Form 1120 2018

What is the Form 1120

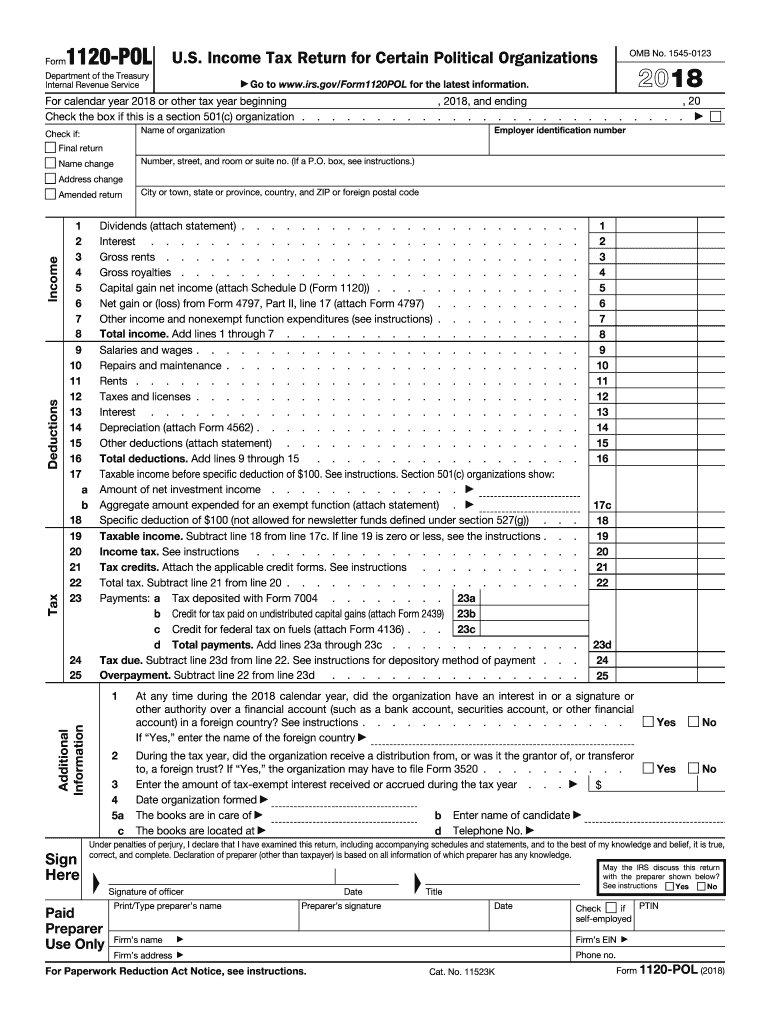

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal income tax liability. It is filed annually with the Internal Revenue Service (IRS). Corporations, including C corporations, must complete this form to comply with federal tax regulations.

How to use the Form 1120

To use the Form 1120 effectively, corporations must gather all necessary financial information, including income statements and balance sheets. The form consists of various sections where corporations report their income, deductions, and tax credits. Accurate information is crucial, as errors can lead to penalties or audits. After completing the form, it should be signed and dated by an authorized officer of the corporation before submission.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather financial documents, including income statements and expense records.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income on the form, including sales and other revenue.

- Detail allowable deductions, such as operating expenses, salaries, and interest.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy before signing and submitting it to the IRS.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 1120 on time can result in significant penalties. The IRS imposes a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, if the form is filed more than sixty days late, the minimum penalty is the lesser of one hundred dollars or the tax due. Corporations may also face interest charges on unpaid taxes, further increasing their financial liability.

Digital vs. Paper Version

Corporations have the option to file Form 1120 either electronically or via paper submission. Filing electronically is often more efficient, as it allows for quicker processing and confirmation of receipt. The IRS encourages electronic filing, especially for corporations with larger tax liabilities. However, some smaller corporations may still prefer to submit a paper version. Regardless of the method chosen, it is essential to ensure that all information is accurate and complete to avoid delays or penalties.

Quick guide on how to complete 2017 form 1120 2018

Uncover the most efficient method to complete and endorse your Form 1120

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior way to finalize and sign your Form 1120 and associated forms for public services. Our intelligent eSignature solution equips you with everything required to handle paperwork swiftly and in accordance with official standards - powerful PDF editing, managing, securing, signing, and sharing tools are all conveniently accessible within an intuitive interface.

Only a few steps are required to fill out and sign your Form 1120:

- Insert the editable template into the editor by using the Get Form button.

- Determine what details you need to supply in your Form 1120.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Cover areas that are no longer relevant.

- Select Sign to create a legally enforceable eSignature using any method you prefer.

- Include the Date alongside your signature and finalize your work with the Done button.

Store your completed Form 1120 in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our service also offers versatile file sharing. There’s no need to print your templates when you need to send them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1120 2018

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1120 2018

How to generate an electronic signature for your 2017 Form 1120 2018 online

How to create an electronic signature for the 2017 Form 1120 2018 in Chrome

How to make an electronic signature for putting it on the 2017 Form 1120 2018 in Gmail

How to generate an eSignature for the 2017 Form 1120 2018 right from your smartphone

How to create an electronic signature for the 2017 Form 1120 2018 on iOS

How to generate an electronic signature for the 2017 Form 1120 2018 on Android OS

People also ask

-

What is Form 1120 and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return used by corporations to report their income, gains, losses, deductions, and credits. Filing Form 1120 is crucial for corporations to comply with federal tax regulations and avoid penalties. Understanding how to accurately complete Form 1120 can help businesses effectively manage their tax obligations.

-

How can airSlate SignNow assist with signing Form 1120?

airSlate SignNow simplifies the process of signing Form 1120 by allowing users to eSign documents securely and efficiently. With our platform, you can send Form 1120 for signature and track its status in real-time. This eliminates the hassle of printing, signing, and scanning paper forms, ensuring a faster submission process.

-

What are the features of airSlate SignNow that support Form 1120 processing?

airSlate SignNow offers features such as customizable templates, document routing, and automated workflows to facilitate the completion of Form 1120. Users can easily create a template for Form 1120 and share it with team members for collaboration. Additionally, our platform provides secure storage for all signed documents.

-

Is there a cost associated with using airSlate SignNow for Form 1120?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution includes features specifically designed for handling documents like Form 1120, ensuring that you get the best value while simplifying your eSigning process. We also provide a free trial to help you explore our services.

-

Can I integrate airSlate SignNow with other software for Form 1120 management?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Zapier, enhancing your workflow when managing Form 1120. These integrations allow you to automate document handling and streamline your processes, making tax season less stressful.

-

What benefits does airSlate SignNow provide for businesses filing Form 1120?

By using airSlate SignNow for Form 1120, businesses benefit from increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning, ensuring that your Form 1120 is completed and submitted on time. Additionally, the ability to track document status helps keep your filing organized.

-

How secure is airSlate SignNow when handling Form 1120?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like Form 1120. We utilize advanced encryption technologies and comply with industry standards to protect your data. You can confidently eSign and manage Form 1120 knowing that your information is secure.

Get more for Form 1120

Find out other Form 1120

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors