Form 8027

What is the Form 8027

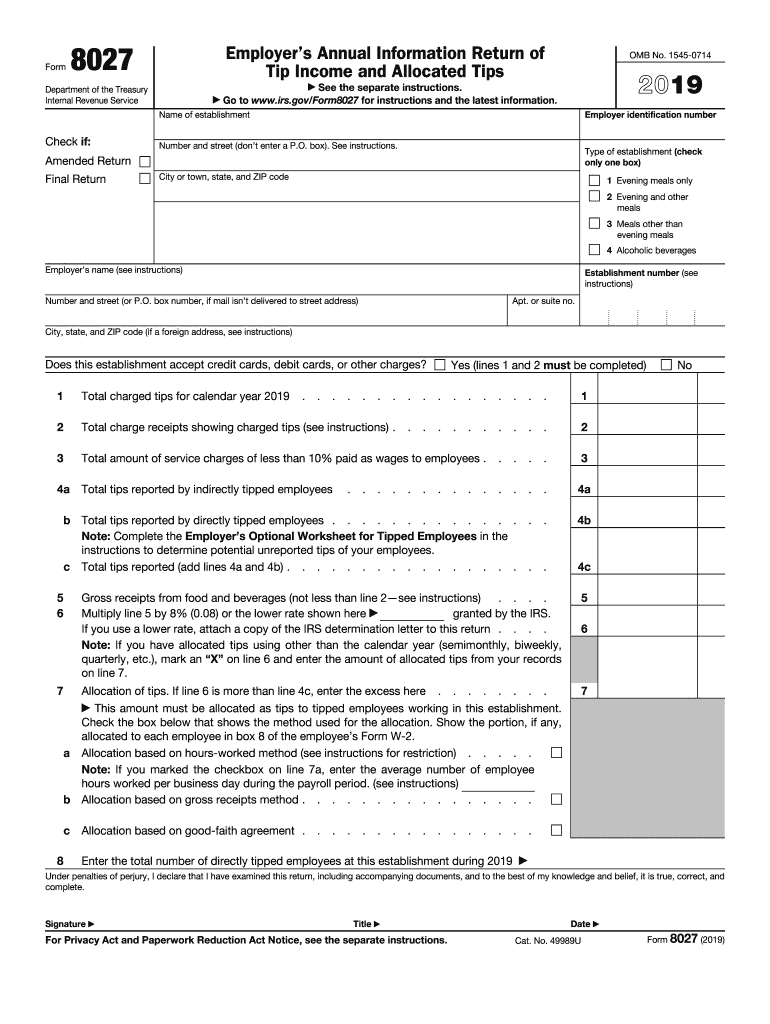

The Form 8027 is an annual information return that businesses must file with the IRS to report the tip income received by their employees. This form is particularly relevant for establishments that provide food and beverages, as it captures the total tips received and ensures compliance with tax regulations. The information reported helps the IRS monitor tip income and ensure that employees are accurately reporting their earnings.

Steps to complete the Form 8027

Completing the Form 8027 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total sales, tips received, and the number of employees. Next, accurately fill out each section of the form, ensuring that all figures are correct. It is essential to double-check calculations to avoid discrepancies. After completing the form, ensure that it is signed and dated by an authorized individual before submission. Finally, retain a copy for your records.

Legal use of the Form 8027

The legal use of the Form 8027 is governed by IRS regulations, which require businesses to report tip income accurately. This form must be filed annually by establishments that meet specific criteria, such as those with a certain number of employees who receive tips. Failure to file the Form 8027 can result in penalties, making it crucial for businesses to understand their obligations under tax law. Compliance with these regulations helps maintain transparency and accountability in reporting income.

Filing Deadlines / Important Dates

Businesses must adhere to specific filing deadlines for the Form 8027. Typically, the form is due on the last day of February following the end of the calendar year. For example, the 2019 Form 8027 must be filed by February 29, 2020. It is important to mark this date on your calendar to avoid late penalties. Additionally, if the form is filed electronically, the deadline may differ slightly, so checking the IRS guidelines is advisable.

Form Submission Methods (Online / Mail / In-Person)

The Form 8027 can be submitted through various methods, including online, by mail, or in person. For online submissions, businesses can use the IRS e-file system, which offers a streamlined process. If submitting by mail, ensure that the form is sent to the correct address provided by the IRS, depending on your location. In-person submissions are less common but can be done at designated IRS offices. Choosing the right method can help ensure timely processing of the form.

Penalties for Non-Compliance

Non-compliance with the Form 8027 filing requirements can lead to significant penalties. The IRS imposes fines for late submissions, inaccuracies, or failure to file altogether. These penalties can vary based on the severity of the non-compliance and the length of the delay. It is crucial for businesses to understand these potential consequences and take steps to ensure timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete form tip income and allocated tips irsgov

Effortlessly Complete Form 8027 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required forms and securely keep them online. airSlate SignNow equips you with all the necessary tools to produce, edit, and electronically sign your documents rapidly without any hold-ups. Manage Form 8027 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The Simplest Method to Edit and Electronically Sign Form 8027 with Ease

- Locate Form 8027 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign function, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then press the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 8027 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tip income and allocated tips irsgov

How to generate an eSignature for your Form Tip Income And Allocated Tips Irsgov online

How to make an eSignature for the Form Tip Income And Allocated Tips Irsgov in Google Chrome

How to generate an eSignature for putting it on the Form Tip Income And Allocated Tips Irsgov in Gmail

How to generate an electronic signature for the Form Tip Income And Allocated Tips Irsgov straight from your smart phone

How to make an electronic signature for the Form Tip Income And Allocated Tips Irsgov on iOS devices

How to generate an eSignature for the Form Tip Income And Allocated Tips Irsgov on Android OS

People also ask

-

What are the top 2019 tips for using airSlate SignNow effectively?

To maximize your experience with airSlate SignNow, consider these 2019 tips: familiarize yourself with the user-friendly interface, utilize templates for common documents, and take advantage of integrations with apps you already use. Staying organized and efficient will streamline your document signing process.

-

How does airSlate SignNow's pricing compare to competitors in 2019?

In 2019, airSlate SignNow offers competitive pricing with various plans tailored to fit businesses of all sizes. Review these plans to see how they stack up against similar services, focusing on the value provided through features and ease of use, making it a cost-effective choice.

-

What features should I look out for in airSlate SignNow in 2019?

Key features to consider in airSlate SignNow this year include customizable templates, secure eSignature capabilities, and collaboration tools. These features help streamline your processes and enhance productivity, making them essential 2019 tips for any business looking to improve document workflows.

-

What integrations are available with airSlate SignNow in 2019?

In 2019, airSlate SignNow integrates seamlessly with various third-party applications like Google Drive, Salesforce, and Dropbox. These integrations allow for a smoother workflow, as they enable you to manage documents directly from platforms you already use, enhancing your overall efficiency.

-

How can airSlate SignNow improve my business workflow in 2019?

Implementing airSlate SignNow in 2019 provides signNow improvements to your business workflow by automating document signing and reducing the time spent on manual paperwork. The ability to track documents in real-time ensures that nothing falls through the cracks, leading to increased operational efficiency.

-

What security measures does airSlate SignNow offer in 2019?

In 2019, airSlate SignNow prioritizes security with features like encrypted document storage, two-factor authentication, and audit trails. These security measures ensure that your sensitive information remains protected while using the platform for eSigning and document management.

-

Is airSlate SignNow suitable for small businesses in 2019?

Absolutely! airSlate SignNow is designed with small businesses in mind, offering cost-effective solutions and intuitive features in 2019. Its affordability and ease of use make it an ideal choice for smaller firms looking to enhance their document handling without breaking the bank.

Get more for Form 8027

- Basic financial accounting review form

- The marilyn westbrook garment fundapplication 5 1 08 doc lymphnet form

- Construction supervision contract template form

- Music teacher contract template 787752859 form

- Music therapy contract template form

- Music video contract template form

- Music venue contract template form

- Musical contract template form

Find out other Form 8027

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online