Form 1065 2018

What is the Form 1065

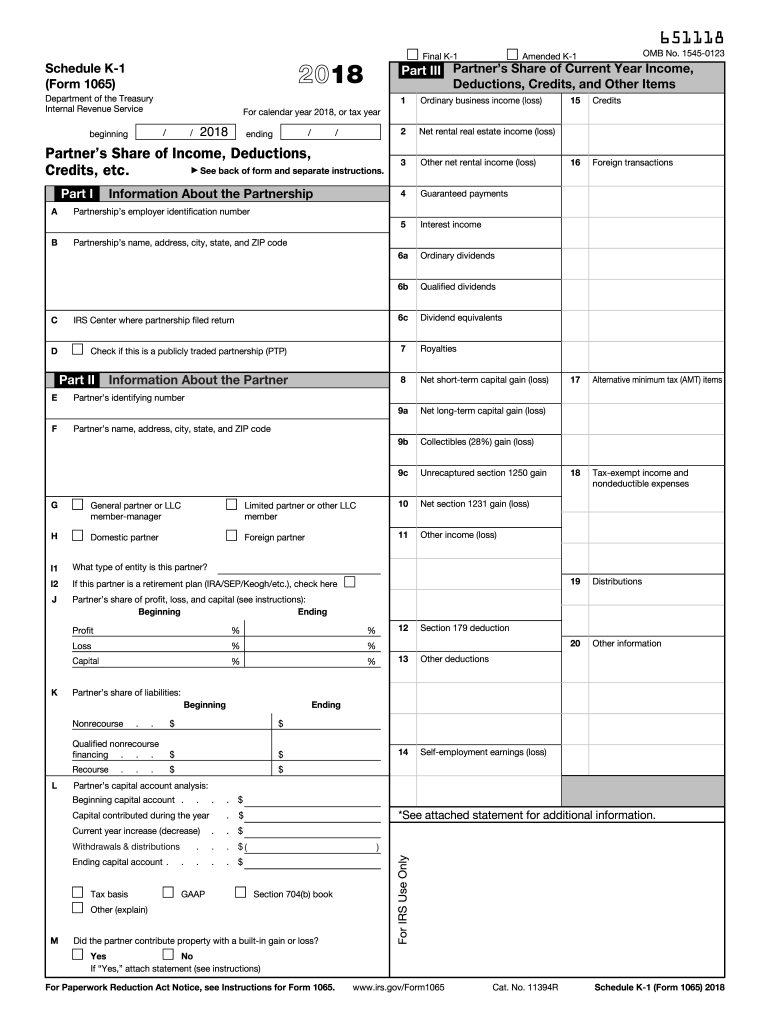

The Form 1065 is a tax document used by partnerships to report income, deductions, gains, and losses from the partnership's operations. This form is essential for partnerships as it provides the IRS with a comprehensive overview of the partnership's financial activities during the tax year. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their individual tax returns.

How to use the Form 1065

To use Form 1065 effectively, partnerships must gather all relevant financial information, including income from operations, expenses, and any capital gains or losses. The form requires accurate reporting of each partner's share of profits and losses, which is reported on the accompanying Schedule K-1. It is crucial to ensure that all entries are precise to avoid discrepancies with the IRS. Partnerships must also be aware of the specific instructions for completing the form, as errors can lead to delays or penalties.

Steps to complete the Form 1065

Completing Form 1065 involves several key steps:

- Gather financial records, including income statements and expense receipts.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report total income and deductions on the appropriate lines of the form.

- Calculate the partnership's net income or loss.

- Complete the Schedule K-1 for each partner, detailing their respective shares of income, deductions, and credits.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Partnerships must file Form 1065 by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the due date is March 15. If additional time is needed, partnerships can file for an extension, which typically allows for an additional six months. However, it is important to note that an extension to file does not extend the time to pay any taxes owed.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1065. Partnerships must ensure they adhere to these guidelines to maintain compliance. This includes using the correct version of the form, providing accurate financial information, and submitting the form by the established deadlines. The IRS also emphasizes the importance of retaining copies of the filed form and all supporting documents for at least three years, in case of an audit.

Legal use of the Form 1065

Form 1065 is legally required for partnerships to report their financial activities to the IRS. Failure to file this form can result in penalties and interest on any unpaid taxes. Additionally, accurate reporting is essential for partners to correctly report their income on their individual tax returns. Partnerships must ensure that they are using the most current version of the form and following all legal requirements to avoid potential legal issues.

Quick guide on how to complete schedule k 1 2018 form

Uncover the easiest method to complete and endorse your Form 1065

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior approach to finalize and endorse your Form 1065 and analogous forms for public services. Our intelligent electronic signature solution equips you with all the necessary tools to manage paperwork swiftly and in compliance with official standards - powerful PDF editing, organizing, securing, endorsing, and sharing instruments all available through an intuitive interface.

Only a few steps are needed to fill out and sign your Form 1065:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to supply in your Form 1065.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross features to fill in the blanks with your data.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Conceal fields that are no longer applicable.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date alongside your signature and finish your task with the Done button.

Store your finished Form 1065 in the Documents section of your profile, download it, or send it to your chosen cloud storage. Our service also provides flexible form sharing options. There's no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 2018 form

FAQs

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 2018 form

How to create an electronic signature for your Schedule K 1 2018 Form in the online mode

How to make an electronic signature for your Schedule K 1 2018 Form in Chrome

How to make an eSignature for putting it on the Schedule K 1 2018 Form in Gmail

How to make an electronic signature for the Schedule K 1 2018 Form right from your smartphone

How to make an eSignature for the Schedule K 1 2018 Form on iOS

How to create an electronic signature for the Schedule K 1 2018 Form on Android devices

People also ask

-

What is Form 1065 and why do I need it?

Form 1065 is an IRS tax form used for reporting income, deductions, gains, and losses from partnerships. If your business operates as a partnership, you will need to file Form 1065 to report the financial activity of the partnership. Using airSlate SignNow makes it easy to eSign and send this important document securely.

-

How can airSlate SignNow help with Form 1065 submissions?

airSlate SignNow simplifies the submission process for Form 1065 by allowing you to prepare, eSign, and send the document electronically. This ensures your partnership's tax information is handled efficiently and securely. Our platform is designed to streamline your workflow, so you can focus on your business.

-

Is airSlate SignNow affordable for small businesses filing Form 1065?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses needing to file Form 1065. With flexible subscription options, you can choose a plan that best fits your budget while ensuring you have the tools needed for seamless document management and eSigning.

-

What features does airSlate SignNow offer for managing Form 1065?

airSlate SignNow provides a range of features to effectively manage Form 1065, including customizable templates, real-time tracking, and automated reminders. These features help ensure that your partnership's tax filings are completed accurately and on time, reducing the risk of errors.

-

Can I integrate airSlate SignNow with accounting software for Form 1065?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your Form 1065 alongside your financial records. This integration enhances your workflow by allowing for direct document transfers and eSigning, streamlining your tax preparation process.

-

What are the benefits of using airSlate SignNow for Form 1065?

Using airSlate SignNow for Form 1065 offers numerous benefits, including enhanced security, faster processing times, and the ability to track document status in real-time. These advantages help ensure that your partnership’s tax documents are filed correctly and promptly, giving you peace of mind.

-

How secure is airSlate SignNow for handling sensitive Form 1065 information?

airSlate SignNow prioritizes security with industry-standard encryption and compliance with data protection regulations. When handling sensitive information related to Form 1065, you can trust that your documents are protected against unauthorized access and data bsignNowes.

Get more for Form 1065

- Nevada personalized license form

- Adult dnr form nevada

- Application for extension of time water nv form

- How to apply varaince nevada health form

- Acd 31015 2007 form

- Form rpd 41096 2011

- Formula to state crs tax nm 2011

- Form h c 1 health care contributions worksheet and form w h t 4 36 quarterly withholding reconciliation and required

Find out other Form 1065

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe