1095 C Form

What is the 1095 C Form

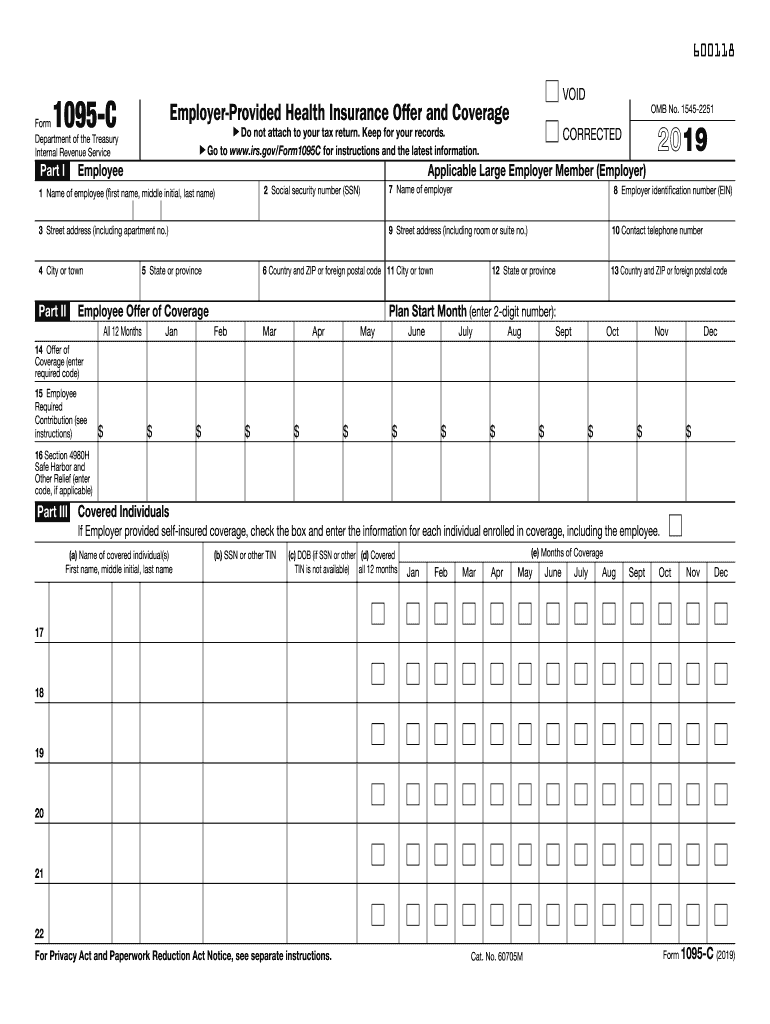

The 1095 C Form is a crucial document used in the United States to report information about health insurance coverage offered by employers. This form is part of the Affordable Care Act (ACA) requirements and is provided by applicable large employers (ALEs) to their employees. The 1095 C Form includes details about the coverage offered, the months of coverage, and information about the employee and their dependents. It is essential for individuals when filing their taxes, as it helps determine eligibility for premium tax credits and compliance with the individual mandate.

How to obtain the 1095 C Form

To obtain the 1095 C Form, employees should first check with their employer, as they are responsible for issuing this form. Employers are required to provide the 1095 C Form to employees by the end of January following the tax year. If an employee does not receive their form, they can request it directly from their HR department or benefits administrator. Additionally, some employers may provide access to the form through their online employee portals.

Steps to complete the 1095 C Form

Completing the 1095 C Form involves several steps to ensure accuracy and compliance. First, gather necessary information, including your personal details, coverage information, and any dependents. Next, fill out the form by providing the required details in the appropriate boxes. Ensure that you accurately report the months of coverage and any applicable safe harbor codes. Finally, review the completed form for any errors before submitting it to the IRS along with your tax return.

Legal use of the 1095 C Form

The 1095 C Form serves a legal purpose in documenting compliance with the ACA. It provides evidence that employers are meeting their obligations to offer health insurance to eligible employees. The form is also used by the IRS to verify that individuals have maintained minimum essential coverage. Failure to provide accurate information on the 1095 C Form can result in penalties for both employers and employees, making it essential to understand its legal implications.

Filing Deadlines / Important Dates

The deadlines for filing the 1095 C Form are critical for both employers and employees. Employers must furnish the form to employees by January thirty-first of the year following the tax year. Additionally, the form must be filed with the IRS by February twenty-eighth if submitted by paper, or by March thirty-first if filed electronically. It is important to adhere to these deadlines to avoid potential penalties.

Who Issues the Form

The 1095 C Form is issued by applicable large employers, which are defined as those with fifty or more full-time employees, including full-time equivalent employees. These employers are obligated to provide the form to their employees to report the health coverage they offered during the year. Smaller employers who do not meet this threshold are not required to issue the 1095 C Form but may still provide information about health coverage through other means.

Quick guide on how to complete form department of the treasuryinternal revenue service us

Effortlessly Prepare 1095 C Form on Any Device

Digital document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without any hold-ups. Manage 1095 C Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Edit and eSign 1095 C Form with Ease

- Obtain 1095 C Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information carefully and then click on the Done button to preserve your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign 1095 C Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form department of the treasuryinternal revenue service us

How to generate an eSignature for the Form Department Of The Treasuryinternal Revenue Service Us in the online mode

How to generate an eSignature for the Form Department Of The Treasuryinternal Revenue Service Us in Google Chrome

How to make an electronic signature for putting it on the Form Department Of The Treasuryinternal Revenue Service Us in Gmail

How to create an eSignature for the Form Department Of The Treasuryinternal Revenue Service Us from your mobile device

How to generate an electronic signature for the Form Department Of The Treasuryinternal Revenue Service Us on iOS devices

How to make an eSignature for the Form Department Of The Treasuryinternal Revenue Service Us on Android OS

People also ask

-

What is the printable 1095 a form 2019?

The printable 1095 a form 2019 is an IRS form used to report information about health insurance coverage provided by the Marketplace. This form includes essential details about the type of coverage you had, making it necessary for filing your taxes. By understanding this form, you can ensure compliance and avoid potential penalties during tax season.

-

How can I obtain a printable 1095 a form 2019?

You can easily access a printable 1095 a form 2019 through the IRS website or your health insurance provider’s portal. Additionally, airSlate SignNow allows you to upload and eSign your 1095 a form directly, ensuring a smooth process from download to filing. This feature is especially convenient for those who prefer digital solutions.

-

What are the benefits of using airSlate SignNow for the printable 1095 a form 2019?

Using airSlate SignNow for the printable 1095 a form 2019 provides an efficient and secure way to eSign documents. The platform streamlines the process, allowing you to electronically sign, store, and share the form without the hassle of printing or mailing. This not only saves time but also enhances document security.

-

Is there a cost associated with printing the 1095 a form 2019 using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to your needs, including options that allow you to print essential forms like the 1095 a form 2019. Although printing itself may incur costs, the platform provides valuable features that can save money in the long run. Opting for a subscription can enhance your document management capabilities.

-

Can I integrate other software with airSlate SignNow when working with the printable 1095 a form 2019?

Yes, airSlate SignNow offers robust integrations with various business applications, making it easy to manage your printable 1095 a form 2019 alongside other tools. This capability allows for seamless workflows, facilitating document sharing and collaboration with team members. Integrating your favorite software ensures a comprehensive solution for all your signing needs.

-

What features does airSlate SignNow offer for managing the printable 1095 a form 2019?

airSlate SignNow provides exceptional features such as electronic signatures, cloud storage, and templates that simplify handling the printable 1095 a form 2019. The user-friendly interface ensures you can quickly navigate through the signing process. Additionally, real-time tracking helps you stay updated on the status of your documents.

-

Is it legal to eSign the printable 1095 a form 2019?

Yes, eSigning the printable 1095 a form 2019 is legally valid in accordance with the ESIGN Act and UETA. AirSlate SignNow ensures that all electronic signatures meet the legal requirements necessary for tax documents, providing you with confidence in the validity of your submissions. This legality simplifies the process while maintaining compliance.

Get more for 1095 C Form

- Colorado department of revenue form 0104ep 2012 instructions

- 2017 form 1120 2018

- 8606 2017 2018 form

- Form 990 ez 2018

- 12a200 kentucky income tax installment agreement request form

- 2017 form m 1 2018

- Married filing separate return enter spouses name and social security number above form

- Form 8812 2018

Find out other 1095 C Form

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now