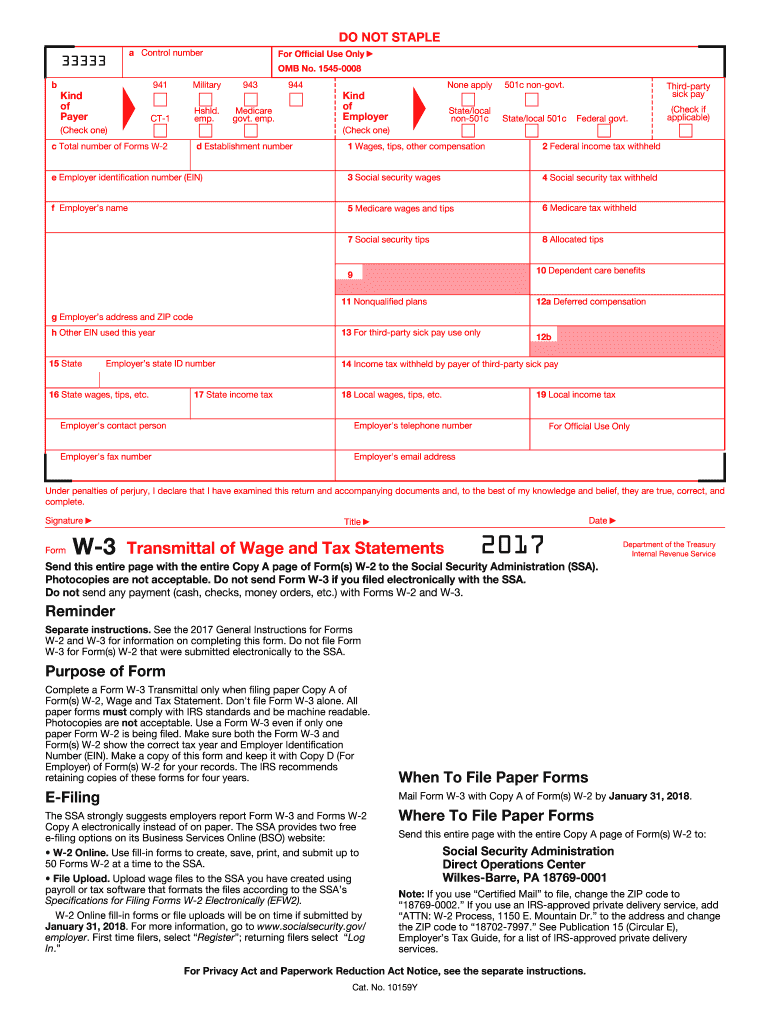

Form W-3 is a required transmittal to accompany your paper-filled Copy A of the W-2, regardless if you submit one record of the Wage and Tax Statement or multiple samples. It’s a one-page document that provides details on wages, tips, compensations, and tax withheld.

While submitting the hardcopy of the W-3 and Copy-A to the Social Security Service, you can use the IRS sample and SSA form printed in black-and-white. Follow the revenue general specifications and instructions in order your information returns to be accepted and approved. These documents should be image-scanned by the SSA’s equipment to recognize the text and process it.

If you make your document with the SSA, apply only black ink for printing to avoid delays or errors in scanning the sheets by the special machines that are used. You have to mail these records to the appropriate administration until January 31s in order to avoid any penalties for the violation of filing deadlines.

Steps to Conclude the W-3 Form

Federal agencies strongly recommend saving a copy of the transmittal statement for your reference and store it for up to four years. To simplify the process, you can fill in the sample online:

- Use airSlate SignNow’s template with fillable fields.

- Type the text in the center of the boxes.

- The font size should be larger than 10-points to make the printed signs recognizable.

- Be sure you supply the total number of W-2 Forms and employer INs correctly.

- Going through the boxes 1 to 19 provide the sums of all appropriate values for your W-2.

- Carefully check the accuracy of the data - if everything is perfect, you can save the document, and then print it.

The Social Security Administration urges you to file your Copy-A to the agency online, so no W-3 Form is needed. Keep in mind not to repeat your information returns via USPS if you’ve already filed them electronically.

Quick guide on how to complete w 3 form 2017 2018

Discover the easiest method to fill out and sign your W 3 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to fill in and sign your W 3 Form and related forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle documents efficiently and in compliance with official standards - comprehensive PDF editing, managing, securing, signing, and sharing functionalities all available within an intuitive interface.

Only a few steps are required to fill out and sign your W 3 Form:

- Upload the editable template to the editor using the Get Form button.

- Verify the information you need to enter in your W 3 Form.

- Switch between the fields using the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize important sections or Blackout fields that are no longer needed.

- Press Sign to generate a legally binding electronic signature using your preferred option.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished W 3 Form in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile file sharing options. There’s no need to print out your templates when you need to submit them to the right public office - simply send them via email, fax, or request a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct w 3 form 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

Create this form in 5 minutes!

How to create an eSignature for the w 3 form 2017 2018

How to generate an electronic signature for your W 3 Form 2017 2018 online

How to generate an eSignature for the W 3 Form 2017 2018 in Google Chrome

How to generate an electronic signature for putting it on the W 3 Form 2017 2018 in Gmail

How to make an eSignature for the W 3 Form 2017 2018 right from your smart phone

How to generate an electronic signature for the W 3 Form 2017 2018 on iOS devices

How to generate an eSignature for the W 3 Form 2017 2018 on Android devices

Get more for W 3 Form

- J form fill 2018

- Dependents information attach to form 502 505 or 515

- Irs form 8888 2018

- Efw individuals can make an extension or estimated tax payment form

- 940pr 2017 2018 form

- 1 federal filing status check only one for each return 2 check if on federal return form

- 4626 2017 2018 form

- Pa schedule ue allowable employee business expenses pa 40 ue formspublications

Find out other W 3 Form

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template