1msearch Com 2018

IRS Guidelines

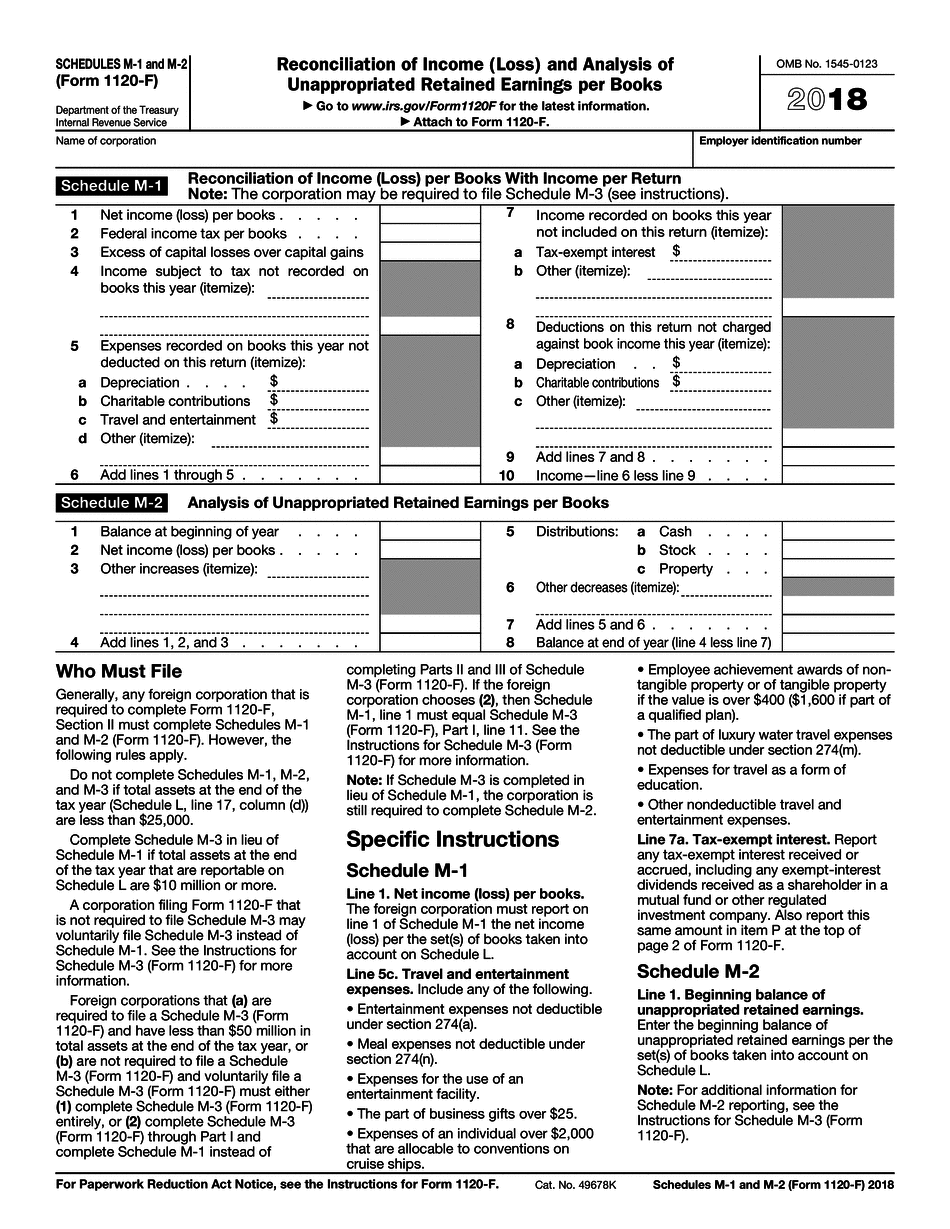

The m1 2017 form is a critical document for tax reporting, specifically related to the IRS Form 1120-F. It is essential to understand the guidelines set forth by the IRS to ensure compliance. The IRS outlines specific instructions for completing the m1 form, emphasizing the importance of accuracy in reporting income and deductions. Taxpayers must adhere to the IRS guidelines to avoid penalties and ensure proper processing of their forms.

Filing Deadlines / Important Dates

Filing deadlines for the 2017 form m1 are crucial for compliance. Generally, the m1 form must be filed by the fifteenth day of the fourth month following the end of the tax year. For the 2017 tax year, this means the deadline is April 15, 2018. Taxpayers should also be aware of any extensions that may apply, as well as the importance of timely submission to avoid late fees and penalties.

Required Documents

To successfully complete the m1 2017 form, taxpayers must gather several required documents. These include financial statements, records of income and expenses, and any relevant supporting documentation. It is essential to ensure that all information is accurate and up to date, as incomplete or incorrect submissions can lead to delays or rejections. Having all necessary documents on hand will streamline the filing process.

Form Submission Methods (Online / Mail / In-Person)

The m1 file can be submitted through various methods, including online filing, mailing, or in-person submission. Online submission is often the most efficient, allowing for quicker processing and confirmation of receipt. If choosing to mail the form, it is advisable to send it via certified mail to ensure it is tracked and received by the IRS. In-person submissions may be made at designated IRS offices, but it is important to check for specific requirements and hours of operation.

Penalties for Non-Compliance

Failure to comply with the requirements for the 2017 form m1 can result in significant penalties. The IRS imposes fines for late filings, inaccuracies, and failure to provide required information. Understanding these penalties is crucial for taxpayers to avoid unnecessary financial burdens. It is advisable to review the IRS guidelines thoroughly and ensure all submissions are complete and timely to mitigate the risk of penalties.

Digital vs. Paper Version

When considering the m1 2017 form, taxpayers have the option to submit either a digital or paper version. The digital version often offers advantages such as faster processing times and reduced risk of errors. However, some individuals may prefer the paper version for record-keeping purposes. It is important to weigh the benefits of each method and choose the one that best suits individual needs while ensuring compliance with IRS regulations.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can impact the completion of the m1 2017 form. Self-employed individuals may have unique deductions and income reporting requirements, while retirees might focus on pension income and social security benefits. Students may have different considerations based on part-time work and educational expenses. Understanding these scenarios is crucial for accurately completing the form and ensuring that all relevant information is reported correctly.

Quick guide on how to complete 2017 form m 1 2018

Uncover the simplest method to complete and endorse your 1msearch Com

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to complete and endorse your 1msearch Com and associated forms for public services. Our advanced electronic signature system offers you all the tools necessary to handle paperwork quickly and in accordance with official standards - robust PDF editing, management, protection, signing, and sharing features all at your fingertips within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your 1msearch Com:

- Upload the editable template to the editor using the Get Form option.

- Review the information you need to supply in your 1msearch Com.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to complete the fields with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Cover up sections that are no longer relevant.

- Click on Sign to create a legally recognized electronic signature using your preferred method.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your completed 1msearch Com in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our platform also offers adaptable form sharing. There’s no need to print your templates when you need to dispatch them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 form m 1 2018

FAQs

-

How does WBJEE counselling work?

WBJEE counselling procedure is very much similar to the counselling procedure adopted in JEE MAINS. After obtaining a rank in the exam interested candidates will be required to generate username and password and will have to pay the registration fee. This registration fee will be non-refundable,which is around 500. After registration candidates will be required to fill their choices online through the website. After declaration of round 1 result a candidate will be left with 3 choices. 1- accept the seat and take admission in the allocated seat.2- consider the candidate for up-gradation to higher filled choices.3- surrender the seat and pull out yourself from the counselling procedure.candidates will have to report to the reporting center within the specified period of time and will have to submit their choices failing to do so in round 1 will automatically remove you from further consideration and you will loose your seat. For choices 1 & 2, candidates will have to pay seat acceptance fee which will be returned in further rounds if you opt for choice 3( but will have to report to the reporting center,otherwise the candidate will not be able to claim it).This procedure will be repeated for three rounds and extra rounds can be introduced if the counselling team feels the necessity of it.In last round you will be forced to either accept the allocated seat or surrender your seat.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

What should be my strategy, while filling out the option form for the CAP Round 1, for first year engineering admissions in 2017-2018?

You are allowed to fill about 100 choices. So use this fact to your advantage. The most popular strategy adopted by the students is to fill the options one by one with the name of most reputed college.Its like this :First most reputed college - CompSecond most reputed college - Comp.. so on.How to find which college is better than others . Just check the previous year cut offs of the colleges. MHT CET Cutoff 2017Fill the form patiently and carefully. All the Best.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

Create this form in 5 minutes!

How to create an eSignature for the 2017 form m 1 2018

How to make an eSignature for your 2017 Form M 1 2018 online

How to generate an electronic signature for the 2017 Form M 1 2018 in Google Chrome

How to create an eSignature for signing the 2017 Form M 1 2018 in Gmail

How to create an eSignature for the 2017 Form M 1 2018 right from your mobile device

How to generate an eSignature for the 2017 Form M 1 2018 on iOS

How to generate an eSignature for the 2017 Form M 1 2018 on Android

People also ask

-

What is airSlate SignNow and how does it relate to 1msearch Com?

airSlate SignNow is an innovative platform that allows businesses to send and eSign documents easily and effectively. By utilizing the services offered on 1msearch Com, users can discover how to streamline their document workflows and improve productivity through electronic signatures.

-

How much does airSlate SignNow cost compared to other solutions found on 1msearch Com?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. When searching on 1msearch Com, you'll find that our pricing is designed to be affordable while providing robust features that ensure a great return on investment.

-

What features does airSlate SignNow offer that can be found through 1msearch Com?

airSlate SignNow includes numerous features such as customizable templates, real-time tracking, and secure cloud storage. When exploring 1msearch Com, you’ll see that these features enhance document management efficiency and security.

-

How can airSlate SignNow benefit my business, as highlighted on 1msearch Com?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document processes, leading to quicker transactions and improved customer satisfaction. 1msearch Com showcases how our solution can lead to enhanced operational efficiency and cost savings.

-

What integrations does airSlate SignNow support that you can learn about on 1msearch Com?

airSlate SignNow seamlessly integrates with popular applications like Salesforce, Google Workspace, and Microsoft Office. You can explore these integrations on 1msearch Com to find out how they can improve your existing workflow.

-

Is airSlate SignNow secure, and how is this addressed on 1msearch Com?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with regulations such as GDPR and HIPAA. 1msearch Com highlights our commitment to keeping your documents and sensitive information safe.

-

Can I customize documents with airSlate SignNow, as noted on 1msearch Com?

Absolutely! airSlate SignNow allows full customization of documents and templates to meet your specific business needs. 1msearch Com provides insights on how this feature can improve your document workflow and user experience.

Get more for 1msearch Com

Find out other 1msearch Com

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free