Form 4852

What is the Form 4852

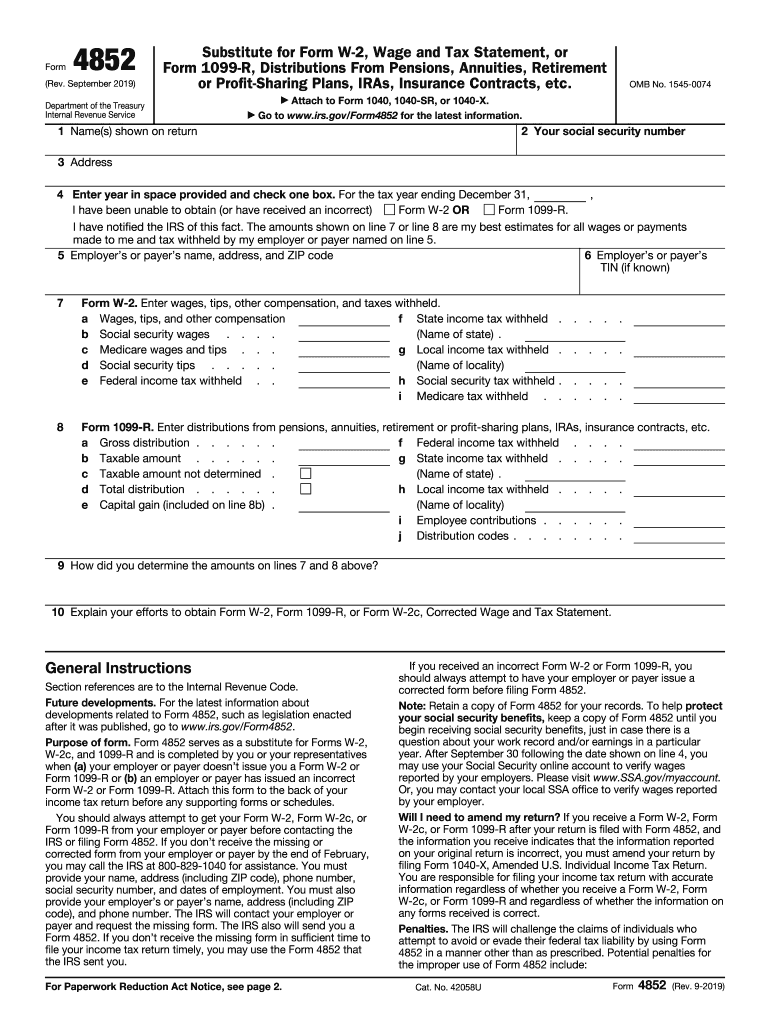

The IRS Form 4852 is a substitute form used by taxpayers who have not received their W-2 or 1099-R forms from their employers or payers. This form allows individuals to report their income and withholding for tax purposes. It is particularly useful for those who have lost their original documents or did not receive them due to various reasons, such as an employer going out of business or a misplacement of the forms. The Form 4852 for 2019 is specifically designed for tax year 2019 and must be filled out accurately to ensure proper tax reporting.

How to use the Form 4852

To use the Form 4852, taxpayers need to gather information about their income and tax withholding. This includes estimating wages and taxes withheld based on pay stubs or other documentation. The form requires detailed entries, including the employer's name, address, and identification number, as well as the taxpayer's information. Once completed, it should be submitted along with the individual's tax return, either electronically or by mail. It is essential to keep a copy of the completed form for personal records.

Steps to complete the Form 4852

Completing the Form 4852 involves several key steps:

- Gather necessary information, including estimated income and withholding amounts.

- Fill out the taxpayer's personal information, including name, address, and Social Security number.

- Provide details about the employer or payer, including their name, address, and identification number.

- Estimate the income earned and the taxes withheld, using available pay stubs or records.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 4852

The Form 4852 is legally recognized by the IRS as a valid substitute for the W-2 or 1099-R forms. To ensure its legal standing, the form must be completed accurately and submitted with the appropriate tax return. Taxpayers should be aware that providing false information on the Form 4852 can lead to penalties and legal consequences. Therefore, it is crucial to use reliable estimates and maintain documentation that supports the income and withholding amounts reported.

Filing Deadlines / Important Dates

For the tax year 2019, the deadline for filing Form 4852 is the same as the deadline for submitting the federal tax return, which is typically April 15 of the following year. If taxpayers require additional time, they may file for an extension, but they must still ensure that any taxes owed are paid by the original deadline to avoid penalties and interest. Staying informed about these important dates helps ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The completed Form 4852 can be submitted through various methods. Taxpayers can file their tax returns electronically using tax software that supports e-filing, which often includes the option to attach Form 4852. Alternatively, the form can be mailed to the appropriate IRS address along with the tax return. For those who prefer in-person submission, visiting a local IRS office may also be an option, although appointments may be required. Each submission method has its own requirements, so it's important to follow the guidelines provided by the IRS.

Quick guide on how to complete substitute for form w 2 wage and tax statement or fillio

Finalize Form 4852 effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 4852 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Form 4852 with ease

- Obtain Form 4852 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Form 4852 and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the substitute for form w 2 wage and tax statement or fillio

How to make an eSignature for the Substitute For Form W 2 Wage And Tax Statement Or Fillio online

How to create an electronic signature for the Substitute For Form W 2 Wage And Tax Statement Or Fillio in Chrome

How to generate an electronic signature for signing the Substitute For Form W 2 Wage And Tax Statement Or Fillio in Gmail

How to generate an eSignature for the Substitute For Form W 2 Wage And Tax Statement Or Fillio straight from your smart phone

How to generate an electronic signature for the Substitute For Form W 2 Wage And Tax Statement Or Fillio on iOS devices

How to generate an eSignature for the Substitute For Form W 2 Wage And Tax Statement Or Fillio on Android

People also ask

-

What is the IRS Form 4852 for 2019?

The IRS Form 4852 for 2019 is a substitute form that taxpayers can use if they have not received their W-2 or 1099-R forms. It's essential to file this form to ensure you report your income accurately when filing your taxes. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with completing the IRS Form 4852 for 2019?

airSlate SignNow simplifies the process of completing the IRS Form 4852 for 2019 by allowing users to fill out and eSign the document digitally. Our intuitive interface ensures that users can complete their forms quickly and efficiently, saving valuable time during tax season.

-

Is there a cost to use airSlate SignNow for filing the IRS Form 4852 for 2019?

Yes, there is a subscription fee to use airSlate SignNow, but it offers various pricing plans to fit your needs. Many users find it cost-effective, especially when you consider the convenience and security provided when sending sensitive documents like the IRS Form 4852 for 2019.

-

Can I integrate airSlate SignNow with other tools for managing IRS Form 4852 for 2019?

Absolutely! airSlate SignNow offers integration with numerous applications, making it easy to manage your IRS Form 4852 for 2019 alongside your other workflow processes. This includes tools like Google Drive, Dropbox, and many CRM systems to streamline your document management.

-

What benefits does airSlate SignNow offer for filing IRS Form 4852 for 2019?

Using airSlate SignNow for your IRS Form 4852 for 2019 brings several benefits, including increased efficiency, document tracking, and enhanced security. You can confidently eSign and send documents, knowing that they are protected, which is especially crucial when dealing with tax forms.

-

How do I ensure my IRS Form 4852 for 2019 is submitted on time?

To ensure your IRS Form 4852 for 2019 is submitted on time, utilize airSlate SignNow's tracking and reminders feature. By setting up notifications, you can stay updated on the status of your document and avoid any last-minute filing issues.

-

Is airSlate SignNow user-friendly for individuals filing the IRS Form 4852 for 2019?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with technology. The straightforward interface guides users through the process of filling out and eSigning the IRS Form 4852 for 2019, making it accessible for everyone.

Get more for Form 4852

Find out other Form 4852

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract