Michigan Department of Treasury 5076 Rev 11 23 Form

Understanding the Michigan Department of Treasury Form 5076 for 2024

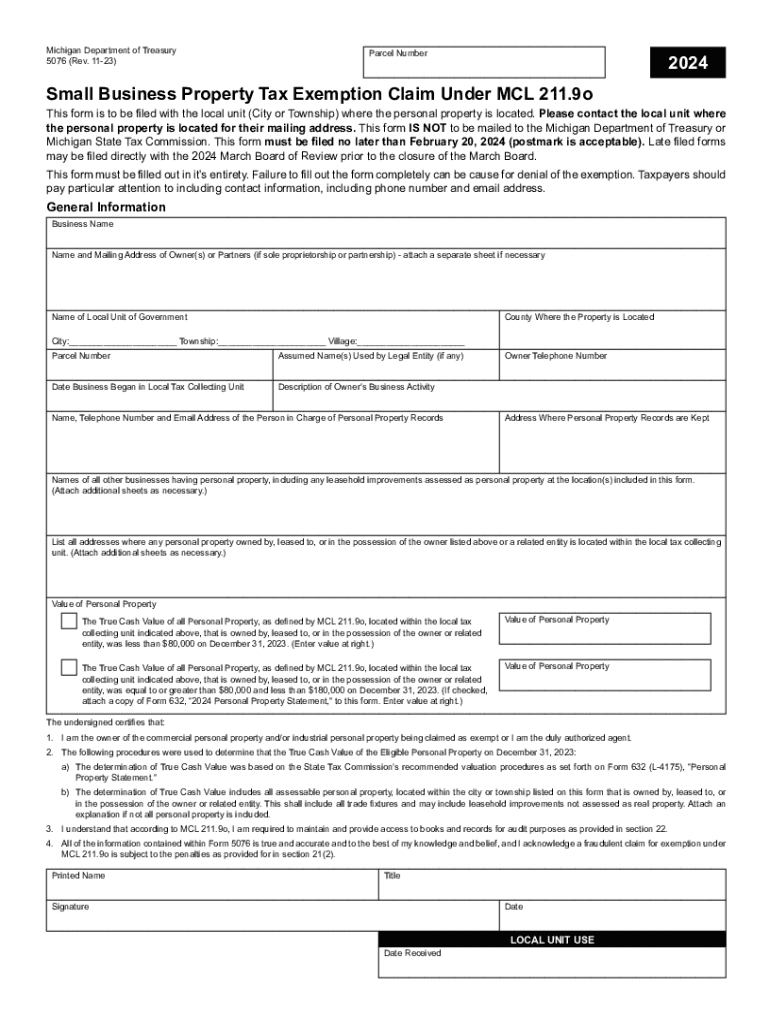

The Michigan Department of Treasury Form 5076 is a crucial document for individuals and businesses seeking a property tax exemption in Michigan. Specifically designed for the 2024 tax year, this form allows eligible applicants to claim the small business property tax exemption. This exemption is particularly relevant for small businesses that meet specific criteria, helping to alleviate some of the financial burdens associated with property taxes.

Steps to Complete the Michigan Department of Treasury Form 5076 for 2024

Completing the Michigan Form 5076 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including the legal name, address, and federal employer identification number (EIN). Next, review the eligibility criteria to confirm that your business qualifies for the exemption. Fill out the form accurately, providing all required details, and ensure that you sign and date the application. Finally, submit the completed form to the appropriate local tax authority by the specified deadline.

Eligibility Criteria for the Michigan Department of Treasury Form 5076

To qualify for the small business property tax exemption using Form 5076, applicants must meet specific eligibility criteria. The business must be classified as a small business under Michigan law, generally defined as having a limited amount of property and revenue. Additionally, the property in question must be used for business purposes, and the applicant must not have claimed any other property tax exemptions for the same property. It is essential to review these criteria thoroughly to ensure compliance and maximize the chances of approval.

Required Documents for Michigan Form 5076 Submission

When submitting Form 5076, applicants must include several supporting documents to validate their claims. These typically include proof of business registration, financial statements reflecting the business's revenue and property values, and any other documentation that demonstrates eligibility for the exemption. Ensuring that all required documents are included with the application can help expedite the review process and reduce the likelihood of delays or rejections.

Form Submission Methods for Michigan Form 5076

Submitting the Michigan Form 5076 can be done through various methods, depending on local tax authority guidelines. Applicants may have the option to submit the form online through designated state portals, by mail to the relevant tax office, or in person at local government offices. It is important to verify the preferred submission method for your area and to keep copies of all submitted documents for your records.

Filing Deadlines for Michigan Form 5076

Timely submission of Form 5076 is critical to ensure eligibility for the property tax exemption. The filing deadline for the 2024 tax year typically aligns with local property tax deadlines, which may vary by municipality. Generally, applications should be submitted by a specific date in February or March. Checking with the Michigan Department of Treasury or local tax authority for exact dates is advisable to avoid missing the deadline.

Quick guide on how to complete michigan department of treasury 5076 rev 11 23

Effortlessly Prepare Michigan Department Of Treasury 5076 Rev 11 23 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without any hindrance. Manage Michigan Department Of Treasury 5076 Rev 11 23 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The Easiest Way to Edit and Electronically Sign Michigan Department Of Treasury 5076 Rev 11 23 Without Effort

- Find Michigan Department Of Treasury 5076 Rev 11 23 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Michigan Department Of Treasury 5076 Rev 11 23 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury 5076 rev 11 23

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5076 for 2024?

The form 5076 for 2024 is a document used for specific tax purposes, allowing businesses to report certain financial information. It is essential for compliance and helps streamline the filing process. Understanding how to fill out this form accurately can save time and reduce errors.

-

How can airSlate SignNow help with the form 5076 for 2024?

airSlate SignNow provides an efficient platform for electronically signing and sending the form 5076 for 2024. Our solution simplifies the document management process, ensuring that your forms are completed and submitted quickly. With our user-friendly interface, you can easily track the status of your documents.

-

What are the pricing options for using airSlate SignNow for the form 5076 for 2024?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that facilitate the completion of the form 5076 for 2024. Our competitive pricing ensures that you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the form 5076 for 2024?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to assist with the form 5076 for 2024. These tools enhance efficiency and ensure that your documents are organized and easily accessible. Additionally, you can integrate with other applications to streamline your processes further.

-

Is airSlate SignNow secure for handling the form 5076 for 2024?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the form 5076 for 2024. We utilize advanced encryption and authentication measures to protect your sensitive information. Our platform is designed to meet industry standards, ensuring that your documents are secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the form 5076 for 2024?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the form 5076 for 2024. Whether you use CRM systems, cloud storage, or accounting software, our integrations help streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the form 5076 for 2024?

Using airSlate SignNow for the form 5076 for 2024 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform allows multiple users to access and sign documents simultaneously, speeding up the process. Additionally, you can track changes and maintain a clear audit trail for compliance purposes.

Get more for Michigan Department Of Treasury 5076 Rev 11 23

- Plumbing contract for contractor virginia form

- Brick mason contract for contractor virginia form

- Roofing contract for contractor virginia form

- Electrical contract for contractor virginia form

- Sheetrock drywall contract for contractor virginia form

- Flooring contract for contractor virginia form

- Virginia contract deed form

- Notice of intent to enforce forfeiture provisions of contact for deed virginia form

Find out other Michigan Department Of Treasury 5076 Rev 11 23

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document