1040 Form 2017

What is the 1040 Form?

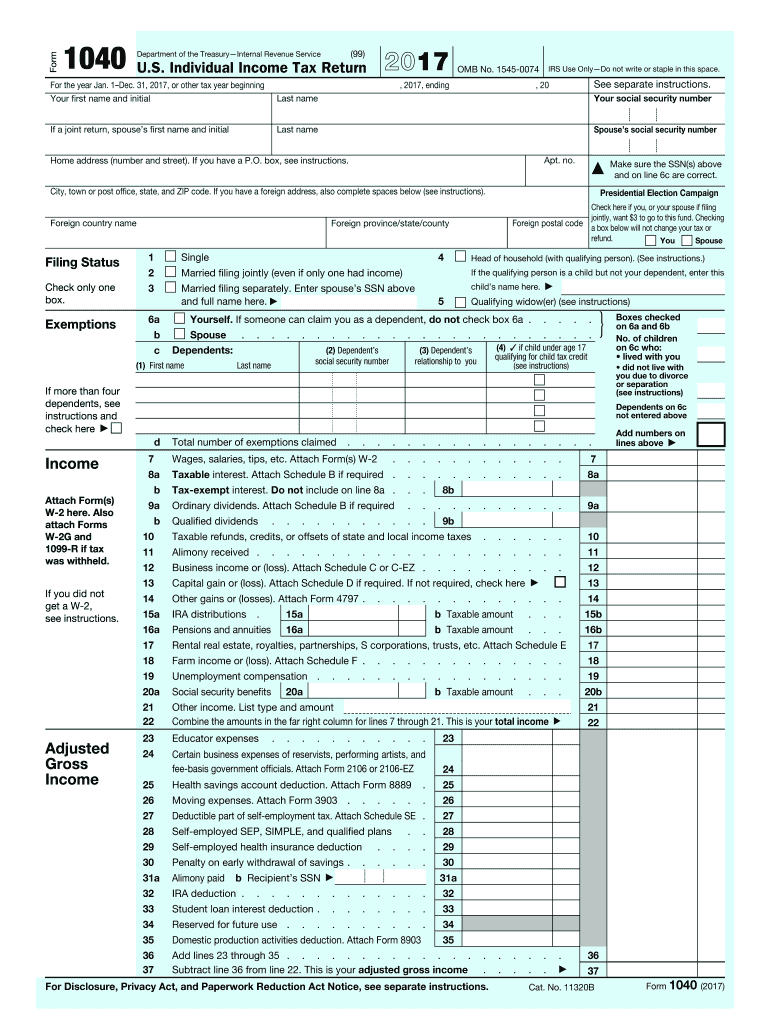

The 1040 Form is the standard individual income tax return form used by taxpayers in the United States to report their annual income to the Internal Revenue Service (IRS). This form provides a comprehensive overview of a taxpayer's financial situation, including income, deductions, and tax credits. It is essential for calculating the amount of tax owed or the refund due. The 1040 Form has undergone updates, with the latest version consolidating previous forms like the 1040A and 1040EZ into a more streamlined document.

Steps to Complete the 1040 Form

Filling out the 1040 Form involves several key steps to ensure accuracy and compliance. Begin by indicating the tax year at the top of the form. Next, provide personal information, including your name, address, and Social Security number. Choose your filing status, which may affect your tax rate and eligibility for certain credits. List any dependents and their information. Carefully enter your income from various sources, such as wages and interest. Calculate your adjusted gross income and follow the prompts to determine your tax liability, credits, and any additional taxes owed. Finally, sign the form electronically or by hand, and ensure all required information is complete before submission.

How to Obtain the 1040 Form

The 1040 Form can be easily obtained from the IRS website, where it is available for download in PDF format. Taxpayers can also request a physical copy by calling the IRS or visiting a local IRS office. Many tax preparation software programs include the 1040 Form as part of their services, allowing users to fill it out digitally. Additionally, some public libraries and community centers may provide copies of the form for those who prefer a paper version.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the 1040 Form. The primary deadline for filing is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need additional time can file for an extension, which generally allows for an extra six months to submit the form. However, it is important to note that an extension to file does not extend the deadline for payment of any taxes owed.

Key Elements of the 1040 Form

The 1040 Form consists of several key sections that taxpayers must complete. These include personal information, income sources, adjustments to income, tax computation, and credits. Each section is designed to capture specific financial details, such as wages, dividends, and capital gains. Additionally, the form includes a section for taxpayers to claim deductions, which can significantly reduce taxable income. Understanding these elements is crucial for accurate reporting and maximizing potential refunds.

Required Documents

To complete the 1040 Form accurately, taxpayers should gather several important documents. These typically include W-2 forms from employers, 1099 forms for other income sources, records of deductible expenses, and any relevant tax forms related to investments or retirement accounts. Having these documents on hand will facilitate the completion of the form and help ensure that all income and deductions are reported correctly.

Quick guide on how to complete 1040 2017 2018 form

Discover the most efficient method to complete and endorse your 1040 Form

Are you still spending time preparing your formal documents on paper instead of managing them online? airSlate SignNow provides a superior way to complete and endorse your 1040 Form and similar forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle paperwork swiftly and in accordance with official standards - powerful PDF editing, organizing, securing, signing, and sharing capabilities all within an easy-to-use interface.

Only a few steps are needed to finalize the completion and signature of your 1040 Form:

- Upload the fillable template to the editor by clicking the Get Form button.

- Verify the information you need to enter in your 1040 Form.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Modify the content with Text boxes or Images accessible from the top toolbar.

- Emphasize key information or Blackout sections that are no longer relevant.

- Click on Sign to create a legally recognized electronic signature using any method you prefer.

- Insert the Date next to your signature and conclude your work with the Done button.

Store your finalized 1040 Form in the Documents folder within your account, download it, or send it to your chosen cloud storage. Our service also provides adaptable form sharing options. There’s no need to print your forms when submitting them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your profile. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 1040 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

Does the IRS require filling in the "cents" fields on form 1040?

No, you are not required to show the cents, however, you should round up or down any cent amount.Computations:The following information may be useful in making the return easier to complete. Rounding off dollars: You can round off cents to whole dollars on your return and schedules. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar.For example, $1.39 becomes $1 and $2.50 becomes $3. If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.Equal amounts: If you are asked to enter the smaller or larger of two equal amounts, enter that amount.Negative amounts: If you file a paper return and you need to enter a negative amount, put the amount in parentheses rather than using a minus sign. To combine positive and negative amounts, add all the positive amounts together and then subtract the negative amounts.You may find this and additional information on this website: https://www.irs.gov/pub/irs-pdf/... Page 12I hope this information is helpful.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

Create this form in 5 minutes!

How to create an eSignature for the 1040 2017 2018 form

How to generate an electronic signature for the 1040 2017 2018 Form in the online mode

How to make an eSignature for your 1040 2017 2018 Form in Google Chrome

How to make an eSignature for signing the 1040 2017 2018 Form in Gmail

How to make an eSignature for the 1040 2017 2018 Form straight from your smartphone

How to make an eSignature for the 1040 2017 2018 Form on iOS

How to create an eSignature for the 1040 2017 2018 Form on Android

People also ask

-

What is the 1040 Form and why is it important?

The 1040 Form is the standard IRS form used by individuals to file their annual income tax returns. It is important because it allows taxpayers to report their income, claim deductions and credits, and determine their tax liability. Accurately completing the 1040 Form ensures compliance with tax laws and helps avoid penalties.

-

How can airSlate SignNow help me with my 1040 Form?

airSlate SignNow simplifies the process of preparing and signing your 1040 Form by providing a user-friendly platform for eSigning documents. With our service, you can easily upload your 1040 Form, collect signatures, and send it securely, ensuring that your tax filings are timely and compliant. This streamlines your tax preparation process and saves you time.

-

What features does airSlate SignNow offer for managing the 1040 Form?

airSlate SignNow offers features like customizable templates, automated workflows, and real-time tracking to manage your 1040 Form efficiently. You can create a template for your 1040 Form to speed up future filings and utilize our integration capabilities with accounting software for seamless data transfer. These features enhance your productivity and accuracy.

-

Is airSlate SignNow affordable for small businesses needing to file a 1040 Form?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to file the 1040 Form. We offer flexible pricing plans tailored to different business sizes and needs, ensuring that our eSigning services fit within your budget. Investing in our service can also help you save time and avoid potential penalties associated with tax filing.

-

Can I integrate airSlate SignNow with other tools for my 1040 Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage your 1040 Form alongside other financial documents. This integration allows for efficient data transfer and ensures that all your documents are organized and accessible in one place, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for my 1040 Form?

Using airSlate SignNow for your 1040 Form provides numerous benefits, including enhanced security for your sensitive tax information and a streamlined signing process. Our platform is designed for ease of use, allowing you to send, sign, and store your 1040 Form securely. Additionally, our support team is always available to assist you with any questions.

-

How secure is my 1040 Form when using airSlate SignNow?

Your 1040 Form and other documents are highly secure with airSlate SignNow, as we implement advanced encryption and security measures to protect your data. We comply with industry standards for data protection, ensuring that your information remains confidential and secure during the eSignature process. You can have peace of mind knowing your tax documents are safe.

Get more for 1040 Form

Find out other 1040 Form

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast